Fannie Mae’s latest iteration of the monthly Home Purchase Sentiment Index (HPSI) fell by a slight 0.5 points to 74.2 in December as consumers wildly differed on whether it is a good time to buy or sell a home and their outlook on the economy. When combined, these metrics may indicate a slowing of the real estate market as we move into 2022.

Fannie Mae’s latest iteration of the monthly Home Purchase Sentiment Index (HPSI) fell by a slight 0.5 points to 74.2 in December as consumers wildly differed on whether it is a good time to buy or sell a home and their outlook on the economy. When combined, these metrics may indicate a slowing of the real estate market as we move into 2022.

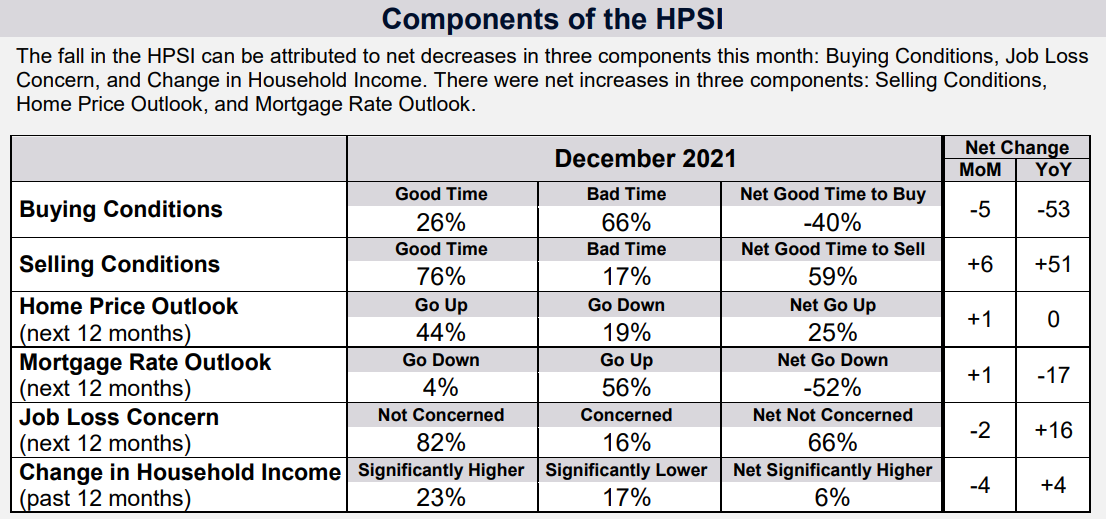

Overall, three of the six indicators used in the report dropped last month. Among the 1,003 heads of households surveyed, 76% responded that now is a good time to sell a home but only 26% of respondents indicated that now is a good time to buy—a record low seen by the survey.

In addition, the number of respondents that felt their job was secure dropped 2% from the 68% seen in November to 66% in December. Only 6% of respondents indicated their income higher than it was 12 months ago, continuing a downward trend that started in September.

The survey also found that 44% of people expect home prices to go up over the next 12 months and 56% think mortgage rates will go up in the next 12 months.

"The HPSI's underlying components changed dramatically in the last 12 months—particularly the two related to homebuying and home-selling sentiment—and we have seen the index drift slightly downward since March 2021, an indication that the housing market may begin to soften in the coming year," said Doug Duncan, Fannie Mae Senior Vice President and Chief Economist. "Over the past year, low mortgage rates plus government stimulus programs helped increase mortgage demand, but the bidding-up of homes increased prices to record levels, making affordability a greater constraint for both first-time and move-up homebuyers. Among homeowners, the 'good time to buy' sentiment fell 30 percentage points over the past year to its current level of 30%; for renters it fell from 37% to 21%. Even though demand remains strong, a majority of consumers clearly have reservations about purchasing a home at current prices."

"We currently expect mortgage rates to continue to drift modestly upward through year end, despite inflation concerns, which will likely compound the affordability concerns expressed by consumers in the HPSI,” Duncan continued. “Recent MBS issuance data indicating a rise in average debt-to-income levels also backstop that concern, suggesting additional affordability constraints. Combined with our survey results showing rising expectations for higher rent prices among consumers, we believe some would-be renters may look to accelerate their home purchase timeline, helping to drive continued strong (though decelerating) home price growth. We do expect an increase in new homes to come to market later in 2022, which should provide some supply relief; however, it may not be enough to meaningfully affect home prices. As such, affordability is likely to be a growing challenge over the coming year."

The HPSI asks homeowners six key questions to determine a score: buying conditions, selling conditions, home price outlook, mortgage rate outlook, job security concerns, and the change in their household income.

Click here to view the 15-page report in its entirety.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news