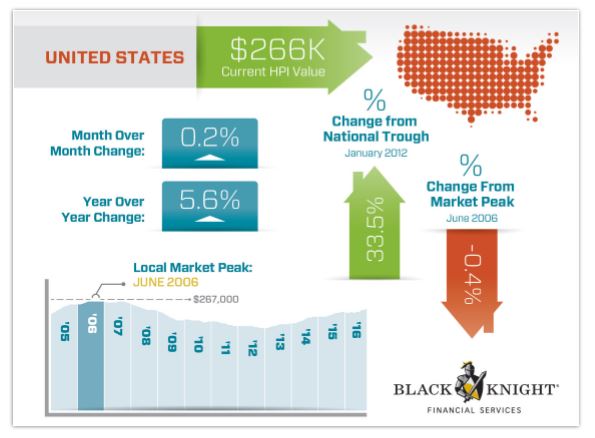

U.S. home prices rose in October, but not by much compared to September, according to the latest Home Price Index Report by Black Knight Financial. But though home prices nationally rose a mere 0.2 percent for the month, they rose 5.6 Percent compared to last October‒‒the 54th consecutive month of sustained year-over-year growth.

U.S. home prices rose in October, but not by much compared to September, according to the latest Home Price Index Report by Black Knight Financial. But though home prices nationally rose a mere 0.2 percent for the month, they rose 5.6 Percent compared to last October‒‒the 54th consecutive month of sustained year-over-year growth.

Also, with October’s bump, home prices nationally are now within just 0.4 percent of a new national peak.

For the fourth straight month, New York led the states in appreciation. Home prices there gained 0.7 percent over September. Florida, also seeing a .07 percent rise, dominated the list of best-performing metropolitan areas. Eight of the top 10 (and all of the top five) cities reporting higher values in October are in Florida. Daytona Beach and Punta Gorda each reported 1.2 percent upturns in prices, according to Black Knight.

In terms of the strength of growth over the year, the Pacific Northwest outperformed much of the country in October. Prices in Seattle and Portland saw annual home price appreciation rates of 10 percent or higher. Denver saw appreciation above 10 percent as well, Black Knight reported.

The Federal Housing Finance Agency (FHFA) reported similar numbers in October for home price appreciation on mortgages sold to or guaranteed by Fannie Mae or Freddie Mac. FHFA found that home prices rose by 6.1 percent over-the-year and 0.4 percent over-the-month in October. According to FHFA, the Mountain region (including Montana, Idaho, Wyoming, Nevada, Utah, Colorado, Arizona, New Mexico) experienced the greatest home price appreciation in October at 8.3 percent.

Price appreciation is expected to ease somewhat in 2017 compared with this year, however. CoreLogic estimated earlier in December that home prices had jumped by 6.7 percent over-the-year in October, but that growth was expected to slow to 4.6 percent over the next 12 months.

“Home prices are continuing to soar across much of the U.S. led by major metro areas such as Boston, Los Angeles, Miami and Denver. Prices are being fueled by a potent cocktail of high demand, low inventories, and historically low interest rates,” said Anand Nallathambi, president and CEO of CoreLogic. “Looking forward to next year, nationwide home prices are expected to climb another 5 percent in many parts of the country to levels approaching the pre-recession peak.”

Click here to view Black Knight’s Home Price Index for October 2016.

Click here to view the FHFA’s Home Price Index for October 2016.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news