According to Veros Real Estate Solutions [1], home price appreciation will increase significantly during the next 12 months in the 100 most-populated markets. VeroFORECAST data found that by the first quarter of 2022, home prices will appreciate 7% higher, an additional increase of 1.1 percentage points compared to 5.9% just a quarter ago. Driving that change are primarily West Coast-based markets.

According to Veros Real Estate Solutions [1], home price appreciation will increase significantly during the next 12 months in the 100 most-populated markets. VeroFORECAST data found that by the first quarter of 2022, home prices will appreciate 7% higher, an additional increase of 1.1 percentage points compared to 5.9% just a quarter ago. Driving that change are primarily West Coast-based markets.

“The VeroFORECAST data indicates upward price pressure in nearly all markets during 2021,” said Darius Bozorgi [2], CEO of Veros Real Estate Solutions. “Buyer demand remains strong, with almost no major metro area showing notable home price depreciation over the next 12 months.”

So what then of affordability? Will a continual rise in prices drive away buyers?

Home prices rose 11.6% in February, according to the latest Home Price Index from Black Knight [3], hitting their highest annual rate in more than 15 years. Also rising at an equally-paced clip, median single-family sales prices rose 15.9% year-over-year in February.

“In 2021, market conditions will be heavily driven by continued low-interest rates and changes in “working from anywhere” practices that were influenced by the Coronavirus pandemic,” said Eric Fox, Veros VP of Statistical and Economic Modeling. “Once the global pandemic is largely behind us, interest rates will stabilize and rise to some degree, but will remain at historically low levels. At that point, we expect the nationwide market to return to a more typical pattern characterized by regional pockets of strength driven by migration patterns, solid fundamentals in many areas, and weaker markets with slight depreciation in a few others.”

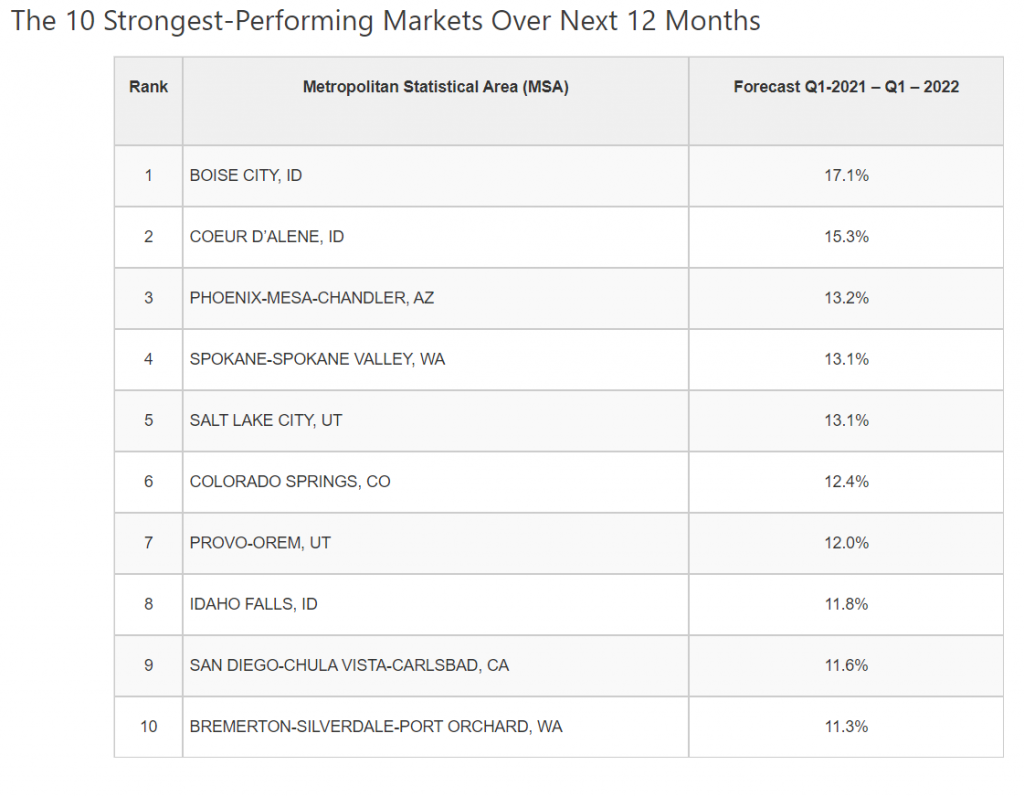

The western region of the U.S. leads the nation in price increases, with home prices in Boise, Idaho projected to rise 17.1% by Q1 2022. Boise is followed closely by another Idaho city, Coeur d'Alene, which is anticipated to see a 15.3% rise in home prices by the first quarter of 2022.

The list of 10 least-performing markets is dominated by cities in Texas, Louisiana, and Illinois. The two markets that will see the slowest growth are forecast to be in Texas oil country–with Odessa at 1.8% price appreciation, and Midland at 2.4% appreciation.