This piece originally appeared in the March 2022 edition of MReport magazine, online now [1].

Over the past few years, supplies of items such as computers, video game systems, and other electronic devices have been hampered by a lack of semiconductor chips. Grocery store shelves have seen various items vanish from the shelves and take longer than expected to be resupplied.

In all these cases, supply-chain issues are at issue, either created by or complicated by the lingering effects of two years spent navigating a global health crisis.

The housing industry is no different.

What exists as a semiconductor chip in a video game console equates to nails, lumber, drywall, and other materials when it comes to new home construction.

With housing demand continuing to soar and insufficient inventory leading to everything from bidding wars to increased rental activity, MReport takes a look at how the supply chain is impacting housing, and whether any relief is on the horizon.

Not a New Problem

It was March 11, 2020, when the World Health Organization (WHO) declared the novel coronavirus (COVID-19) outbreak a global pandemic. The population adhered to local stay-at-home mandates as the nation and medical community attempted to get a grip on just what this new illness was and how to contain it.

Many also attribute this time as the genesis of the supply-chain issues we currently face, an ongoing problem that put even more pressure on an already strained national housing inventory.

The pandemic forced wood mills to shutter, factories to close, and put the world on pause, initiating ripple effects that continue even two years later.

However, as Pat Stone [2], Williston Financial Group Chairman [3] and CEO, noted, these issues may have been around long before March 2020, dating back to the previous housing crisis of 2007-2009.

“Since the Great Recession, there has been a shortage of approximately 1.6 million new homes built in relation to demand,” Stone said. “So, we’ve been experiencing a fairly dramatic shortage of homes for a long time. We were very optimistic around this time last year that we were going to see builders ramp up activity. Builder confidence, builder attitudes, and desires went up, and if you look at the end of the year, the numbers of permits and applications also went up.”

However, the number of finished homes did not.

“That’s where the impact is hitting the market,” Stone added. “It’s stretching out the length of time it takes to build a home, and it’s also increasing the cost of that home. We’d initially thought we could be back to a good supply/demand balance in three to five years. Now it looks like it will take longer.”

Thomas Showalter [4], CEO of Candor Technology, has experienced the effects of the supply chain issue first-hand.

“In September of 2020, I personally attempted to get some home repairs accomplished, and my builder reported that he could not respond before six months,” Showalter said. “And again, a full year later, in September of 2021, when I attempted to purchase and install a home theater system, my contractor could not promise any equipment deliveries before April 2022.”

As the spring turned to the summer of 2020, the market began to change profoundly as construction deadlines were missed in light of many states mandating stay-in-place orders.

“Construction timelines expanded due to lack of timely material delivery and the availability of appliances began to shrink,” said Jon Maynell [5], President of Advanced Data Corp. [6] “Buyers who traditionally selected their appliances midway through a build were asked to select them up front—at the very beginning of the build or before construction even started—to ensure they were delivered before/by the projected completion date. Once delivered, buyers often found that the price of appliances had increased, a new eventuality for which builders and lenders had to make provisions.”

As these prices rose, a majority of these costs were passed onto the consumer, but all in the housing chain were impacted.

“Ultimately, and unsurprisingly, consumers absorb the bulk of the cost increases caused by supply chain issues, as builders, contractors, and real estate investors build these costs into the purchase and rental prices of properties they’re bringing to market,” said Rick Sharga [7], EVP of RealtyTrac [8]. “But everyone in the ecosystem is impacted to some extent: builders won’t be able to scale up as rapidly as they’d like in order to meet demand; investors may have to absorb some of the costs, thus limiting ROI; and even contractors may find themselves unable to move forward on projects, reducing their income.”

As Ken Dicks [9], Director of Appraisal Compliance at valuation fintech Reggora [10] added, “Buyers typically bear the cost of supply-side constraints, as new home pricing will take into account current and anticipated costs to construct the product. Builders and developers bear some risk of material cost volatility, as construction periods for a new home can extend beyond a six-month time-frame.”

The New Reality

Delays and disappointment followed for homebuyers over the span of the next few years. A market that seemed like it was the ideal time to take advantage of record-low rates was met with an ever-shrinking list of homes for sale and unprecedented bidding wars as homes began to spend less and less time on the market.

Data from the National Association of Realtors (NAR) found that since 2019, home prices have risen 30%—approximately $80,000 for a typical home—while housing inventory has declined to under one million units available for sale.

