Mortgage credit availability, a key component of the mortgage application process, decreased in March, according to the Mortgage Credit Availability Index [1] (MCAI), a monthly report from the Mortgage Bankers Association [2] (MBA).

Mortgage credit availability, a key component of the mortgage application process, decreased in March, according to the Mortgage Credit Availability Index [1] (MCAI), a monthly report from the Mortgage Bankers Association [2] (MBA).

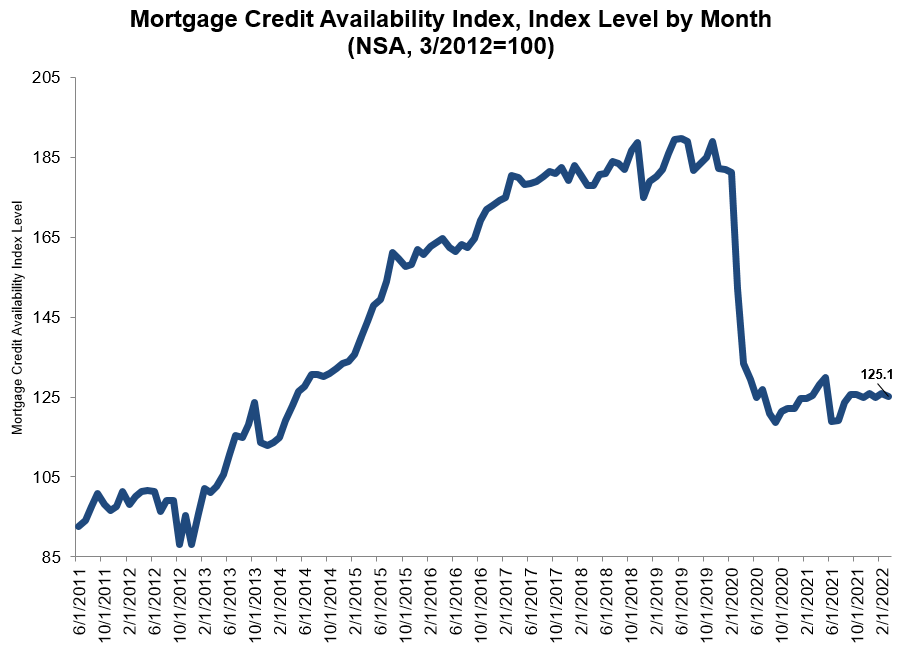

The MCAI fell by 0.7% to 125.1 in March. A decline in the MCAI indicates that lending standards are tightening, while increases in the index are indicative of loosening credit. The index was benchmarked to 100 in March 2012. The Conventional MCAI increased 0.3%, while the Government MCAI decreased by 1.6%. Of the component indices of the Conventional MCAI, the Jumbo MCAI increased by 1.5%, and the Conforming MCAI fell by 1.9%.

“Overall credit availability was down slightly in March, driven by a reduction in higher LTV, lower credit score programs,” said Joel Kan [3], MBA’s Associate Vice President of Economic and Industry Forecasting. “Credit availability has gradually trended higher since mid-2021 but remains around 30% tighter than it was in early 2020. There were also mixed trends for the various loan categories, as conventional loan credit availability increased for the second month in a row, while government credit supply decreased to its tightest level since February 2014. Additionally, jumbo credit expanded for the tenth time in the past 12 months but remained almost 40% lower than the pre-pandemic level.”

The MCAI fell by 0.7% to 125.1 in March 2022. The Conventional MCAI increased 0.3%, while the Government MCAI decreased by 1.6%. Of the component indices of the Conventional MCAI, the Jumbo MCAI increased by 1.5%, and the Conforming MCAI fell by 1.9%.

The Conventional, Government, Conforming, and Jumbo MCAIs are constructed using the same methodology as the Total MCAI and are designed to show relative credit risk/availability for their respective index. The primary difference between the total MCAI and the Component Indices are the population of loan programs which they examine.

The Government MCAI examines FHA/VA/USDA loan programs, while the Conventional MCAI examines non-government loan programs. The Jumbo and Conforming MCAIs are a subset of the conventional MCAI and do not include FHA, VA, or USDA loan offerings. The Jumbo MCAI examines conventional programs outside conforming loan limits, while the Conforming MCAI examines conventional loan programs that fall under conforming loan limits.

To read the full report, including all charts and methodology, click here. [1]