[1]

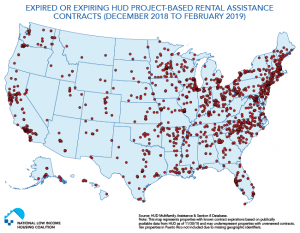

[1]Click the graphic to view an interactive map of expired or expiring HUD Project-Based Rental Assistance Contracts.

As the longest government shutdown in history continues, the Department of Housing and Urban Development [2](HUD) has issued guidelines on what lenders and borrowers can do to address their concerns.

The guidelines [3], which are in the form of frequently asked questions (FAQ), give lenders and servicers a sense of the business they can and cannot do with HUD during this period. They include questions on the departments that will be open, submitting FHA mortgage insurance premiums, submitting loans for approvals as well as packages for condo approvals, payments to borrowers, FHA monitoring, and guidelines related to REO/HUD home sales.

Low-Income Housing and the Shutdown

HUD has an extremely limited number of employees answering emergency questions during the shutdown at present, even as HUD’s headquarters, as well as its regional and field offices, remain closed.

HUD employees are among the 800,000 federal workers who are on furlough or working without pay. However, as it continues, its effects are being felt even by those not working in the federal government.

For example, an immediate result of the shutdown is HUD’s inability to renew federal contracts for 1,650 contracts with private building owners who rent to low-income households that have an average income of around $12,000.

According to the National Low Income Housing Coalition [4] (NLIHC), which sent a letter to Congress last week outlining the effects of the shutdown on affordable housing and community development, additional contracts will expire later in January and February, should the shutdown continue for that long, as HUD does not have funding to renew contracts while the government is shut down.

“The shutdown’s impact is being felt across the market as a growing number of federal workers fall behind on their mortgage payments,” said Ed Delgado, President and CEO, The Five Star Institute. “Even with lenders working with agencies such as FHA to assist these borrowers, a continued shutdown is likely to have a far-reaching effect on housing and the economy.”

Taking Steps to Help Borrowers

Recently, Bank of America [5] joined its peers in providing assistance to borrowers affected by the government shutdown. The bank said that it had reached out to clients who may be impacted by the partial federal government shutdown to make them aware of its Client Assistance program.

“We know the partial federal government shutdown is affecting many of our clients, and we want them to know that we are here to help,” said Aron Levine, Head of Consumer Banking, Bank of America. “Our Client Assistance Program is available to individuals affected by the shutdown for personalized financial assistance, tailored to their specific situation and financial needs.”

The Federal Housing Administration (FHA) has also called on [6] all approved mortgagees and lenders to assist federal workers and contractors impacted by the shutdown. “In accordance with its longstanding policy, FHA expects mortgagees to assist borrowers experiencing a loss of income to the greatest extent possible by extending special forbearance plans to borrowers impacted by the shutdown, and fully evaluating borrowers for available loss mitigation options to avoid foreclosure whenever possible,” FHA Commissioner Brian Montgomery said.

Chase [7]has also offered hardship programs to customers who have been affected by financial strain, unemployment, or natural disasters. The bank has said that it will automatically waive or refund overdraft and monthly service fees on Chase checking and savings accounts if an employee’s salary from an affected federal agency was direct-deposited into the account in November 2018.

“We’re here for our government worker customers whose pay may be disrupted,” said Thasunda Duckett, CEO of Consumer Banking at Chase. “We all hope this will be resolved soon.”

Last week, Congresswoman Maxine Waters (D-California), Chairwoman of the House Financial Services Committee [8] sent a letter to the heads of the Federal Reserve, Federal Deposit Insurance Corporation, Consumer Financial Protection Bureau, Office of the Comptroller of the Currency, and National Credit Union Administration, urging them to consider the needs of consumers who may be experiencing temporary financial hardship in meeting credit obligations as a result of the shutdown.

“This is important to ensure that customers can meet loan payments and avoid high fees and other penalties that they may otherwise incur,” Waters wrote in her letter. “Through no fault of their own, some affected federal employees and others, such as federal contractors, may be unable to pay all their bills on time because of the shutdown.”