On a national level, the current MiMi level stands at 82.7, on a scale where any number between 80 and 120 mean the housing market is stable. Additionally, the market showed a 0.18 percent improvement between December and January and a 7.57 percent improvement year-over-year. The nation has rebounded by 40 percent since the national all-time low of 121.7, reached in October 2010.

Len Kiefer, Freddie Mac's Deputy Chief Economist, noted, "Despite a stronger jobs market and declining unemployment, wage gains have not kept pace with house prices putting a pinch on homebuyer affordability."

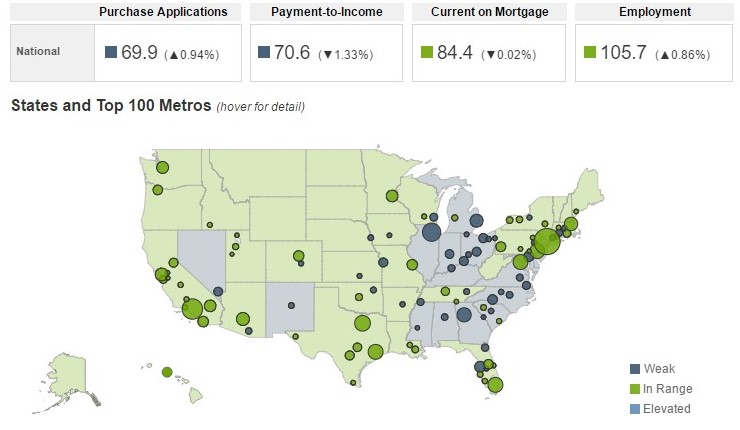

Source: Freddie Mac

Kiefer continued, "In the top 100 metro areas MiMi tracks, Los Angeles and Honolulu have elevated payment-to-income indicators and Miami, FL, is very close to elevated. An additional six metro areas have their MiMi payment-to-income indicators over 100, indicating that the payment-to-income statistic for that area is above its historic benchmark. At the state level, the District of Columbia has an elevated payment-to-income indicator while Hawaii and California have values above 100."

The leading indicators of the housing market's stability are employment and current mortgage payments. According to Freddie Mac, the employment indicator stood at 105.7 in January, up 0.86 percent from last month and 5.67 percent year-over-year. The current mortgage payment indicator rose 0.02 percent from last month and is up 7.75 percent year-over-year to 84.4.

"These payment-to-income indicators are high despite the fact that mortgage interest rates remain low. Mortgage rates fell at the start of the year, helping to bolster affordability heading into the spring season. But a lack of available inventory of for-sale homes has constrained many markets. We see that reflected in the MiMi purchase applications indicator, which remains weak nationwide."

Freddie Mac's Top 5 Most Stable Housing Markets (on a scale of 0 to 200, with 80 to 120 being "stable"):

- District of Columbia (101.8)

- North Dakota (96)

- Hawaii (95.6)

- Montana (95.1)

- Utah (94.5)

Click here to view the full report.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news