The next phase of the housing market recovery will be dependent upon looser credit standards.

The next phase of the housing market recovery will be dependent upon looser credit standards.

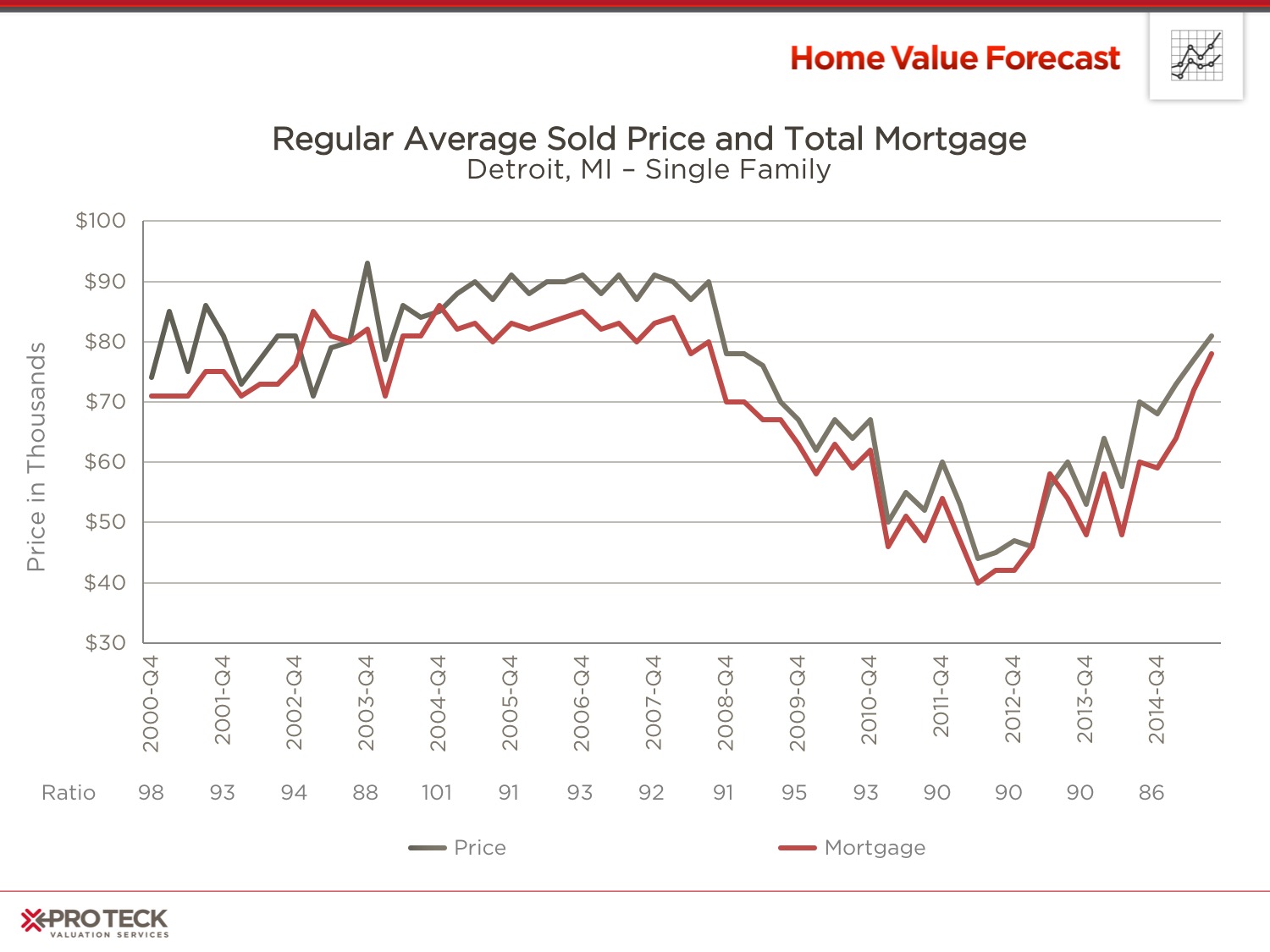

Pro Teck's Home Value Forecast (HVF) found that in markets like San Francisco and Detroit are experiencing different recoveries and one reason for this is the credit availability.

The forecast found San Francisco, California buyers have averaged 20 percent of more down over the last 14 years, with loan-to-value (LTV) ratios between 67 percent and 82 percent. On the other hand, Detroit, Michigan buyers' average LTV ratios between 86 percent and 101 percent.

"While we don’t want to go back to the days of sub-prime loans and zero down, some loosening of credit policy will be needed for the recovery to penetrate deeply into the communities hardest hit by the housing crisis," Pro Teck said.

Pro Teck also outlined the top 200 core-based statistical areas (CBSAs). Leading these areas was Bellingham, Washington; Boise City, Indiana; Durham-Chapel Hill, North Carolina; Mount Vernon-Anacortes, Washington; and Oak Harbor, Washington.

At the bottom of this list were: Midland, Texas; Atlantic City-Hammonton, New Jersey; Hagerstown-Martinsburg, Maryland-West Virginia; Jacksonville, North Carolina; and Saginaw, Michigan.

Phoenix, Arizona metro held the sixth spot in the top ten CBSAs, with high demand and low inventory levels, the report noted. Within this metro, Scottsdale, Arizona home prices have been rebounding since 2011 and are now 20 percent below peak levels following a 37.5 percent drop. Scottsdale, Arizona

In Apache Junction, Arizona, at the height of the housing crisis, homes lost over half their value another city within the CBSA, is still 36 percent below its all-time high. At the height of the housing crisis, homes in Apache Junction lost more than half their value.

"Higher LTV has historically meant more foreclosures also — something we saw during the housing crisis," the report explained. "Apache Junction has seen a steeper drop in home prices and a slower recovery, due to more foreclosures on high LTV loans. Just like Detroit and Cleveland, the town would benefit from higher LTV limits to spur the housing recovery."

Pro Teck concluded that higher LTV ratios combined with many of the other credit safeguards that were initiated over the last five years should "protect banks and safeguard the economy from a repeat of 2007."

Click here to view the full Pro Teck Home Value Forecast Report.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news