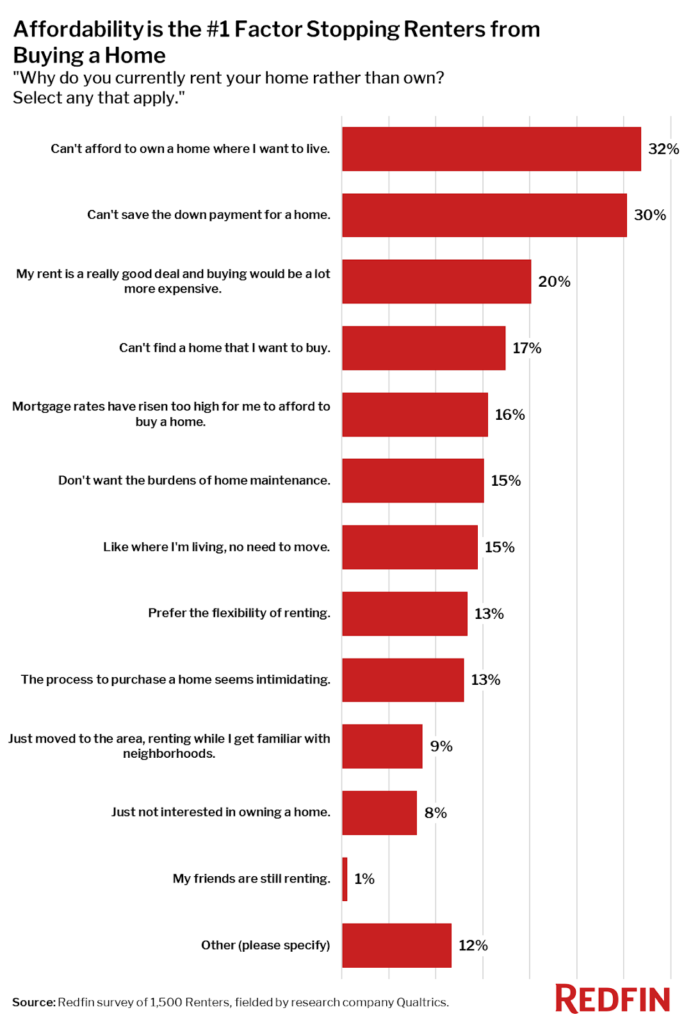

According to a new report from Redfin [1], roughly 32% of renters nationwide are doing so because they can’t afford to buy a home in the area they desire to live in — while 30% of renters are unable to save for a down payment, and 45% say debt is stopping them from buying a home.

The housing market is unaffordable for many prospective first-time buyers largely because home prices have shot up since the start of the pandemic, with remote work and last year’s record-low mortgage rates leading to a boom in demand.

Homes are 34% more expensive than they were before the pandemic started, and would-be buyers have half as many homes to choose from. U.S. rental prices are also soaring, with the average monthly asking rent up 15% year-over-year in February to $1,901. An estimated 20% of respondents said they rent because they have a good deal and buying a home would be more expensive, whereas 17% can’t find a home they want to buy.

“The housing market is seeing early signs of a cooldown, which could benefit first-time homebuyers,” said Redfin Chief Economist Daryl Fairweather. “Mortgage rates are rising fast, which is a double-edged sword: Higher rates mean higher monthly mortgage payments, but they will also eventually ease competition for homes, making it so fewer houses sell above their asking price.”

“The housing market is seeing early signs of a cooldown, which could benefit first-time homebuyers,” said Redfin Chief Economist Daryl Fairweather. “Mortgage rates are rising fast, which is a double-edged sword: Higher rates mean higher monthly mortgage payments, but they will also eventually ease competition for homes, making it so fewer houses sell above their asking price.”

Debt is the most common financial obstacle for renters, with 45% of U.S. renters saying debt from credit cards, student loans, medical bills, car loans, etc. are hurdles preventing them from trying to buy a home.

Paying down debt can make it difficult to come up with a down payment and/or monthly mortgage payments, especially now that home prices have shot up. Plus, homebuyers with a lot of debt can have trouble getting approved for a mortgage. Buying a home can still be a sound financial decision — even with significant debt — and rising home equity can even help pay off debt down the line.

“Debt doesn’t have to be a curse,” said Fairweather. “My advice for aspiring homeowners is to make a monthly budget and add debt to their expenses along with things like gas, groceries or entertainment. Saving for a down payment should be another line in the budget, keeping in mind that there are mortgage options like FHA loans that require little to no money down. Would-be buyers should also get preapproved for a mortgage to find out how much they can realistically spend on a monthly basis, and add that to their budget, too.”

Some 44% of respondents said home prices are too high where they would want to buy, and 38% said they didn’t have enough income to save money to buy a home.

Meanwhile, 23% of renters said pandemic-related setbacks like loss of a job or wages have kept them from buying, and 19% said high rental prices are a factor. Just 12% of renters said financial obstacles are not a factor keeping them from buying a home.

“A lot of American renters want to buy a home, but they’re stuck renting because it’s simply too expensive to break into the housing market,” said Fairweather. “That’s especially true since they’re often competing against investors or other deep-pocketed individual buyers. Unfortunately, the fact that buying a home is out of reach for so many Americans is a driver of inequality: Not owning a home means not benefiting from rising home values, one of the main ways to create and pass down generational wealth in this country.”

Even though financial obstacles are holding most renters back from buying a home, 56% of respondents said they’re not planning to make any compromises or sacrifices to save for a down payment or buy a home. At least 1 in 10 renters who are moving are doing so because they are being forced out of their home for one reason or another.

While 29% of respondents said the most common reason to move was upgrading to a better home, 20% cited the desire to be in an area with lower rent, with 18% citing a lower cost of living. A surprisingly large share was moving for reasons outside their own volition as an estimated 11% said their landlord is selling, and 10% are moving because their current rental doesn’t have adequate heat, hot water, electricity, etc. Approximately 6% are moving because their landlord is terminating their lease.

With rental prices up so much over the last year, one of the only ways to get around rising rental costs is to move to a more affordable area.

To view the full report, including more charts and methodology, click here [2].