[1]Mortgage rates lowered to 3.86 percent for the week ending September 24, 2015 after the Federal Reserve decided to keep interest rates near zero last week.

[1]Mortgage rates lowered to 3.86 percent for the week ending September 24, 2015 after the Federal Reserve decided to keep interest rates near zero last week.

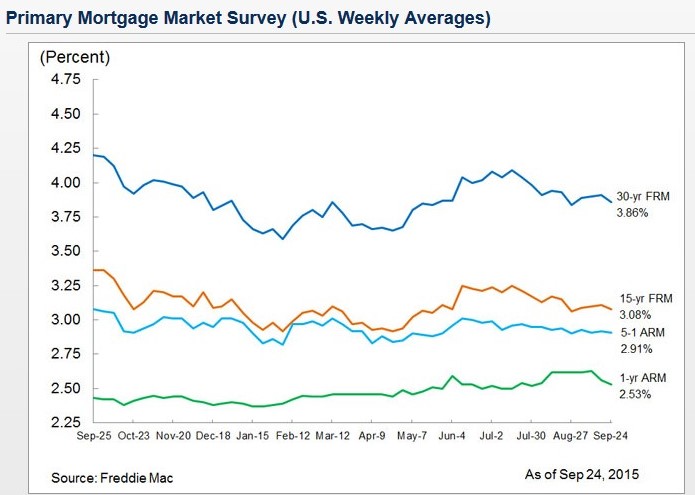

Freddie Mac [2]'s Primary Mortgage Market Survey [3] (PMMS), showed that the 30-year fixed-rate mortgage (FRM) averaged 3.86 percent with an average 0.7 point for the week. This rate is down from last week when it averaged 3.91 percent, and a year ago at this time, it averaged 4.20 percent.

"Global growth concerns and lackluster inflation convinced the Fed to defer a hike in the Federal funds rate," said Sean Becketti, chief economist, Freddie Mac. "In response, Treasury yields fell about 9 basis points over the week, with some larger day-to-day swings along the way. In response, the interest rate on 30-year fixed rate mortgages dropped by 5 basis points to 3.86 percent."

The report also found that the 15-year FRM averaged 3.08 percent with an average 0.6 point, a decrease from last week when the rate was 3.11 percent. One year ago, the rate averaged 3.36 percent.

"Global growth concerns and lackluster inflation convinced the Fed to defer a hike in the Federal funds rate."

The 5-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 2.91 percent with an average 0.5 point. Last week this ARM averaged 2.92 percent and a year ago, it averaged 3.08 percent.

Meanwhile, the 1-year Treasury-indexed ARM averaged 2.53 percent this week with an average 0.2 point. Last week this ARM averaged 2.56 percent and a year ago, it averaged 2.43 percent.

"Mortgage rates have remained below 4 percent for 9 consecutive weeks and have remained range-bound between 3.8 and 4.1 percent since May," Becketti said. "These low mortgage rates have supported strong home sales, and 2015 is on pace to have the highest home sales total since 2007."

Last week [5], the Federal Reserve [6] decided on Thursday to keep the federal funds target rate at zero to 1/4 percent, where it has been for nine years, at the September meeting of the Federal Open Market Committee (FOMC).

"In determining how long to maintain this target range, the Committee will assess progress—both realized and expected—toward its objectives of maximum employment and 2 percent inflation," the Fed said in a statement [7]. "This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments. The Committee anticipates that it will be appropriate to raise the target range for the federal funds rate when it has seen some further improvement in the labor market and is reasonably confident that inflation will move back to its 2 percent objective over the medium term."