Zillow’s latest Home Price Expectations (ZHPE) survey for Q1 2021 has found that the need for  homes with larger work spaces will be in demand, as telework has fueled the need for work at home accommodations.

homes with larger work spaces will be in demand, as telework has fueled the need for work at home accommodations.

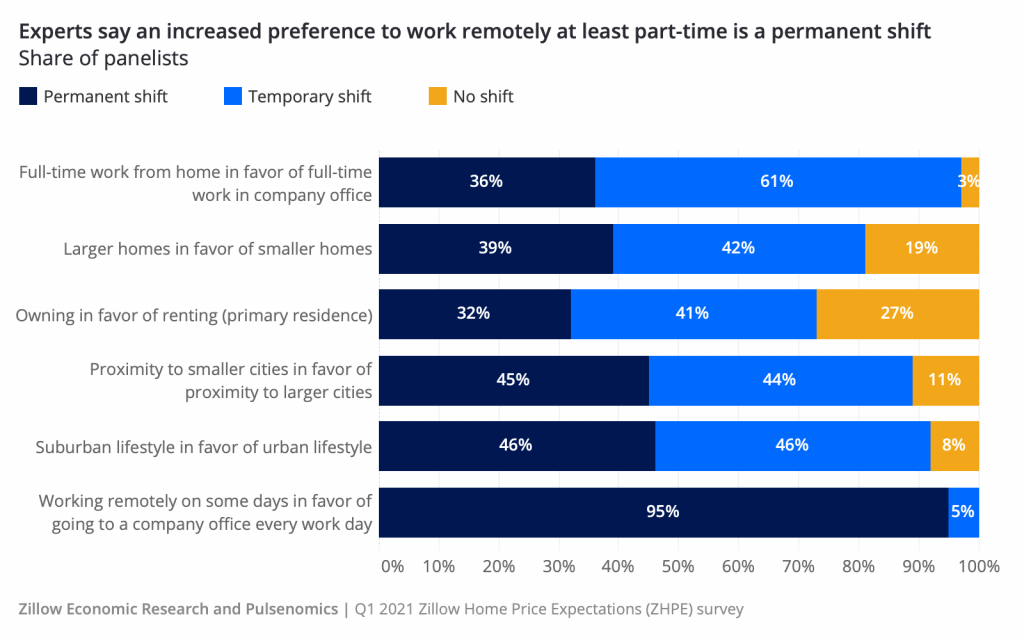

A majority (95%) of economists and real estate experts polled by Zillow for the ZHPE survey say an increased preference to work remotely at least part-time will be a permanent shift. Of employed individuals who work remotely at least one day a week, 23% said they were more likely to consider moving because of the pandemic, as only 13% of employed people who always work at their employer's location said the same.

Zillow economists expect 17.2% more home sales this year than in 2020.

“As the pandemic subsides and the economy begins to recover, lowered health risks and renewed homeowner financial confidence should bring more sellers to the market," said Zillow Economist Arpita Chakravorty. "That increased inventory would ease buyer competition that has driven prices higher during the pandemic, but expect a steady pace of home value growth to persist into the near future. Mortgage rates have risen some but are still low by historical standards, adding to people's purchasing power and helping to keep competition for homes revved up."

Pandemic-related job loss has contributed to a number of the nation’s renters being forced to sit on the sidelines in a buyer’s market. Federal actions extending eviction and foreclosure moratoria have been extended several times, as estimated 2.3 million Americans are currently in forbearance plans according to the Mortgage Bankers Association (MBA). Zillow panelists believe a large majority (85%) of cash-strapped renters will either find ways to remain in their current home or will avoid eviction by moving to a less-expensive home. Still, panelists said they expect some 15% of currently distressed renters will ultimately be evicted, representing millions of households.

In terms of the ideal home that shoppers seek, the survey found that Americans prefer a 2,000-square-foot home with three bedrooms and two bathrooms—the same as when surveyed a year ago.

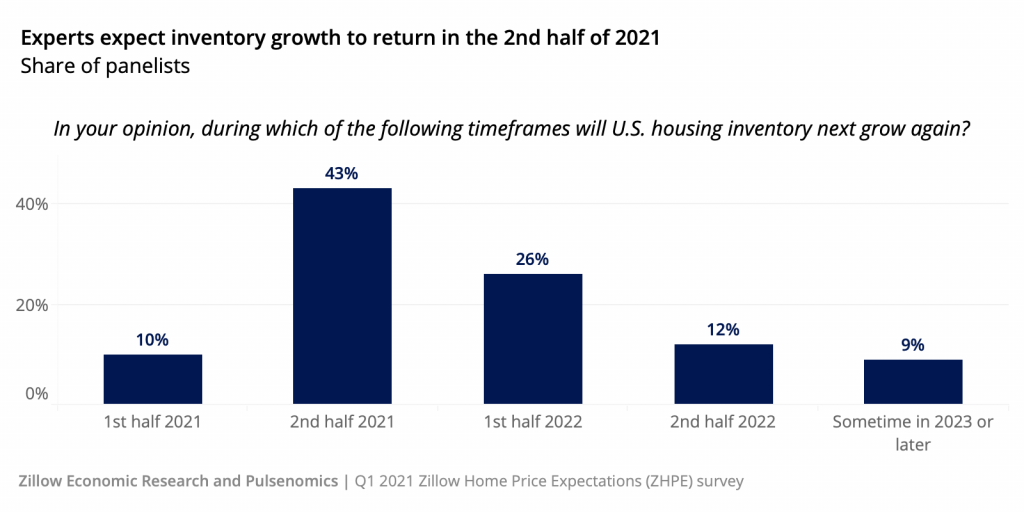

And while the ideal home has not changed, the number of homes has dried up as the demand has far exceeded the supply nationwide. A majority of ZHPE panelists (53%) expect home inventory to grow again this year, likely during the second half of 2021. An increase in existing-homes being listed for sale is expected to be the biggest factor in the reversal, with 38% of panelists saying this will factor as a catalyst for this growth in inventory.

"As the economy continues to recover, more potential sellers will enter the market as they gain confidence in their employment," said Samer Kuraishi, President and Founder at The ONE Street Company in Washington, D.C. "It's been tough on homeowners who want to sell but might have lost their job, or cannot work remotely. Increased employment stability will only raise confidence and push people off the sidelines. While we have optimism about April and the summer, our work with clients will remain the same: arm, educate, and empower them to learn the market and understand the road ahead."

Strong competition for the short supply available forced prices upward last year, as the typical U.S. home appreciated by more than $20,000 in 2020. Even with an expectation for more inventory to help meet buyer demand, ZHPE panelists on average expect home prices to grow 6.2% in 2021—a full two percentage points higher than when they were surveyed in Q4 2020—as several panelists call for double-digit price growth this year.

“In the wake of last year's heady home equity gains, these new projections indicate that the aggregate value of homes across the country will increase by another $2 trillion in 2021,” said Terry Loebs, founder of Pulsenomics. “This is great news for existing homeowners, but even with a robust economic rebound in the coming months affordability will likely remain a challenge for many aspirational renters looking to move into homeownership this year."

Click here to read more about the Q1 2021 Zillow Home Price Expectations (ZHPE) survey.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news