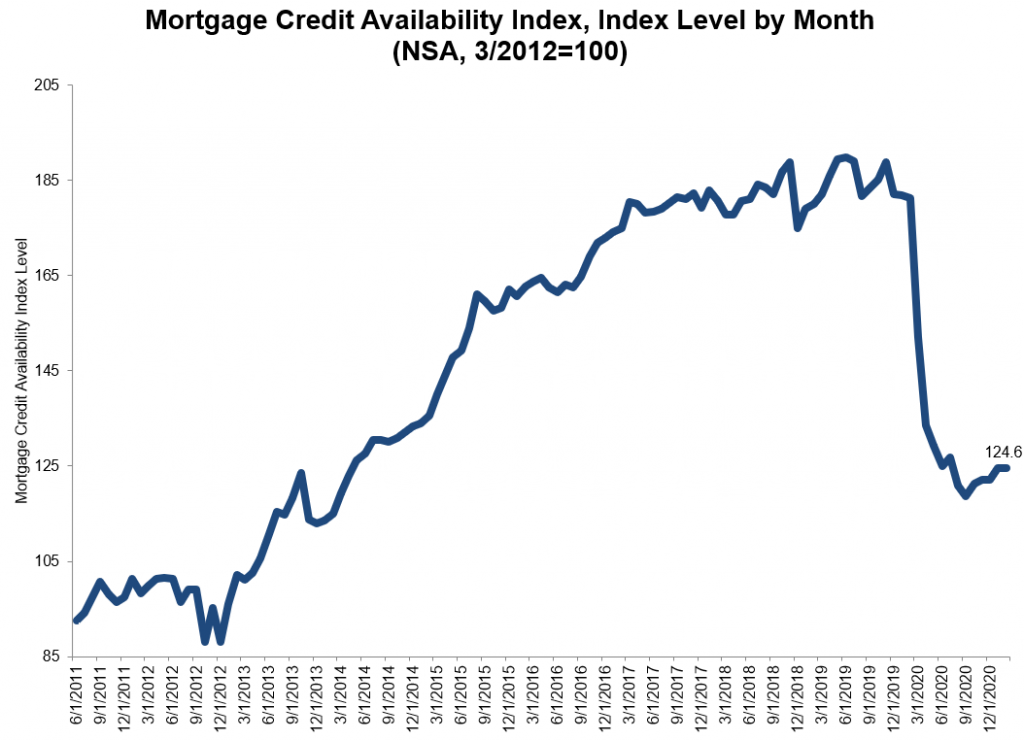

The Mortgage Bankers Association (MBA) is reporting that the Mortgage Credit Availability Index (MCAI) remained stable month-over-month in February, unchanged at 124.6.

The Mortgage Bankers Association (MBA) is reporting that the Mortgage Credit Availability Index (MCAI) remained stable month-over-month in February, unchanged at 124.6.

A decline in the MCAI indicates that lending standards are tightening, while increases in the MCAI indicate that credit is loosening. The index was benchmarked to 100 in March 2012.

In February, the Conventional MCAI decreased 0.3%, while the Government MCAI increased by 0.3%, the Jumbo MCAI increased by 0.2%, and the Conforming MCAI fell by 0.7%.

"Credit availability in February was unchanged from January, remaining close to its lowest level since 2014," said Joel Kan, MBA's Associate Vice President of Economic and Industry Forecasting. "The housing market is in strong shape heading into the spring, with robust growth in purchase applications, home sales, and new residential construction. Government credit supply has increased in five of the past six months, albeit in small increments, but remains tight by historical standards. This adds another obstacle for many aspiring first-time buyers who are already navigating supply and affordability constraints."

As reported by Nerdwallet, those obstacles Kan mentions include a number of factors for first-time homebuyers, the top factor being affordability.

"Expected home sales growth this year is still likely to be driven by first-time buyers, spurred by millennials reaching peak first-time homebuyer age,” said Kan. “Many of these potential buyers will likely utilize FHA and other low down payment loans to purchase a home."

The spring housing market is projected to be a hot one, as short supply, combined with low rates, will combine to create bidding wars on this very limited inventory.

Clever Real Estate’s recent “2021 Millennial Home Buyer Report,” found that while millennials are keen on purchasing larger homes, they remain anxious about homebuying, because they’re still unable to afford the traditional 20% down payment.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news