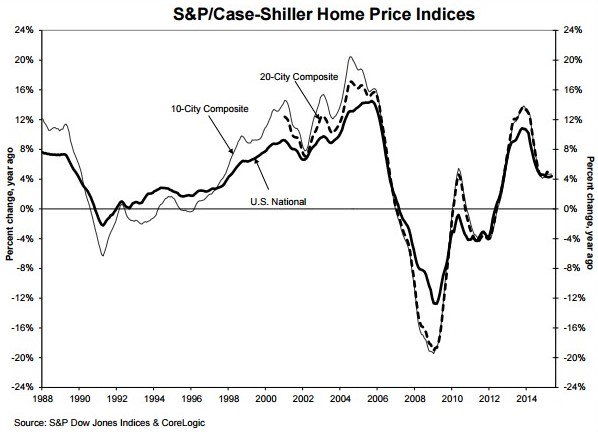

S&P Dow Jones Indices released the results for their S&P/Case-Shiller Home Price Indices (HPIs) on Tuesday, finding that U.S. home prices continued to increase across the country over the last year.

S&P Dow Jones Indices released the results for their S&P/Case-Shiller Home Price Indices (HPIs) on Tuesday, finding that U.S. home prices continued to increase across the country over the last year.

“As home prices continue rising, they are sending more upbeat signals than other housing market indicators,” said David M. Blitzer, managing director and chairman of the Index Committee at S&P Dow Jones Indices. “Nationally, single family home price increases have settled into a steady 4 percent-5 percent annual pace following the double-digit bubbly pattern of 2013."

According to the indices, the 10-city composite and national indices showed slightly higher year-over-year gains at 4.7 percent, while the 20-city composite had marginally lower year-over-year gains when compared to last month at 4.9 percent year-over-year. The S&P/Case-Shiller U.S. National Home Price Index recorded a 4.4 percent annual increase in May 2015 compared to the 4.3 percent increase in April 2015.

"While the appreciation in home prices picked up slightly, it is still slower than what we’ve seen over the two years," said Selma Hepp, Trulia's chief economist. "This lack of monthly growth suggest steadier market conditions and is a welcomed change because it indicates a more sustainable housing recovery and a balance between buyers and sellers."

S&P reports that Denver, San Francisco, and Dallas experienced the highest year-over-year gains among the 20 cities with price increases of 10 percent, 9.7 percent, and 8.4 percent, respectively. A total of ten cities reported greater price increases for May 2015 over April 2015.

"A slower pace of growth is a good news for potential home buyers because it means the housing market will be less frenzied," Hepp stated. "Variation in home price appreciation rates reflects varying local economies. Robust increases in prices persists in markets with the strongest job growth, but also where inventories of homes available for sale have been tight."

In May, the national index for both 10-city and 20-city composites all posted a gain of 1.1 percent month-over-month before seasonal adjustment. On the other hand, after seasonal adjustment, the national index was unchanged with 10-city and 20-city composites both down 0.2 percent month-over-month.

"Over the next two years or so, the rate of home price increases is more likely to slow than to accelerate. Prices are increasing about twice as fast as inflation or wages,"Blitzer said. "Moreover, other housing measures are less robust. Housing starts are only at about 1.2 million units annually, and only about half of total starts are single family homes. Sales of new homes are low compared to sales of existing homes."

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news