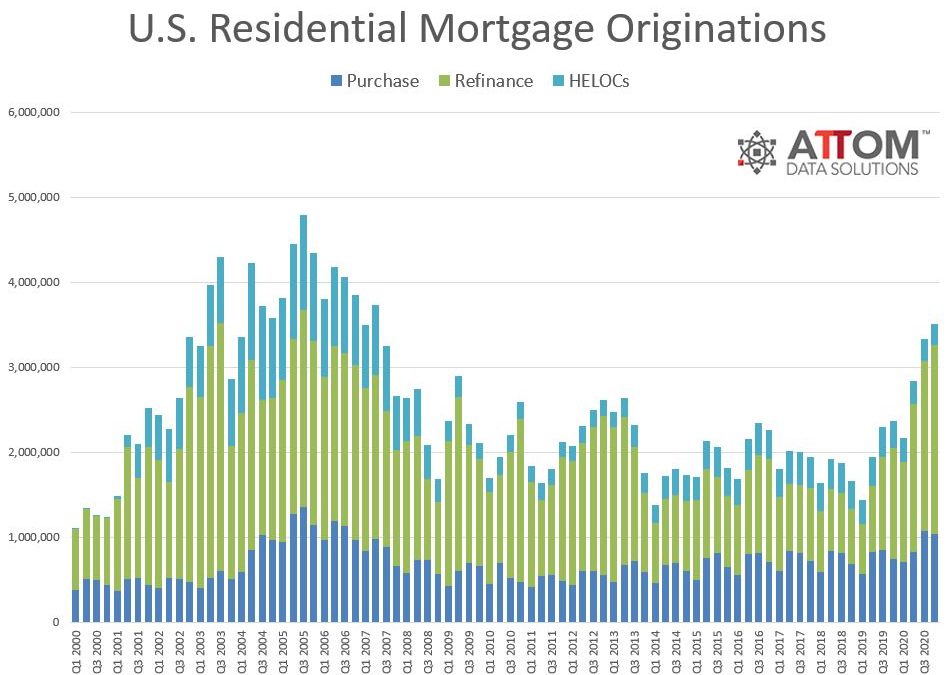

According to the Q4 2020 U.S. Residential Property Mortgage Origination Report from ATTOM Data Solutions, 3.51 million mortgages secured by residential property (one- to four-units) were originated in Q4 of 2020, up 5.5% from Q3 of 2020, and up 48% from Q4 of 2019–to the highest level in nearly 14 years.

According to the Q4 2020 U.S. Residential Property Mortgage Origination Report from ATTOM Data Solutions, 3.51 million mortgages secured by residential property (one- to four-units) were originated in Q4 of 2020, up 5.5% from Q3 of 2020, and up 48% from Q4 of 2019–to the highest level in nearly 14 years.

ATTOM attributes this boost in activity to a strong push by refinances, as lenders issued 2,226,951 residential refinance mortgages in Q4, up 11.5% from Q3 and 70.7% from Q4 of 2019. The dollar volume of refinance packages rose to $666.8 billion in Q4 of 2020, up 11.4% over the prior quarter and 66.6% from a year earlier.

Interest rates held below 3% in Q4, as lenders issued $1.06 trillion worth of mortgages in Q4–up 6% from the third quarter of 2020, and 55% from a year ago, to the largest quarterly amount since at least 2000. The quarterly rate of increase in loans and dollar volume represented the largest gains during any fourth-quarter period since 2011.

“Lenders continued working overtime across the United States in the fourth quarter or 2020, with increases in loans and dollar volumes rarely seen during a time of year when activity normally slows down,” said Todd Teta, Chief Product Officer at ATTOM Data Solutions. “The rising numbers left another in a long string of markers showing how the housing market has mostly avoided economic damage stemming from the virus pandemic. As with other housing market measures, the appetite for loans among homeowners and home seekers in the coming months remains uncertain, depending on interest rates and multiple factors connected to the pandemic. But the fourth-quarter data shows continued strong demand for new mortgages, especially among homeowners looking to refinance.”

Refis increased quarter-over-quarter in Q4 in 189 of the 214 metropolitan statistical areas (88.3%) that had a population greater than 200,000 and at least 1,000 total loans, and rose by at least 15% in 100 metro areas (46.7%). The largest quarterly increases were in Sioux Falls, S.D. (up 75.3%); Reno, Nev. (up 55.5%); Toledo, Ohio (up 55.1%); Lake Charles, La. (up 47.1%); and Chicago (up 44%).

Other than Chicago, metro areas with at least one million people that had the biggest increases in refinance activity from Q3 to Q4 were Baltimore (up 35.6%); San Jose, Calif. (up 27.5%); Tampa (up 25.9%); and Indianapolis (up 24.7%).

Metro areas with the largest declines in refis from Q3 to Q4 of 2020 were led by Ann Arbor, Mich. (down 63.8%); Baton Rouge, La. (down 31%); Pittsburgh (down 27.9%); Harrisburg, Pa. (down 20.5%); and Trenton, N.J. (down 17.4%).

Click here for more information on ATTOM’s latest findings.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news