Consumers’ experiences in the credit market have improved compared to earlier in the year, but at the same time consumers seem to be more pessimistic about their prospects for future credit approval—particularly with access to mortgage credit, according to the New York Fed’s SCE (Survey of Consumer Expectations) Credit Access Survey released Friday.

Consumers’ experiences in the credit market have improved compared to earlier in the year, but at the same time consumers seem to be more pessimistic about their prospects for future credit approval—particularly with access to mortgage credit, according to the New York Fed’s SCE (Survey of Consumer Expectations) Credit Access Survey released Friday.

Rejection rates declined overall from 20.9 percent in the previous SCE Credit Access Survey in February down to 19.3 percent, near the all-time series low of 19.2 percent reached in June 2015. The decline was driven by lower credit score respondents (lower with a credit score lower than 680).

All credit types—credit card, credit card limit increase, auto loan—experienced declines in rejection rates since February’s survey except for housing-related debt. For mortgage applications, the rejected rate shot up from 5.7 percent in February to 10.3 percent in the survey released Friday. Mortgage applications experienced a similar increase in the last five months, from 9.7 percent up to 17.3 percent, according to the New York Fed. Even with the substantial hikes, these rejection rates are still below their 2015 levels, the New York Fed reported.

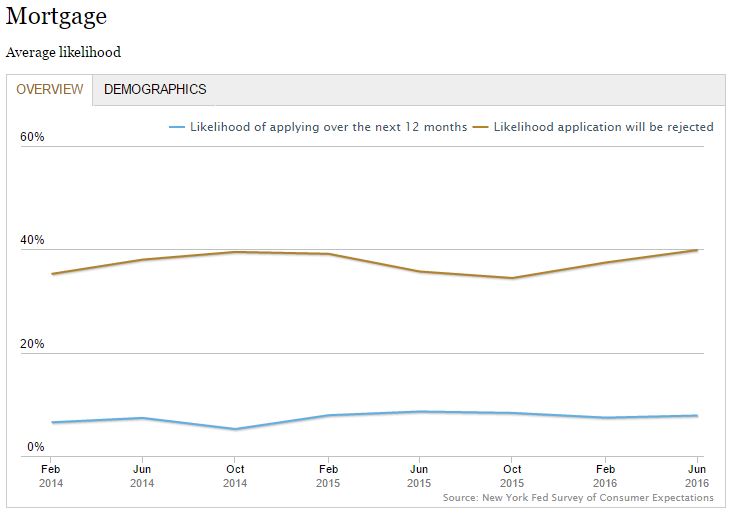

The spike in the number of rejections for mortgage applications and mortgage refi applications may explain the drop in expectations for being approved for a mortgage loan or a refinance. The perceived likelihood of a mortgage application being rejected (conditional upon applying) has risen by 5 percentage points since October 2015 up to 39.9 percent, according to the survey.

Still, the fear of rejection is apparently not going to deter consumers from applying for a mortgage refinance. While the average likelihood of applying for specific kinds of credit over the next 12 months was little changed, the expected likelihood of applying for mortgage refinancing spiked from 8.7 percent up to 11.6 percent—and the increase was prevalent among all age and credit score groups, the New York Fed reported.

Click here to view the entire survey.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news