A decade ago, mortgage brokers boasted about low interest rates on 30-year mortgages. But then 2020 came along, and rates dipped lower than they ever had before, sending Millennials into a refinancing frenzy, according to the ICE Mortgage Technology Millennial Tracker [1].

A decade ago, mortgage brokers boasted about low interest rates on 30-year mortgages. But then 2020 came along, and rates dipped lower than they ever had before, sending Millennials into a refinancing frenzy, according to the ICE Mortgage Technology Millennial Tracker [1].

For nine months in a row, rates fell lower and lower, hitting 2.93% in December 2020. At the same time, refinance activity represented 46% of all loans.

“Millennials, even those that had just purchased a home in the past few years, found themselves in a great position to take advantage of the historically low rates and contributed to the ongoing high refinance volume,” said Joe Tyrrell, president, ICE Mortgage Technology. “At the same time, lenders that have already adopted virtual solutions, like eClose, are seeing their early investments really pay off as they are better positioned to efficiently manage this long-term refinance boom.”

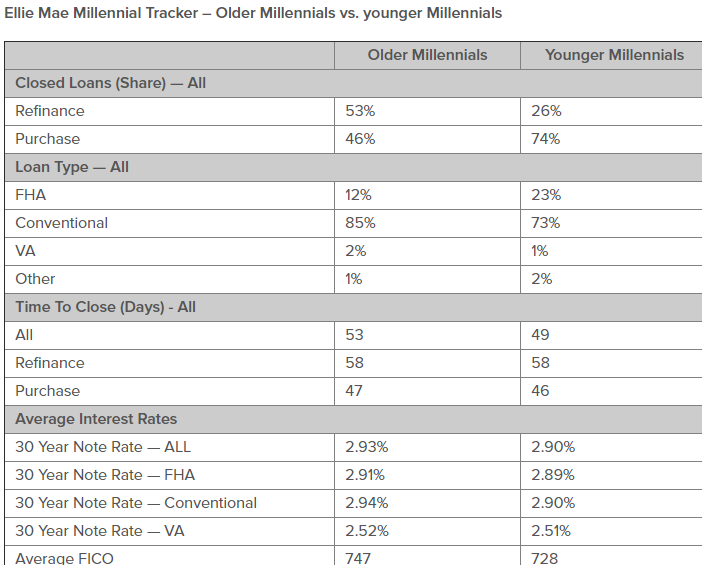

The tool separates millennials into two groups: older millennials, which are between 30 and 40 years old, and younger millennials, those between 21 and 29 years old.

Refinancing for older millennials jumped to 53% in December, whereas younger millennials were responsible for 26% of refinances. The younger subset was able to secure a lower rate on average, 2.90% versus 2.93%.

As for the time it took to refinance, average closing time for all loans took 52 days, which is nine days longer than it took in December 2019.

Data for the ICE Mortgage Technology Millennial Tracker is mined from approximately 80% of mortgages initiated on ICE Mortgage Technology’s Encompass all-in-one mortgage management solution. Data goes back to 2014.