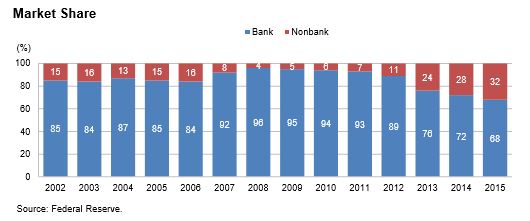

In October, Home Mortgage Disclosure Act (HMDA) data showed that non-banks took a larger share of the mortgage market in 2015 compared with the previous year.

In October, Home Mortgage Disclosure Act (HMDA) data showed that non-banks took a larger share of the mortgage market in 2015 compared with the previous year.

Now, Fitch Ratings says they expect non-banks to take an even larger share in 2017. In an RMBS roundtable hosted by Fitch Ratings, 89 percent of industry experts on the panel said they believe that non-banks will increase their market share next year. But they expect that the growth will come from a different source than it has in the past.

“Whereas MSR sales and subservicing had in the past driven servicing growth among non-banks, future activity will be driven by new loan origination activity by competitive non-banks who also service loans,” said Fitch Ratings Managing Director Roelof Slump. “Servicing sales from banks who want to reduce the associated regulatory impact on capital will also drive growth.”

Non-bank lenders have seen their market share increase substantially over the last few years, according to HMDA data, which included 6,913 institutions reporting data on 14.3 million loans. The non-bank lender share jumped from 27 percent in 2010 up to 43 percent in 2015. It increased from 40 percent up to 43 percent from 2014 to 2015.

Ed Pinto, Codirector and Chief Risk Officer of the American Enterprise Institute, noted that banks typically are well-capitalized and have multiple lines of business compared with non-banks, but also, “It's easier for (non-banks) to expand in the mortgage space because they are willing to take on the risks. They don't have the reputational risks that banks have to deal with if a loan goes bad and goes into foreclosure.”

While President-elect Donald Trump has vowed to take a more relaxed regulatory approach, particularly within the housing industry, Fitch stated that non-bank servicers will not be emphasizing compliance any less next year.

“Servicers speculated that some change in regulatory focus is possible due to the change in the administration, but this is still uncertain, and servicer emphasis on compliance will not be altered or reduced in 2017,” Slump said. “The overall sentiment expressed was that high regulatory scrutiny for the servicing industry is the new norm.”

Additionally, while increased regulation has resulted in higher servicing costs and added burdens for servicers, Fitch reported that most roundtable attendees agreed that the quality of servicing has improved and that consumers have benefited.

Additionally, while increased regulation has resulted in higher servicing costs and added burdens for servicers, Fitch reported that most roundtable attendees agreed that the quality of servicing has improved and that consumers have benefited.

“Regulation has made servicing transfers cleaner due to better data quality on in-flight loan modifications and loss mitigation efforts already undertaken by the prior servicer,” Slump said.

Fitch found that servicers believe that regulators choose which servicers they will review based on complaint-level data. According to Fitch, one servicer reported a 60 percent decline in complaints against it in the past 18 months after making addressing and preventing complaints a major initiative during that period.

Click here to read the highlights of Fitch’s RMBS Roundtable.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news