“As long as there’s the kind of supply and demand imbalance we’re seeing today, prices are going to continue to rise,” Sharga said. “Unchecked, this will eventually lead to buyers opting out of the market due to affordability issues. This may already be happening, as many newly formed households are renting rather than buying—despite nearly seven million home sales in 2021, homeownership rates only moved up by one tenth of a point. This has led to increased investor activity.”

RealtyTrac estimates that nearly 17% of residential home purchases in the third quarter of 2021 were made by investors, an increase of nearly 40% from the prior year.

“This limits supply for homebuyers even further,” Sharga added. “It’s important to note, however, that the shortage of homes available for sale was a problem before the pandemic-driven supply-chain issues began; builders had been largely AWOL for almost a decade. The fact that the builders decided to ramp up activity at precisely the time that the supply-chain disruption occurred is just incredibly ironic, and very problematic.”

The Well Runs Dry

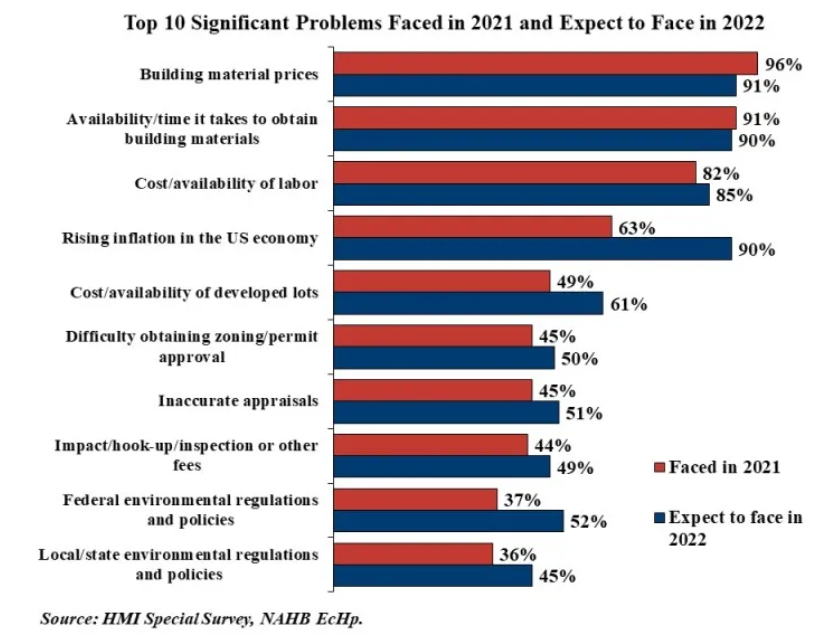

In terms of new construction, the price of materials and overall availability of supplies were principal issues faced by builders.

A recent National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index report found building material prices as the most significant concern for 96% of builders in 2021, with 91% of those polled believing this issue will linger over the next 12 months.

Yet another issue cited by builders in 2021 was the scarcity of materials and the timeframe in obtaining these building materials, as 91% of builders expressed that as a secondary reason.

Comparing these present-day numbers to 2011, when, according to a similar NAHB study, building material prices was reported as a significant problem by just 33% of builders, followed by 46% in 2012, 68% in 2013, 58% in 2014, 42% in 2015, 48% in 2016, 77% in 2017, 87% in 2018, and 66% in 2019, before peaking at 96% in both 2020 and 2021.

In terms of materials, key to any new home construction is the lumber required to frame the home. After a few months of moderation in pricing in the summer and spring of 2021, the first few months of 2022 have found the cost of lumber reaching record numbers once again, further exacerbating an already dire situation.

“Homebuilders simply cannot get access to the products they need to finish properties and put homes on the market, so that’s impacting home sales greatly,” said Ralph McLaughlin [11], Chief Economist for proptech firm Kukun [12]. “The consumer price for these products is rising at a pace not seen since 1975 and is hitting its highest point yet.”

According to Random Lengths Framing Lumber Composite, a broad measure of price behavior in the U.S. framing lumber market, as of December 29, the price of framing lumber topped $1,000 per thousand board feet—marking a 167% increase since late August.

NAHB estimates that this upward trajectory in lumber prices has forced the price of an average new single-family home to increase by more than $18,600. This price hike in one of the key materials in new construction has also added nearly $7,300 to the market value of the average new multifamily home, resulting in households paying $67 per month more to rent a new apartment.

