As the weather warms and COVID-19 vaccines roll out to more around the country, U.S. economic expansion is expected to accelerate this spring, with real GDP growth hitting 8.4% in Q2 and 6.6% for the full year before moderating in 2022, according to the latest commentary from the Fannie Mae Economic and Strategic Research (ESR) Group [1].

As the weather warms and COVID-19 vaccines roll out to more around the country, U.S. economic expansion is expected to accelerate this spring, with real GDP growth hitting 8.4% in Q2 and 6.6% for the full year before moderating in 2022, according to the latest commentary from the Fannie Mae Economic and Strategic Research (ESR) Group [1].

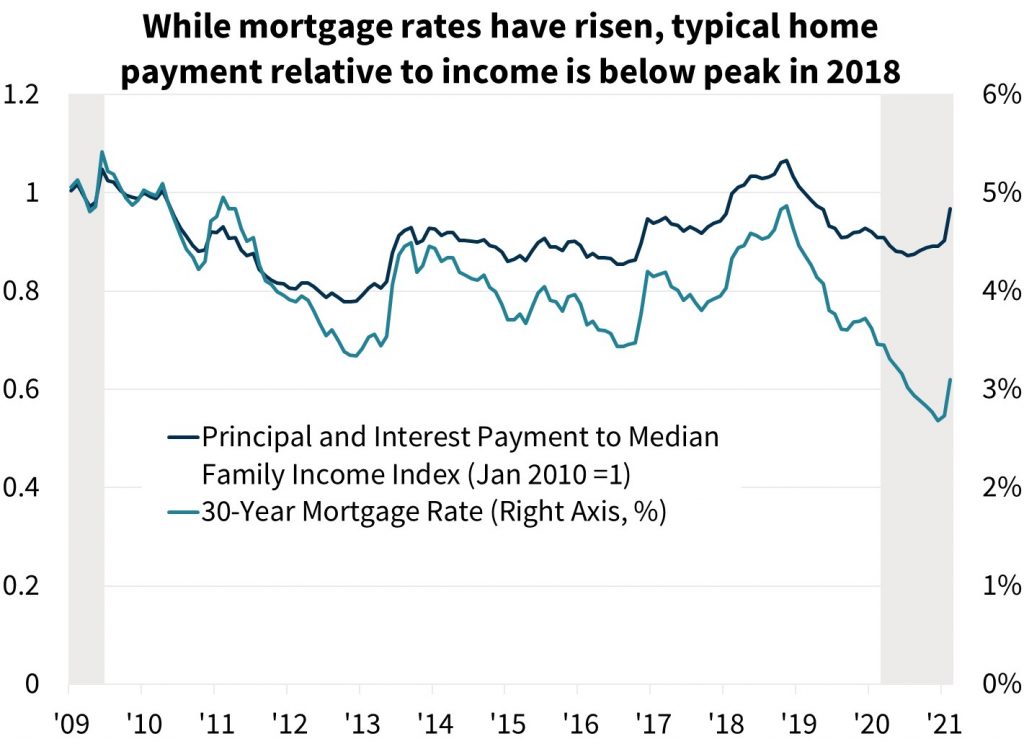

Home sales are likely to be minimally affected by rising mortgage rates to date according to Fannie Mae, though a further jump in record-low mortgage rates remains a risk. Mortgage originations are likely to be adversely affected, however, due to the weakening of refinance mortgage demand. In 2021, the refinance share of origination activity is forecast to dip to 54%, down from 64% in 2020; and by 2022, the refinance share is expected to hit 39%, as rates rise and the pool of outstanding mortgages with an incentive to refinance continues to decline. Purchase demand, meanwhile, is expected to remain relatively steady over the next few months, with $1.82 trillion expected in 2021, up from $1.61 trillion in 2020, and another $1.80 trillion expected in 2022.

"At the moment, economists' eyes are on interest rates given the size of the recent increases to Treasury and mortgage rates and the short time period over which those changes occurred," said Doug Duncan, Fannie Mae Senior Vice President and Chief Economist [2]. "Perspective is helpful here: While we forecast some continued upward movement, mortgage rates remain historically low, as they are still 0.8 percentage points below the 2019 average. Underlying Treasury rates have risen, though lenders have absorbed some of the rise by shrinking spreads, as confirmed by our recent Mortgage Lender Sentiment Survey results [3]. While the rate rise will curtail refinances to some degree, 2021 is poised to be a good year overall for housing activity and housing finance, as the economy continues to recover and COVID-19 restrictions ease. We expect a brisk acceleration in economic growth in the coming months. As always, there are downside risks to our forecast, and many center around monetary and fiscal policy impacts on interest rates going forward."

The Mortgage Bankers Association (MBA), in its Weekly Mortgage Applications Survey [4], found that apps decreased 2.2% for the week ending March 12, 2021 over last week. However, concern remains in the limited number of homes available, as demand continues to outpace supply nationwide [5]. The limited supply of homes for sale is likely holding back transactions, as many would-be buyers are likely unable to find a suitable listing or are being outbid. Even if some people drop out of the market due to rising rates, Fannie Mae feels there is an ample “reserve” of buyers able to fill their place in the near-term. Home price appreciation would likely soften as fewer bidding wars occurred, but the effect on transactions would be limited. Additionally, homebuilders are currently struggling to keep up with demand, suggesting they would continue a brisk construction pace, even if foot traffic cooled.

Click here [1] for more highlights from Fannie Mae’s ESR Group.