The number of underwater borrows dropped by nearly half from Q1 2012 to Q1 2013, Lender Processing Services (LPS) reported in its May Mortgage Monitor. As of the end of Q1, the total share of mortgages with loan-to-value (LTV) ratios of greater than 100 percent was down to 14.7 percent of all currently active loans. Even in the Western "sand states," where borrowers have struggled in recent years, LPS reported underwater loans were down as much as 53 percent year-over-year.

Read More »60% of Homeowners Planning for Home Improvements

A recent survey by Zillow Digs found 60 percent of respondents have some kind of plan in the works for a home improvement project this summer. The median budget for homeowners who are planning projects was $1,200, though owners with children and those 54 years of age and younger plan to spend a bit more, with a median of $1,500. To get ideas for projects, online sources were the most frequently utilized, with 37 percent turning to the web for inspiration.

Read More »First Quarter Sees Significant Decline in Underwater Borrowers

Significant improvements in home values helped lift 850,000 borrowers out of negative equity in the first quarter, CoreLogic reported. Overall, 9.7 million borrowers, or 19.8 percent of all residential mortgages, were underwater in the first quarter of 2013, down from 10.5 million, or 21.7 percent of all mortgages, according to the data provider's estimate.

Read More »Negative Equity Rate Down, but Concerns Loom

The number of homeowners underwater on their mortgages continued to fall in Q1, but millions still lack enough equity to afford to move, Zillow revealed in its first-quarter Negative Equity Report. According to the report, the national negative equity rate was 25.4 percent in the last quarter compared to 27.5 percent at the end of 2012. However, when including homeowners with less than 20 percent home equity, the "effective" negative equity rate is 43.6 percent, or 22.3 million homeowners.

Read More »Zillow: Home Values Pick Up Steam in April, Rents Cool

Zillow's Home Value Index climbed to $158,300 for April, an increase of 0.5 percent month-over-month and 5.2 percent year-over-year. April marked the sixth consecutive month in which home values appreciated more than 5 percent on a yearly basis. "In the short-term, this has been welcome news for homeowners. But in the long-term, this cannot be sustained, and consumers entering the market today should not expect this kind of appreciation to last," said Zillow chief economist Dr. Stan Humphries.

Read More »FNC Price Index Rises in March for 13th Straight Month

The latest Residential Price Index (RPI) from FNC, Inc., shows home price gains continuing in March for the 13th straight month. The index, which is based on recorded sales of non-distressed properties in the nation's 100 largest metros, rose 0.4 percent month-over-month in March and 5.5 percent year-over-year. On a quarterly basis, prices were up 0.7 percent from Q4 2012 and 5.7 percent from Q1 2012 as of the end of March, FNC reported. As usual, growth was more accelerated in the smaller 30- and 10-metro indexes.

Read More »CoreLogic: Home Price Gains Accelerate to 7-Year High in March

Including distressed sales, home prices rose 10.5 percent year-over-year in March, marking the biggest annual gain in seven years, according to CoreLogic's Home Price Index (HPI). "For the first time since March 2006, both the overall index and the index that excludes distressed sales are above 10 percent year over year," said Dr. Mark Fleming, chief economist for CoreLogic. "The pace of appreciation has been accelerating throughout 2012 and so far in 2013 leading into the home buying season."

Read More »RE/MAX: Prices, Sales Climb in March, Inventory Sees New Low

According to RE/MAX's National Housing Report for March, closed transactions climbed 27.8 percent month-over-month, starting the selling season off strong. Year-over-year, sales were up 2.9 percent, making March the 21st straight month to see higher sales than the previous year. Months Supply of homes fell to 3.8 in March, down 29.5 percent year-over-year and the lowest level recorded since RE/MAX's National Housing Report began in August 2008.

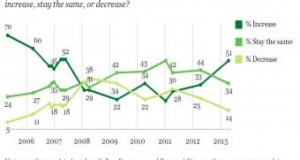

Read More »Poll: Americans Growing More Optimistic on Home Prices

The infectious optimism surrounding the housing market has the majority of Americans feeling more positive, according to survey results from Gallup. According to Gallup's findings, 51 percent of those surveyed said they expect home prices to rise in their area over the next year--the first time since 2007 that that number has been above 50 percent. Last year, only 33 percent of respondents gave the same answer. In this year's survey, 34 percent of Americans said prices will stay the same, while 14 percent said prices will fall.

Read More »FNC February Price Index Sees 28-Month High

U.S. property values went into spring continuing the growth trend that started a year ago, according to FNC's Residential Price Index (RPI) for February. The index, based on recorded sales of non-distressed properties (both new and existing homes) in the 100 largest metropolitan statistical areas (MSAs), recorded a 28-month high after rising for 12 consecutive months. Yearly, the index was up 6.1 percent--its fastest gain since July 2006. Month-over-month, the index was up 0.2 percent.

Read More »

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news