According to Interthinx's latest Mortgage Fraud Risk Report, the company's mortgage fraud risk index climbed to 159 in last year's fourth quarter, representing a 16 percent increase from Q3 2012 and 9 percent increase from Q4 2011. Reflecting the national trend, the number of "very high risk" metros spiked from 70 in Q3 to an unprecedented 125 this quarter, the report revealed. In addition, 26 states have at least one newly added "very high risk" metro.

Read More »Consumer Confidence Rebounds in February

After taking a hit from January's payroll tax hike, consumer confidence recovered somewhat in February, according to The Conference Board's Consumer Confidence Index. The overall index climbed more than 10 points in February, settling at 69.6 from January's 58.4. Lynn Franco, director of economic indicators at The Conference Board, said February's increase reflects the fading "shock effect" from January's fiscal cliff uncertainty and the expiration of payroll tax cuts.

Read More »NAR Forecasts Strong Demand, Falling Vacancy in CRE Sectors

Major commercial real estate (CRE) sectors continue to improve, albeit at a slow pace, the National Association of Realtors (NAR) said in its latest quarterly CRE forecast. The outlook, published by NAR's Research Division, projects national vacancy rates to decline across all commercial sectors in the next year, with the largest drop hitting the office sector as "gradual economic improvement and job creation [drive] absorption of space." The multifamily market is forecast to see the smallest decline in vacancy rates as space remains tight.

Read More »Conference Board: Economic Indicators Looking Up

Both leading economic indicators and lagging economic indicators for the U.S. economy rose in January, according to the Conference Board.

Read More »Initial Time Jobless Claims Up, Adding to Labor Concerns

First-time claims for unemployment insurance jumped 20,000 to 362,000 for the week ending February 16, the Labor Department reported Thursday. Economists expected 359,000 initial unemployment claims. The spike in filings--the largest in three weeks--marked a reversal of what had been a downward trend in layoffs.

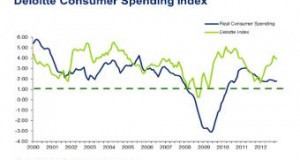

Read More »Deloitte Consumer Spending Index Falls in January

Deloitte's Consumer Spending Index declined for the third straight month in January, the company reported. The index, which tracks consumer cash flow as an indicator of future spending, fell to 3.87 from a previous reading of 3.93. Patricia Buckley, director of economic policy and analysis at Deloitte and author of the monthly index, explained the decrease is "primarily due to slowing increases of new home prices," though gradual improvements in initial unemployment claims and real wages may reverse the downward trend in the future.

Read More »First-Time Jobless Claims Drop, Continuing Claims Hit 43-Month Low

Bolstered by favorable seasonal adjustment factors, first-time claims for unemployment insurance dropped 27,000 to 341,000 for the week ending February 9, the Labor Department reported Thursday. Economists expected a much smaller decline to 360,000. Initial claims were under 350,000--a dividing line between a strong and weak labor market--for the third time in the last five weeks, hinting layoff activity has returned to normal.

Read More »NAR: End of 2012 Sees Gains in Prices, Sales, Affordability

According to the NAR, the depleting share of lower-priced homes is contributing to price growth as distressed sales--foreclosures and short sales--diminish. The association found the national median price for an existing single-family home rose to $178,900 in Q4, up 10 percent from the fourth quarter of 2011. The increase marks the biggest year-over-year gain since the fourth quarter of 2005, when the median price was up 13.6 percent. Existing-home sales improved as well in Q4, rising to a seasonally adjusted annual rate of 4.90 million.

Read More »Consumers More Optimistic About Housing, the Economy

Consumers are showing increased confidence in home sales and a greater sense of job security, according to the results of Fannie Mae's most recent National Housing Survey. January's findings show 41 percent of respondents believe home prices will go up in the next year, a decline of 2 percentage points from December's high. However, the share who believe prices will fall also dropped, returning to a survey low of 10 percent. The average 12-month home price change expectation in January was 2.4 percent.

Read More »Mortgage Rates Steady as Markets Watch for Next Catalyst

After spiking,, fixed mortgage rates held their ground last week as the economy showed signs of stability, at least for the near future.

Read More »

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news