The home construction industry, like a multitude of the nation’s trades, was impacted by the pandemic as a lack of skilled laborers played a key role when most states lifted their stay-at-home orders and workers were allowed to return to day-to-day life. Some were earning more through their government stimulus than they were from their regular nine-to-five jobs, meaning it was more worthwhile financially to remain on the sidelines than return to the workforce. In addition to supply-chain issues and the skyrocketing price of materials, the task of finding skilled construction labor became yet another factor in the lack of housing inventory and the rise in affordability issues.

Findings by the Home Builders Institute (HBI) in its Fall 2021 Construction Labor Market Report noted that the required number of construction workers to keep up with the nation’s housing demand is approximately 740,000 new workers per year for the next three years. HBI based their study on an analysis of Bureau of Labor Statistics (BLS) data by the NAHB.

The challenge of replenishing the nation’s housing supply seems even more insurmountable when described by Ed Brady [13], HBI President and CEO.

“The construction industry needs more than 61,000 new hires every month if we are to keep up with both industry growth and the loss of workers, either through retirement or simply leaving the sector for good,” Brady said. “From 2022 through 2024, this total represents a need for an additional 2.2 million new hires for construction. The construction worker shortage has reached crisis level. The situation will become more challenging in the coming year when other industries rebound and offer competitive wages and benefits to prospective employees.”

And it’s not just new construction that has been impacted. Many DIYers who grew bored during the pandemic took up new hobbies and decided to take a shot on their own to renovate and spruce up their existing homes.

“The supply chain disruptions have also negatively impacted existing homeowners, who are struggling to find materials necessary for renovations and appliances that need replacement,” said First American Deputy Chief Economist Odeta Kushi [14]. “This could keep some existing homes off the market, as homeowners who wish to list their property have to wait for materials and labor to make improvements. A lack of new and existing-home inventory is contributing to a historic housing shortage relative to demand, which puts upward pressure on home prices.”

An Emerging Market Seeks Their Share

Grounded by a pandemic that kept people from traveling and curbing spending, Americans were saving more than ever before. Adding to this savings was the $2.2 trillion economic stimulus bill passed by the 116th U.S. Congress, the Coronavirus Aid, Relief, and Economic Security Act (CARES Act), putting more money into the pockets of Americans.

An increase in savings and the ability for some to work from home opened the doors for a new market of homebuyers. Once crammed into major metros, these workers now had the ability to reach out into less populous regions, areas with more acreage for the kids to run around and homes with more square footage to house one, if not two, parents now working from home.

First-time and step-up buyers had new competition: investors and second-home buyers who now further threatened the ever-shrinking piece of the American housing pie.

Redfin has reported real estate investors and second-home buyers purchased 18.4% of the homes sold in the U.S. during the fourth quarter of 2021—a record high—up from 12.6% a year earlier. Investors bought 80,293 homes in Q4 alone, up 43.9% year over year.

“Investors buying up a record share of for-sale homes is one factor making this market difficult for regular homebuyers,” Redfin Economist Sheharyar Bokhari [15] said. “It’s tough to compete with all-cash offers, and rising mortgage rates have a smaller impact on investors because they often don’t use mortgages at all. If home-price growth slows in the coming year, investor demand may cool down because rental price growth will slow, too.”

Kushi noted, “The housing market was facing a significant supply shortage even prior to the pandemic, but that deficit has since grown. Builders are facing multiple supply-side headwinds that make it difficult and more expensive to build, including a lack of construction materials and appliances, a chronic construction labor shortage, and higher input costs. All these challenges are increasing the time needed to build a home and contributing to higher new-home prices.”

Is There an End in Sight?

In what seems like a vicious and non-stop cycle, the impacts of today’s supply chain issues on the housing market are far-reaching and may leave a lasting impact on the housing marketplace.

But what is being done on a temporary basis to alleviate the issue?

“There is talk about eliminating some of the tariffs that were put into place during the past administration, but even that may not help in the short-term,” Stone noted. “The supply chain needs to return to normal, but that’s not going to happen quickly. I don’t see an immediate solution. However, I do think you will see the labor shortage issue take care of itself by the summer. That’s the first step. The supply issue will probably take nine months to one year to get relatively resolved, and then you may see a real surge in new home construction.”

Kushi added, “One potential remedy to deal with supply chain issues is to switch to alternative comparable materials. However, this may not always be a cost-effective or sustainable solution.”

