Mortgage interest rates appear to be following a pattern of ups and downs, especially as consumers anticipate the Federal Reserve's rate hike.

Mortgage interest rates appear to be following a pattern of ups and downs, especially as consumers anticipate the Federal Reserve's rate hike.

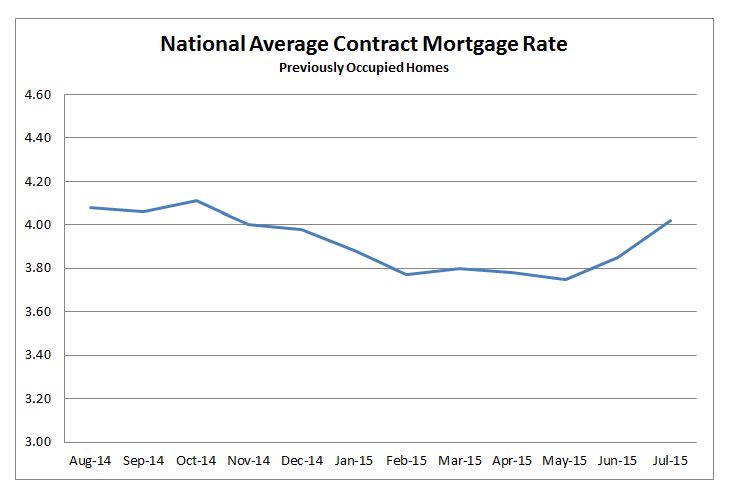

According to the Federal Housing Finance Agency's (FHFA) monthly indices of new mortgage contracts, mortgage interest rates increased in from June to July.

The indices found that the national average contract mortgage rate for the purchase of previously occupied homes by combined lenders was 4.02 percent for loans that closed in late July, an increase of 17 basis points from 3.85 percent in June. In addition, the average interest rate on all mortgage loans was 4.01 percent, up 16 basis points from 3.85 in June.

Source: FHFA

The FHFA also reported that the average interest rate on conventional, 30-year, fixed-rate mortgages of $417,000 or less was 4.20 percent, an increase of 16 basis points from 4.04 in June. Meanwhile, the effective interest rate, which accounts for the addition of initial fees and charges over the life of the mortgage, was 4.17 percent in July, up 18 basis points from 3.99 percent in June.

The report also noted that the average loan amount for all loans was $304,600 in July, down $21,000 from $325,600 in June.

Freddie Mac also released the results of their weekly Primary Mortgage Market Survey (PMMS), showing how ongoing global volatility out of China helped lower average fixed mortgage rates to their lowest levels since May of this year.

According to the PMMS, the 30-year fixed-rate mortgage (FRM) averaged 3.84 percent with an average 0.6 point for the week ending August 27, 2015. This rate is down from last week when it averaged 3.93 percent and down from 4.10 percent recorded a year ago at this time.

"Events in China generated eye-catching volatility in equity markets worldwide over the past week," said Sean Becketti, chief economist, Freddie Mac. "Interest rates also rocked up and down—although to a lesser extent than equities—as investors alternated between flights to quality and bargain hunting among beaten-down stocks. Amidst all this confusion, the 30-year mortgage rate dropped to 3.84 percent, the lowest mark since May and the fifth consecutive week with a rate below 4 percent."

The 15-year FRM this week averaged 3.06 percent with an average 0.6 point, down from last week when it averaged 3.15 percent, Freddie Mac reported. A year ago at this time, the 15-year FRM averaged 3.25 percent.

The 5-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 2.90 percent this week with an average 0.4 point, down from last week when it averaged 2.94 percent. A year ago, the 5-year ARM averaged 2.97 percent. The 1-year Treasury-indexed ARM averaged 2.62 percent this week with an average 0.3 point, unchanged from last week. At this time last year, the 1-year ARM averaged 2.39 percent.

"Given the recent volatility, mortgage rates could change up or down significantly by the time this report is released," Becketti said. "There are indications though that the unsettled state of global markets will make the Fed think twice before taking any action on short-term interest rates in September. If that's the case, the 30-year mortgage rate may remain subdued in the short-to-medium term, providing support for continued strength in the housing sector. Just this week, new home sales were reported to be up 26 percent year over year."

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news