In advance of Housing Mortgage Disclosure Act (HMDA) data, which will issue mid-September, CoreLogic Principal Economist Molly Boesel took a look back at last years’ mortgage origination volume data. Boesel analyzed what drove last year’s strong numbers, and outlined the reasons why she predicts 2017 won’t match it.

In advance of Housing Mortgage Disclosure Act (HMDA) data, which will issue mid-September, CoreLogic Principal Economist Molly Boesel took a look back at last years’ mortgage origination volume data. Boesel analyzed what drove last year’s strong numbers, and outlined the reasons why she predicts 2017 won’t match it.

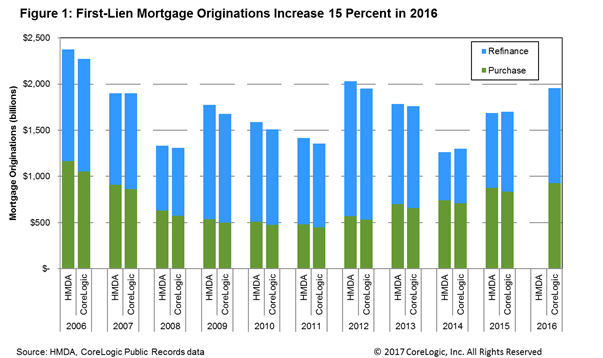

Based on CoreLogic’s information, the dollar volume of all mortgages—purchase and refinance combined—originated were near $2 trillion, a 15 percent increase over the 2015 originations.

Interest rates played an important role when accounting for more than half of mortgages originated due to refinances, which increased in dollar amount by 19 percent in 2016 compared to 2015, the volume of refinancing increased 13 percent year-over-year.

Purchase originations also increased by the year, rising 11 percent in dollar amount, a 7 percent increase in volume. This increase was driven by a growth in home sales, a decrease in the share of homes purchased with cash only, and strong home price appreciation.

With increases in mortgage rates over the past year and the declining supply of mortgages with interest rates above the current market rate—the average 30-year mortgage interest rate in 2016 was 3.65 percent, and through mid-August of this year, it has been an average of 4.05 percent— and data revealing that only 10 percent of outstanding mortgage debt would have high enough mortgage rates to make refinance a money-saving option, fewer originations are anticipated for 2017.

To read CoreLogic’s entire HMDA forecast, click here.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news