While the pandemic turned lives upside down nationwide over the past year, the 2020 U.S. Home Flipping Report from ATTOM Data Solutions found that 241,630 single-family homes and condos in the U.S. were flipped in 2020, down 13.1% year-over-year from 2019 to the lowest point since 2016. ATTOM reported that the number of homes flipped in 2020 totaled 5.9% of all home sales in the nation during the year, down from 6.3% in 2019 to the same percentage seen in 2018.

While the pandemic turned lives upside down nationwide over the past year, the 2020 U.S. Home Flipping Report from ATTOM Data Solutions found that 241,630 single-family homes and condos in the U.S. were flipped in 2020, down 13.1% year-over-year from 2019 to the lowest point since 2016. ATTOM reported that the number of homes flipped in 2020 totaled 5.9% of all home sales in the nation during the year, down from 6.3% in 2019 to the same percentage seen in 2018.

"Last year was a banner year for the U.S. housing market, with the apparent exception of the home-flipping business, which saw its fortunes slide a bit more in 2020,” said Todd Teta, Chief Product Officer at ATTOM Data Solutions. “Home flippers did still make a nice profit on investments that generally take around six months to turn around—just not as much as they did in the previous few years. It's too early to know if that small slide was a sign of weakness in the broader housing market or just a bump in the road. We will know much more as we gauge other key market metrics in the coming months."

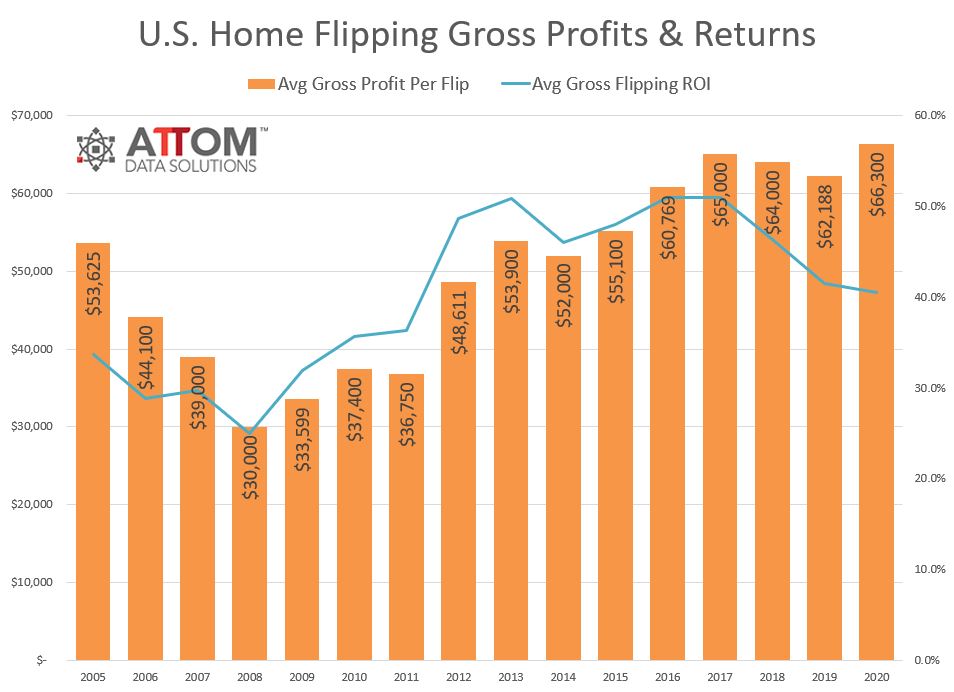

While flipping activity slid, gross profits and profit margins shifted in opposite directions, with profits rising in 2020, but profit margins dipped, the third consecutive year that returns on investments declined. Homes flipped in 2020 typically generated a gross profit of $66,300 nationwide (the difference between the median sales price and the median amount originally paid by investors), up 6.6% from $62,188 in 2019 to the highest point since at least 2005. But the typical gross flipping profit of $66,300 translated into just a 40.5% return-on-investment (ROI) compared to the original acquisition price. The 2020 ROI was off more than 10 percentage points from peaks over the past decade in 2016 and 2017. The 2020 figure also stood at the lowest point since 2011.

Some of the biggest markets hit by the decline in flipping were found in the South and West regions, led by San Antonio, Texas (rate down 27.3%); Tuscaloosa, Alabama (down 25.7%); Santa Rosa, California (down 24.8%); Brownsville, Texas (down 24.1%) and Houston (down 22%).

On the “flip” side, home flipping rates increased from 2019 to 2020 in 72 metro areas with the largest annual increases in Norwich, Connecticut (up 38.2%); Hartford, Connecticut (up 31.1%); Boulder, Colorado (up 29%); Albuquerque, New Mexico (up 26.9%); and Anchorage, Alaska (up 26.2%).

Those looking to profit off the flipping market found the largest gross profits in the major metros of San Jose ($274,000); San Francisco ($171,000); Manhattan, N.Y. ($152,000); Los Angeles ($151,500); and San Diego ($147,750). The lowest gross-flipping profits among metro areas with a population of at least 1 million included Raleigh, North Carolina ($30,000); Houston ($37,174); San Antonio ($39,867); Las Vegas ($45,600); and Charlotte, North Carolina ($46,000).

Click here to read more about ATTOM’s 2020 U.S. Home Flipping Report.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news