Borrowers in owner-occupied homes are sitting on trillions worth of accessible home equity by today’s lending standards—but not all of the country's housing wealth is equally distributed, according to a new report from the Urban Institute’s Housing Finance Policy Center.

Borrowers in owner-occupied homes are sitting on trillions worth of accessible home equity by today’s lending standards—but not all of the country's housing wealth is equally distributed, according to a new report from the Urban Institute’s Housing Finance Policy Center.

Authors Laurie Goodman and Wei Li of the Urban Institute’s HFPC point out that about 64 percent of the $11 trillion, or about $7 trillion, in net housing wealth in owner-occupied homes nationwide is accessible under the standard which most lenders today use, which is allowing homeowners to borrow about 75 percent of their home’s value.

That $7 trillion in accessible wealth breaks down to about $150,500 for each homeowner on average spread out among the 52 million homeowners nationwide (out of about 73 million owner-occupied units) with accessible housing wealth. However, about half of those 52 million homeowners have some outstanding home debt and half have none; those with no outstanding home debt had about $229, 300 in home equity available to them while those who still owed money on their mortgages could access an average of about $104,900 in equity.

The study revealed that the nation’s home equity is highly concentrated geographically, by household, and by age. Geographically, most of the accessible housing wealth in the U.S. was concentrated in four states: California, Florida, New York, and Texas, according to Goodman and Li. California has only 9.3 percent of the country’s owner-occupied housing units but 20.4 percent of net housing wealth, which computes to about $2.3 trillion, and 20 percent of accessible housing wealth, or about $1.4 trillion.

Broken down by household, Goodman and Li found that 46 percent of net housing wealth and 51 percent of accessible housing wealth is concentrated in 10 percent of owner-occupied homes. By age, the authors found that older homeowners have a greater share of accessible housing wealth—about 44 percent of accessible housing wealth (about $3 trillion out of $7 trillion) is held by owners older than 65, even though they own only 30 percent of owner-occupied homes. Homeowners under age 40 own 17 percent of owner-occupied homes but have only 6 percent of the nation’s accessible housing wealth, according to Goodman and Li.

Broken down by household, Goodman and Li found that 46 percent of net housing wealth and 51 percent of accessible housing wealth is concentrated in 10 percent of owner-occupied homes. By age, the authors found that older homeowners have a greater share of accessible housing wealth—about 44 percent of accessible housing wealth (about $3 trillion out of $7 trillion) is held by owners older than 65, even though they own only 30 percent of owner-occupied homes. Homeowners under age 40 own 17 percent of owner-occupied homes but have only 6 percent of the nation’s accessible housing wealth, according to Goodman and Li.

These numbers prompt several policy questions as to how much homeownership contributes to inequality, whether or not government policies that support homeownership exacerbate inequality, how wealth of lower-income borrowers can be better protected if house prices crash, and how to improve access to mortgage credit that allows for sustainable homeownership and enhances economic well-being.

“The numbers in today’s report provide a solid baseline against which to judge progress in addressing these issues,” Goodman and Li wrote.

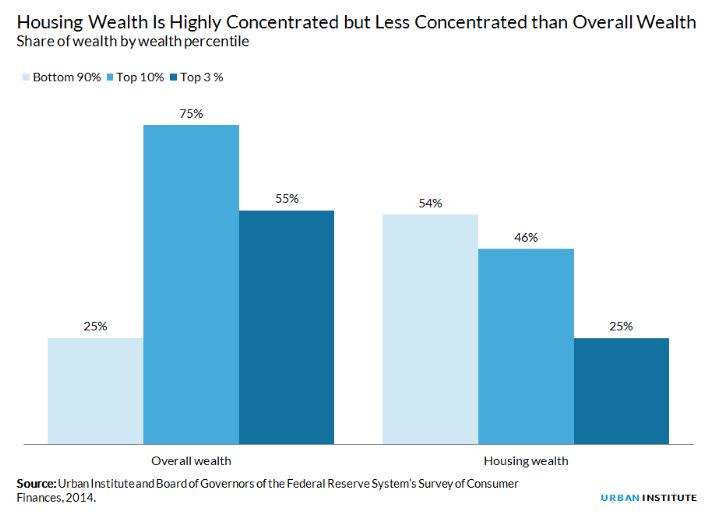

Even though home equity is highly concentrated, it is still less concentrated than other forms of wealth. According to the authors, the top 3 percent holds about 55 percent of overall wealth; the top 10 percent holds about 75 percent of overall wealth; and the bottom 10 percent holds about 25 percent of overall wealth. By comparison, the top 3 percent holds 25 percent of housing wealth; the top 10 percent holds about 46 percent of housing wealth; and the bottom 90 percent holds about 54 percent of housing wealth.

Click here to view the complete report.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news