Now that the Federal Reserve has raised the federal funds target rate, which will impact interest rates, prospective homebuyers are probably weighing their mortgage financing options.

Now that the Federal Reserve has raised the federal funds target rate, which will impact interest rates, prospective homebuyers are probably weighing their mortgage financing options.

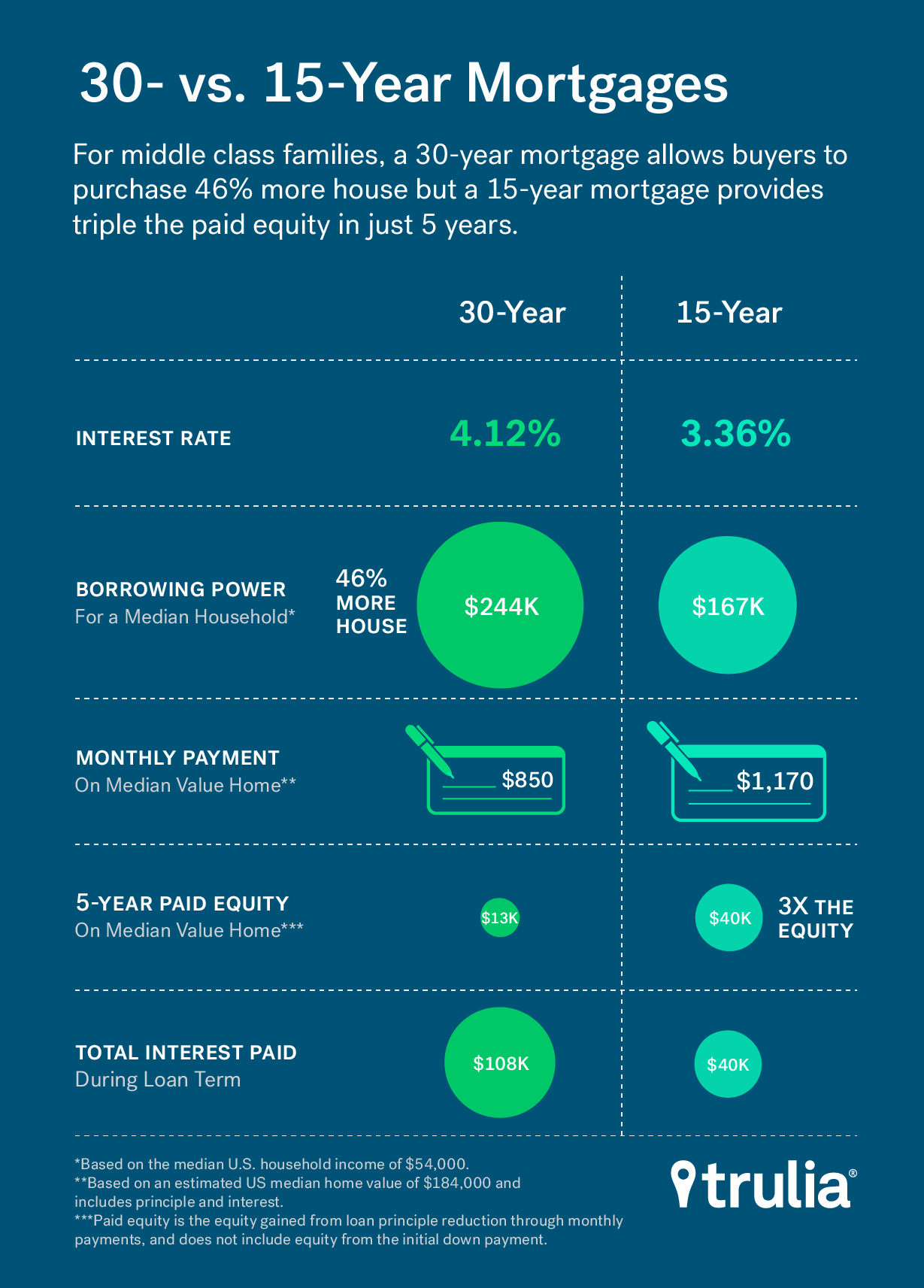

Well, a Trulia report may help make the decision a bit easier by outlining the advantages and disadvantages of both 15-year mortgages and 30-year mortgages.

In the largest U.S. metros, with a median household income, a 30-year mortgage allows buyers to get more bang for their buck by purchasing 46 percent more house.

On the other hand, with a 15-year mortgage provides homeowners with three times more equity in a just a short five years, this is especially true in areas with rapidly rising prices.

"Home equity can come from three sources: down payment, principal reduction, and home value appreciation. This means that in markets with slow appreciation, a larger share of equity will come from homeowners paying down the loan balance when compared to home value appreciation. In such markets, 15-year loans offer a relatively faster route to building equity."

Meanwhile, in areas with slow-growing or flat prices, buyer will benefit more from the 30-year mortgage option.

Meanwhile, in areas with slow-growing or flat prices, buyer will benefit more from the 30-year mortgage option.

Trulia says that 30-year mortgages offer buyers low monthly payments, higher borrowing power, and better tax benefits.

Payment on a 30-year mortgage average about $320, or 27 percent less than a 15-year mortgage, the report shows. Borrowing power on the 30-year mortgage total $244,000 on average and only $167,000 on a 15-year mortgage. In addition, buyers that go the 30-year route can write off almost $68,000 in their taxes compared to the 15-year.

The 15-year mortgage option offers buyers faster growing equity, lower interest rates, and a shorter loan term, the report says.

Although the payment is much higher for a 15-year loan, more of this payment goes toward paying the loan principal, Trulia found. The interest rate for the 15-year mortgage is 3.36 percent, compared to 4.12 percent for the 30-year. In addition, over the life of the loan, 15-year mortgages spend under $40,000 in interest, while 30-year mortgages spend over $107,000 in interest.

"[The] 15-year mortgages are a great option for those wanting to build equity, regardless of how expensive or how fast growing a market is," Trulia explained. "However, in places with historically low appreciation, 15-year mortgages are a much better deal for building equity because it’s about the only way to do so though paying of the loan balance."

"On the other hand, in areas with historically high price appreciation that also happen to be expensive, households need to consider the tradeoffs between the borrowing power of 30-year mortgages, expected equity from home price appreciation, and whether or not they will use equity from their existing home as a down payment on their next one," Trulia concluded.

Click here to view the full report.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news