If there was any doubt as to how mortgage rates were going to fare after the presidential election was over, it’s gone now.

If there was any doubt as to how mortgage rates were going to fare after the presidential election was over, it’s gone now.

You've heard of the “Taper Tantrum” with mortgage rates. Now, the “Trump Tantrum” is here.

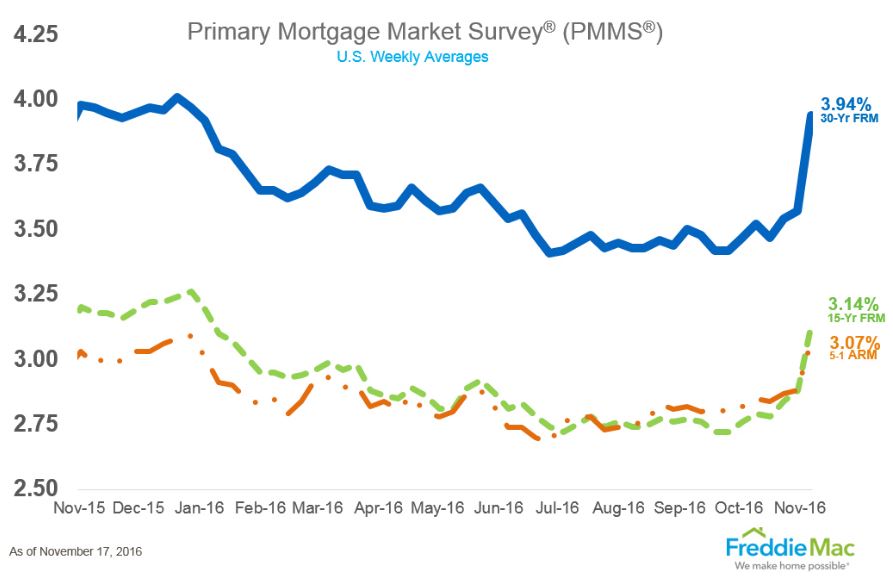

Freddie Mac reported in its weekly Primary Mortgage Market Survey (PMMS) for the week ending November 17, the first full week after the election, that the average 30-year FRM skyrocketed by 39 basis points up to 3.94 percent from the previous week’s rate of 3.57 percent—the largest weekly increase in mortgage rates since the Taper Tantrum of June 2013 when they spiked by 49 basis points. The average 30-year FRM is now only 3 basis points below the level it was at this time last year, 3.97 percent.

The average 15-year FRM shot up by 26 basis points from the previous week, from 2.88 percent up to 3.14 percent, according to Freddie Mac.

“Last week's election fell in the middle of our survey week, making it impossible to determine how closely the mortgage rate would track the post-election sell-off in the Treasury market,” Freddie Mac Chief Economist Sean Becketti said. “This week, the verdict is in—over the last two weeks the 30-year mortgage rate jumped 40 basis points to 3.94 percent, almost identical to the 39 basis point increase in the 10-year Treasury yield. If rates stick at these levels, expect a final burst of home sales and refinances as 'fence sitters' try to beat further increases, then a marked slowdown in housing activity.”

Bankrate.com’s weekly survey produced similar results, with a 30-year FRM of 4.01 percent (up 28 basis points) and a 15-year FRM rate of 3.21 percent (up 24 basis points).

“Mortgage rates spiked above the 4 percent mark to 4.01 percent in Bankrate.com’s survey, responding to market speculation—and that’s all it is at this point—about the potential for more government borrowing, higher inflation, and faster economic growth under a Trump administration,” said Bankrate.com Chief Financial Analyst Greg McBride, adding that “This week’s increase in mortgage rates, being dubbed the ‘Trump Tantrum’, is the biggest one-week increase since the ‘Taper Tantrum’ in June 2013.”

The industry is already feeling the effects of the spike in mortgage rates—earlier this week, the MBA reported a decline of 9.2 percent in mortgage application volume from the previous week, which is also the largest since the Taper Tantrum of three years ago. Homeowners who did not take advantage of the near-low record mortgage rates may not have completely missed their opportunity, McBride said.

“Homeowners that dragged their feet on refinancing over the past few months as mortgage rates flirted with record lows have missed a golden opportunity,” he said. “But stay tuned. The window of opportunity may open up once again if the administration’s eventual plans fall short of expectations, or if something like slower economic growth or a stock market pullback materializes.”

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news