One such alternative being explored is manufactured-housing, an industry which has accelerated due to supply-chain disruptions and labor-supply shortages. According to the latest Texas Manufactured Housing Survey (TMHS) [16], manufacturers expect even faster growth in this market during the first half of 2022, as industry optimism has prompted a flood of capital expenditures and operational expansions.

“Manufactured housing is centered on driving as much efficiency into the home-building process as possible,” according to Rob Ripperda, VP of Operations for the Texas Manufactured Housing Association. “That means homes from plants get built with less labor and less materials wasted. Given widespread inflationary pressures, manufacturers are bullish that their value proposition will only look better as site-built producers get hit harder by rising costs and interest rates.”

Sharga added that lenders may play a role in a short-term solution as well.

“Fixing the global supply chain is way above my pay grade, but from a building and repairing standpoint, in the short-term, it comes down to adjusting schedules, adapting plans to use alternate materials and supplies, working with multiple suppliers, and building in room for unanticipated price increases,” Sharga said. “Lenders need to keep this in mind, as well when they’re pre-approving borrowers: the ultimate purchase price may be higher than what was originally submitted on the loan application; if the borrower doesn’t have cash reserves to make up the difference, the loan may need to be reworked, and quickly.”

A Return to the Days of Old?

Many wonder when these forces impacting the housing market will eventually align and bring normalcy to both the nation’s housing inventory issue and the supply chain issue. A 12- to 24-month timeframe is a solid estimate projected by most as to when the market will find a sense of stability once again.

“Most supply chain analysts seem to believe that it will take the rest of 2022, and perhaps the early part of 2023 before most of the problems we’re seeing today will be under control,” Sharga said. “But it’s possible—maybe even likely—that some parts of the supply chain will recover more quickly than others, and home builders seem to be having fewer issues overall than they did last year (although they still site delays with windows, engineered wood products, and lumber).”

Kushi added, “It’s difficult to predict when supply chain disruptions may resolve, particularly because supply chains are so interconnected. Labor shortages may ease in some industries, as some workers are enticed by higher wages, but transportation logjams and material shortages may take time to clear up. It’s unlikely that bottlenecks will dissipate in 2022, but issues may begin to ease in 2023.”

And will a lasting impact be left on the industry after having been forced to deal with these supply chain concerns?

“My feeling is that the impact has been so deep, and the disruptions so pronounced that we won’t see a return to the pre-pandemic infrastructure, such as it was,” Maynell said. “Supply chain leaders are already making permanent changes to build in more flexibility to protect against similar future events. All of this may very well be transparent to the consumer, so from their perspective, once the disturbances subside and the global market is thrumming with re-engineered supply chains (this will take the better part of a decade or longer), they may very well experience what feels like a return to normal.”

Stone feels that after experiencing this hiccup, things will eventually improve, and a more stable and efficient process will rise as a result.

“One interesting statistic is that $25 billion was invested in supply chain technology last year,” Stone said. “Forty percent of everything manufactured worldwide is manufactured by U.S. corporations, half of which is manufactured offshore. For this reason, every U.S. corporation out there is investing in supply chain technology and trying to make their supply chain work more durable and sustainable. I think the net result of all this is, five years from now, we’ll have a much more efficient supply chain, and we’ll probably have a much more consistent pricing regime because of it.”

A Side Note

One random post-holiday evening in January, I was in my local big box store grabbing a few items. There in a shopping cart, sat the Holy Grail of video next-generation gaming systems I had scoured the retail stores and online world for over a year. It was at customer service and my initial thoughts were that it was a throwback because I had never seen one “in the wild,” and it was damaged. But when I questioned the clerk, she said it was headed out to the electronics department for the display case to be sold. Let’s just say it didn’t make it to that display case and my hunt was over. A happy ending in this household.

Will the housing market end with similar success? And will today’s homebuyer, restricted to a minimal number of offerings as the market works feverishly to rebuild its supply and align the links in the supply chain, exercise patience and persistence?

As 2022 faces rising rates, many prospective buyers are growing bored and tired of the waiting game. Once-desirable rates are pushing upward, bordering in the 4% pre-pandemic range, thus forcing many to reconsider the strategy of landing the home of their dreams as the shelves of inventory are restocked over the next 24 months.

Will American homebuyers find a happy ending to their story? That remains to be seen.