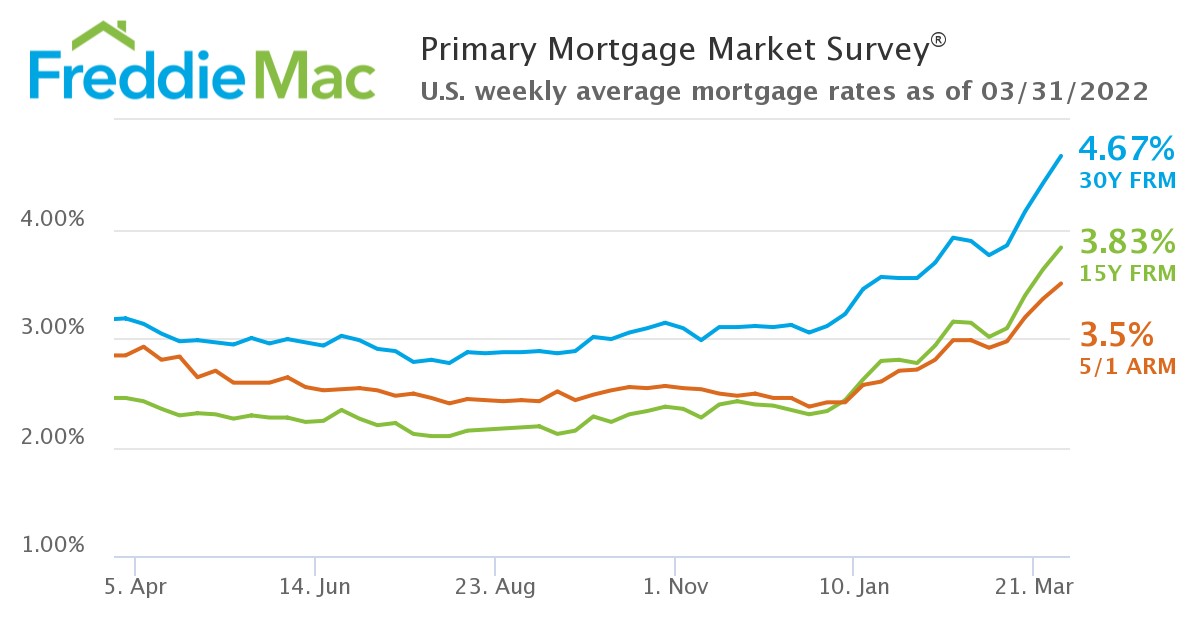

The latest Primary Mortgage Market Survey (PMMS) from Freddie Mac, for the week ending March 31, 2022 found the 30-year fixed-rate mortgage up again, averaging 4.67%, with an average 0.8 point, over last week’s reading of 4.42%. A year ago at this time, the 30-year FRM averaged 3.18%.

The latest Primary Mortgage Market Survey (PMMS) from Freddie Mac, for the week ending March 31, 2022 found the 30-year fixed-rate mortgage up again, averaging 4.67%, with an average 0.8 point, over last week’s reading of 4.42%. A year ago at this time, the 30-year FRM averaged 3.18%.

Also this week, Freddie Mac reported the 15-year FRM averaged 3.83% with an average 0.8 point, up from last week when it averaged 3.63%. A year ago at this time, the 15-year FRM averaged 2.45%.

“Mortgage rates continued moving upward in the face of rapidly rising inflation as well, as the prospect of strong demand for goods and ongoing supply disruptions,” said Sam Khater, Freddie Mac’s Chief Economist. “Purchase demand has weakened modestly, but has continued to outpace expectations. This is largely due to unmet demand from first-time homebuyers, as well as a select few who had been waiting for rates to hit a cyclical low.”

And as rates continue to rise, buyers are feeling the crunch as the Mortgage Bankers Association (MBA) reported yesterday, overall mortgage application volume continued to fall, dropping 6.8% week-over-week. Also tailing off is refi volume, falling to 40.6% of total mortgage applications from 44.8% the previous week.

“Continuing on the recent trajectory, would have mortgage rates hitting 5% within a matter of weeks, but longer-term rates have receded somewhat this week as investors reassess the economic outlook,” commented Danielle Hale, Chief Economist for Realtor.com. “A very strong labor market in which job openings and worker quits remain near highs is making it difficult for firms to hire the workers that they need. This could slow the pace at which mortgage rates reach that 5% milestone, granting a temporary reprieve to home shoppers hoping to find a home and lock in a rate before they trend higher.”

Keeping pace with the hike in mortgage rates is the price of homes, which continue to outprice most first-time buyers and are causing affordability issues for many.

Redfin reports that housing prices jumped the most since summer 2021—up 17% year-over-year to a new high. Simultaneous, a 7% drop in new listings has kept homebuyer competition elevated as well with the median asking price of newly listed homes increasing 15% year-over-year to $398,850.

“Already, home prices have continued their recent climb, with home sales prices according to Case-Shiller accelerating and home asking prices hitting a new high of $405,000,” added Hale. “Rising mortgage rates are an added consideration for buyers, when rising costs are already widespread for other budget items such as groceries and gas. With rents continuing to rise at a double-digit pace nationwide and in many markets, buyers remain motivated. For today’s home shoppers, financing 80% of a home at the median listing price, the monthly mortgage payment is up more than $440 or more than 36% compared to a year ago. The steep increase in costs is likely to price out some buyers, and may lead to more options and less competition for home shoppers who can afford to stick with their home search.”

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news