Refinances closed by millennials during February 2021 accounted for 54% of all loans to members of this generation, according to the latest ICE Mortgage Technology Millennial Tracker. The millennial share of refinances was up 8% over January’s total, a share not seen since April 2020 during the peak of the pandemic refinance surge, when it hit 55%.

Refinances closed by millennials during February 2021 accounted for 54% of all loans to members of this generation, according to the latest ICE Mortgage Technology Millennial Tracker. The millennial share of refinances was up 8% over January’s total, a share not seen since April 2020 during the peak of the pandemic refinance surge, when it hit 55%.

“As we’ve seen with February’s refinance share increase, loan activity can change drastically from month to month, making it critical for lenders to set themselves up for success by adopting digital solutions early,” said Joe Tyrrell, president of ICE Mortgage Technology. “As we emerge from the pandemic, many borrowers will still want to complete the mortgage process as virtually as possible. Lenders can meet this demand by adopting new digital solutions early, like eClosing technology, that put them closer to a fully end-to-end digital mortgage process.”

A recent analysis by Zillow found that tech-savvy millennials are not only driving the home shopping trend, but overwhelmingly want more digital tools available during the home shopping process.

"It's clear that strong demand from the next generation of buyers will keep real estate technology in place long after the pandemic is over," said Zillow Senior Vice President of Product Matt Daimler. "Digital tools rapidly adopted during the pandemic not only make home shopping safer, they make it faster and easier."

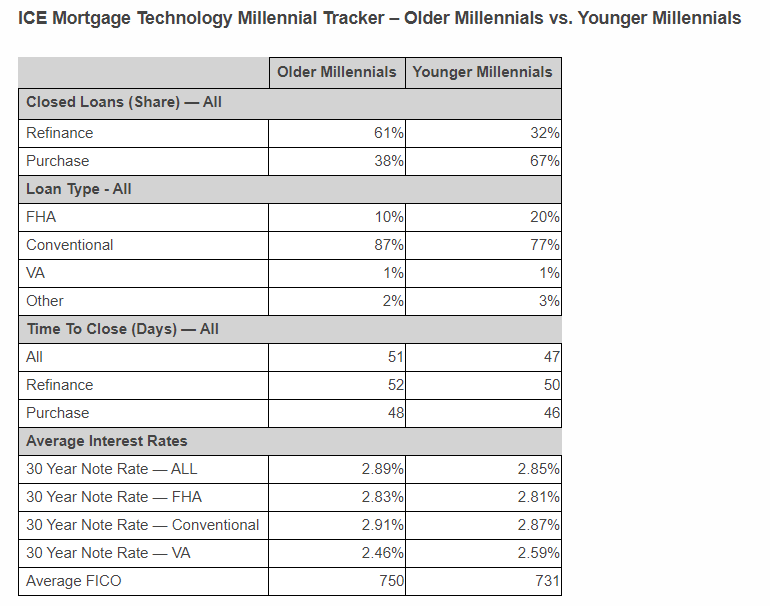

Younger millennials (classified as those born between 1991 and 1999) also closed a record high share of refinances in February. This age group have typically closed more purchase loans than refinances, as many are entering the housing market for the first time. However, in February, refinances accounted for 32% of loans closed by younger millennials–a significant jump since ICE Mortgage Technology began tracking the age groups separately in January of 2020. However, older millennials (born between 1980 and 1990) continued to be the driving force behind the refinance surge, with 61% of all loans closed by this age group as refis.

Average interest rates for all age groups changed little month-over-month at 2.88%. Younger millennials continued to secure lower rates than their older counterparts. However, average interest rates for this age group increased to 2.85%, while average interest rates for older millennials remained the same at 2.89% of the share. The average age of millennial homebuyers also came in at 32.9, near January’s record high of 33.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news