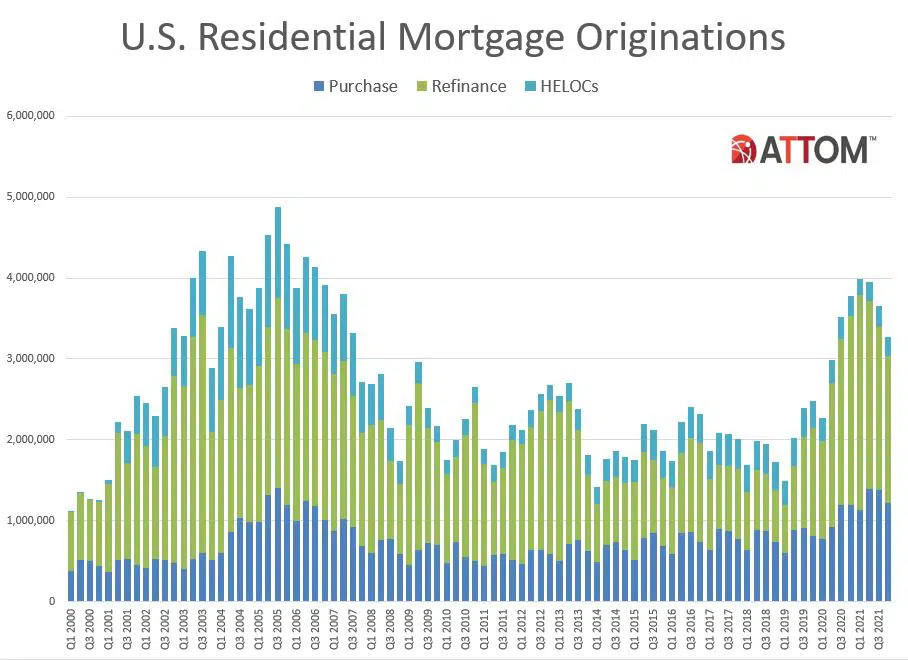

Mortgage lending has now dropped in the second, third, and fourth quarters of 2021 with 3.27 million residential mortgages being secured in the fourth quarter, a figure that is down 11% from the third quarter of 2021 and 13% year over year.

Mortgage lending has now dropped in the second, third, and fourth quarters of 2021 with 3.27 million residential mortgages being secured in the fourth quarter, a figure that is down 11% from the third quarter of 2021 and 13% year over year.

According to ATTOM Data’s U.S. Residential Property Mortgage Origination Report, the number of mortgages issued largely mirrored a decline seen in 2018; the overall drop-off resulted from across-the-board declines of all types of conventional mortgages: purchase, refinance, and home equity.

All-in-all, lenders issued a total of $1.06 trillion of mortgages in the fourth quarter of 2021. This number is down 9% from the third quarter and 7% year over year.

Looking specifically at refinance loans during the fourth quarter, 1.81 million home loans (representing $578 billion) were reissued as new mortgages. This is down 11% from the third quarter and 23% from the fourth quarter of 2020. In total, this is again the third straight quarter of declines. Refinances represented 55% of all fourth quarter mortgages, down from 56% in the third quarter.

The number of purchase loans issued in the fourth quarter of 2021 stands at 1.22 million loans (representing $439 billion). This is down 11% from last quarter, but remains 3% above where it was year over year. As a portion of all lending, purchase loans slipped from 38% in the third quarter of 2021 to 37% in the fourth quarter 2021, while still up annually from 32%.

Home-equity lending also dropped quarterly, by 5.5%, to about 230,700 loans (representing $45.6 billion).

“The decrease in all three mortgage categories during the fourth quarter, as well as the third straight drop in total lending, represented another sign that the near-tripling of lending activity from 2019 through 2021 has ended, at least temporarily,” ATTOM said in their report. “The latest numbers likely reflect several trends coming together at the same time. They include homeowner appetite for refinance loans finally getting satisfied and mortgage rates ticking upward. In addition, a tight supply of homes for sale throughout the Coronavirus pandemic has helped drive prices up but purchases down.”

“The receding volume of business for the residential mortgage industry is now showing up across all major categories of loans and appears to be more than just a temporary slide. The ebbing wave of refinance loan that started in early 2021 has fully spread to home-purchase and home-equity lending,” said Todd Teta, Chief Product Officer at ATTOM. “No doubt, total lending levels are still up over normal amounts over the past decade. And the drop-off in purchase loans seems to flow from a lack of housing supply rather than the housing market boom ending. But declining business for lenders remains a key point to watch in assessing the state of the market, especially with interest rates likely to climb this year.”

FHA mortgages accounted for 9.8%, or 319,334 loans, during the fourth quarter. While this number is up from the third quarter, it remains down 10.7% year over year.

VA loans accounted for 6%, or 197,313, of all residential property loans during the fourth quarter. This number is down 6.4% from the previous quarter and 8.4% from the previous year.

When looking at median down payments, the average borrower provided a $26,000 down payment, down 1% from the $26,250 in the third quarter but remains up 18.8% from the $21,891 median down payment seen during the fourth quarter of 2020.

The median home loan amount during the fourth quarter of 2021 was $293,400, up 1.3% from the prior quarter and up 10.5% year over year.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news