First-time claims for unemployment insurance fell 5,000 to 359,000 for the week, the Labor Department reported Thursday. The previous week's report ├â┬ó├óÔÇÜ┬¼├óÔé¼┼ô and all data reports back to 2007 - were revised to show a jump for mid-March to 364,000 instead of the originally reported 348,000. Even with the upward revisions, claims dipped to the lowest level since April 2008. Economists had expected initial claims would increase to 350,000. Data for the week ended mid-March covered the same "reference" week used by the Bureau of Labor Statistics in its survey.

Read More »Clouds May Lift for Housing, Economy by 2014: Survey

Housing lingered in the doldrums of a recovery last year but may pick up by 2014 as the U.S. economy generally improves, analysts and economists said Wednesday. The Urban Land Institute polled 38 real estate analysts and economists to signal their expectations for "broad improvements" in the nation├â┬ó├óÔÇÜ┬¼├óÔÇ×┬ós economy and real estate markets in 2012. The survey revealed that transaction volume in commercial real estate markets could reach as much as $312 billion in 2014, up from a projected $250 billion in 2012. The news is welcome for an industry that has stayed under a cloud since the crisis.

Read More »Despite Crisis, Americans Still Believe in Homeownership: Survey

Job and employment figures may keep homeowners near the sidelines, but more Americans still value homeownership and consider it an investment worth making, according to a recent survey. Mortgage giant Fannie Mae polled some 3,000 respondents during the fourth quarter and revealed the figures in a Quarterly National Housing Survey Tuesday. More Americans prefer homeownership to the alternative ├â┬ó├óÔÇÜ┬¼├óÔé¼┼ô renting ├â┬ó├óÔÇÜ┬¼├óÔé¼┼ô and see it as an investment in their futures. The belief in homeownership also extended to respondents across all education levels.

Read More »Declining Initial Unemployment Claims Reverse Trends

First time claims for unemployment insurance fell 14,000 in the week ended March 9, according to the Labor Department. In a Thursday report, the bureau noted that the decline represents the first drop in four weeks. Continuing claims, reported on a one-week lag, also fell, dropping 81,000 to 3,343,000, after two second straight weekly increases. The four week moving average for initial claims was flat at 355,750, unchanged from the previous week while the four week average for continuing claims declined 25,250 to 3,394,250.

Read More »Payrolls Up, Unemployment Steady in February

The Bureau of Labor Statistics reported data that indicates nationwide employment gains during February, with the country adding 227,000 jobs during the month.

Read More »Initial Unemployment Claims Rise For Third Straight Week

According to data released today by the U.S. Department of Labor, first time claims for unemployment insurance rose 8,000 in the week ended March 2. The report marks the third straight weekly increase, following revisions to earlier statistics. Continuing claims, reported on a one-week lag, increased 10,000 to hit 3,416,000, representing the second straight weekly increase. The four week moving average for initial claims edged up modestly to 355,000 from 354750 while the average for continuing claims fell.

Read More »More Americans Feel Confident About Housing: Survey

More Americans feel confident about their household finances, the housing recovery, and the prospect of an economic upturn, Fannie Mae said Wednesday. The mortgage giant drew on poll data from some 1,000 respondents to sketch a blend of guardedness and hopefulness in a National Housing Report. Thirty-five percent of Americans now believe the economy is on the right track, an increase from 19 percent in November, compared with 57 percent who still feel damp about the state of recovery. Fewer respondents fielded layoff concerns.

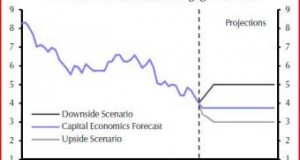

Read More »Group: Euro Crisis Could Choke ‘Healing’ Housing Market

A steady pace for home prices and sales signals housing recovery, but a disorderly default by any of the euro zone states overseas could choke affordability according to Capital Economics analysts.

Read More »Initial, Continuing Unemployment Claims Fall Again

First-time claims for unemployment insurance edged down by 2,000 for the week ended February 25, the Labor Department reported Thursday. Data for the previous week were revised upward, turning a flat report into an increase in initial claims. The revision means claims rose and did not decline during the week used by the Bureau of Labor Statistics in its month survey for the unemployment rate. Continuing claims, reported on a one-week lag, fell 2,000 to 3,402,000 as the numbers for the previous week were also revised upward.

Read More »Bernanke: Tight Credit Continues to Hamper Recovery

Negative equity, tight mortgage credit, and an overhang of foreclosed properties conspire to delay a full-fledged housing rebound and economic recovery, Federal Reserve chairman Ben Bernanke said Friday. He said that the inability ├â┬ó├óÔÇÜ┬¼├óÔé¼┼ô or unwillingness ├â┬ó├óÔÇÜ┬¼├óÔé¼┼ô of lenders to lend puts the brakes on much-needed activity by first-time and repeat homebuyers. He cited a contraction in mortgage credit outstanding for U.S. homes by about 13 percent, with mortgage originators reluctant to lend to otherwise eligible borrowers.

Read More »

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news