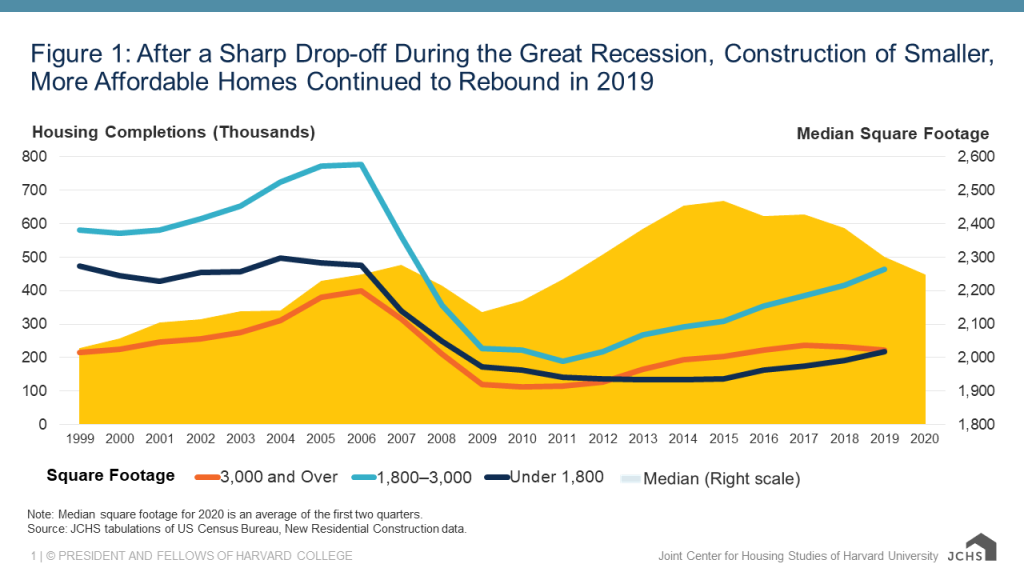

A study released by the Harvard Joint Center for Housing Studies has found that while the pandemic has yielded the need for bigger and more spacious homes, the demand for smaller and more modestly-priced homes remains relatively high.

A study released by the Harvard Joint Center for Housing Studies has found that while the pandemic has yielded the need for bigger and more spacious homes, the demand for smaller and more modestly-priced homes remains relatively high.

As many have vacated their offices and commercial spaces due to social distancing and HVAC concerns amid COVID-19, the demand for greater space in the home to accommodate offices and exercise space remains high. According to the Harvard Joint Center study, this boom in the search for larger spaces has not impacted the momentum in smaller home construction of the past half-decade.

“The COVID-19 pandemic has shined a light on the importance of adequate housing, including the crucial function of private indoor and outdoor space,” said co-authors of the report, Alexander Hermann, Senior Research Analyst and Dixi Wu, Research Assistant, both of the Harvard Joint Center for Housing Studies. “But demand for larger housing should not detract from the need to build diverse housing units that are more affordable to potential buyers, including entry-level and lower-market homes. Ensuring affordability over the long term requires building not just more housing, but more smaller homes.”

The study found that 10-Ks filed in 2019 (which provide an overview of a company’s financial conditions)—of at least four of the nation’s 10 largest builders in 2019—acknowledged a growing demand for lower-cost housing.

Cited in the study was D.R. Horton reporting a rise in the share of home closings for their Express Homes (entry-level housing for buyers focused on affordability), from approximately 15% in 2015 to 35% in 2019. These homes are often under 2,000-square feet, and typically cost between $200,000 and $400,000. In contrast, the company’s luxury offerings can be as large as 4,500-square feet and cost well above the $400,000 mark.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news