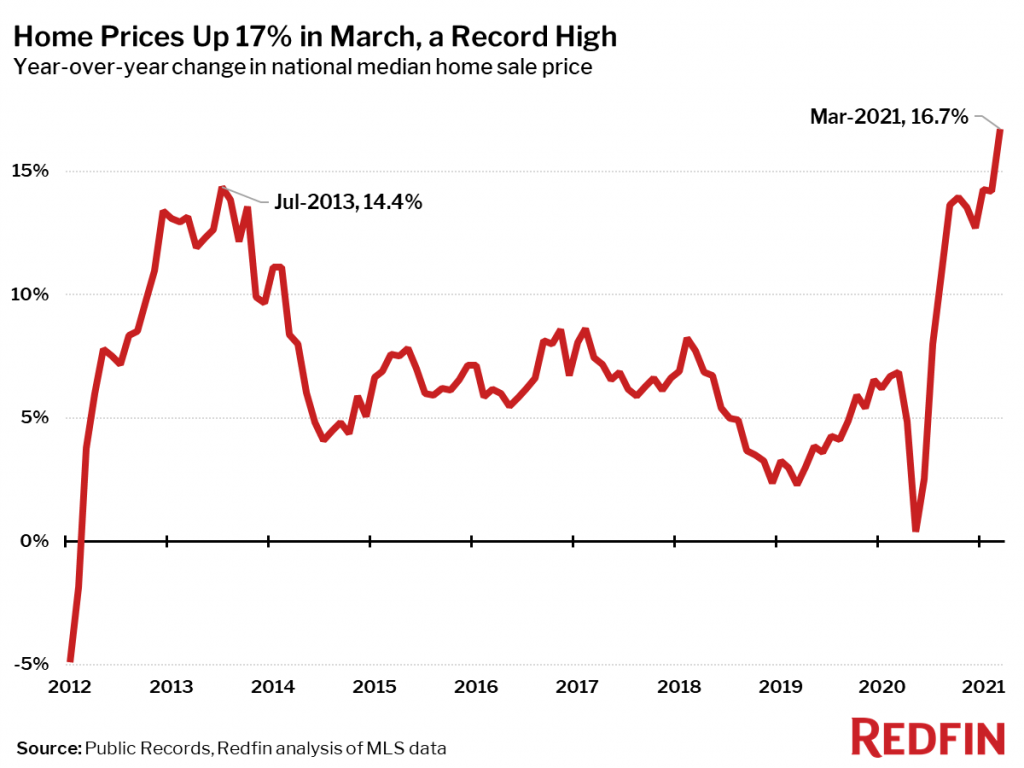

Redfin reports that in the month of March 2020, the national median home-sale price hit a record high of $353,000, up 17% from 2020, and a record high rate of growth.

Redfin reports that in the month of March 2020, the national median home-sale price hit a record high of $353,000, up 17% from 2020, and a record high rate of growth.

Regionally, median sale prices increased from over 2020 in all but two of the 85 largest metro areas that Redfin tracks. The only places prices didn't increase were Honolulu, where they fell 4.7% from a year ago and San Francisco, where they were down 1.6%. The largest price increases were in Austin, Texas (+28%); Fresno, California (+23%); and North Port, Florida (+23%), three popular destinations for newly-remote workers who have been leaving the most expensive metro areas during the pandemic in search of more affordable locales.

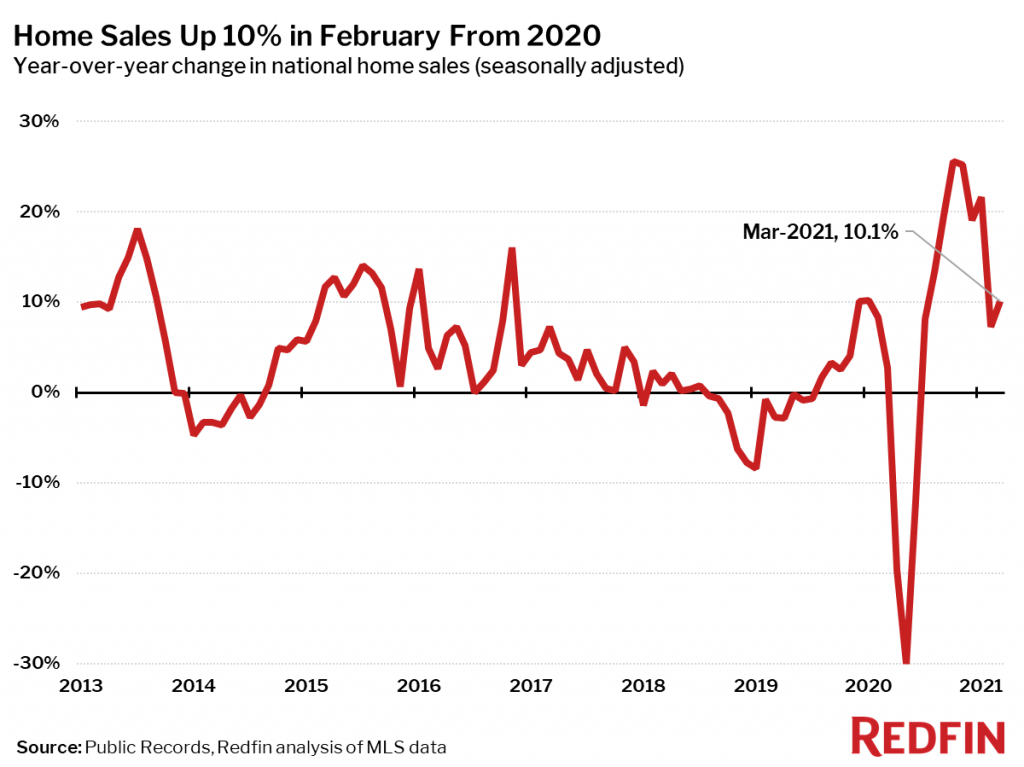

One factor that may have led to the rise in price is the nationwide shortage of available homes, as in March, the number of homes for sale fell to a record low, with a record year-over-year drop of 29%. And while the number of homes sold in March was up year-over-year in most of the 85 largest metro areas Redfin tracks, 11 metros did see declines. The largest gains in sales were in New York (+58%), San Jose (+56%), and San Francisco (+55%). The metro areas where home sales fell the most were Rochester, N.Y. (-9%), Grand Rapids, Michigan (-9%), and Dayton, Ohio (-7%).

With potential buyers picking the inventory clean, the typical home sold in March 2021 went under contract in 25 days—19 days fewer than a year earlier and the fastest pace on record. And in March a record-high 42% of homes sold above list price, the largest share on record.

In terms of inventory, active listings fell 29% year-over-year to their lowest level on record, marking the largest year-over-year drop on record, and the 20th-straight month of declines.

Only four of the 85 largest metros tracked by Redfin posted a year-over-year increase in the count of seasonally-adjusted active listings of homes for sale with San Francisco at +34%; San Jose at +20%; Oakland, California at +8%; and Los Angeles a+3%. The biggest year-over-year declines in active housing supply in March were seen in the Salt Lake City (-66%); Baton Rouge, Louisiana (-59%); and Allentown, Pennsylvania (-52%) markets.

New listings of homes for sale fell 7% in March from a year earlier. And despite the steady decline in new listings of homes for sale, pending sales were still up 22% from 2020.

“Despite the intense competition and high prices we face, I still see more big gains to be made in home equity,” said Redfin Lead Economist Taylor Marr. “Fundamentals like low mortgage rates and high demand for housing are fueling the record-high price gains, so I don't believe that homes are overvalued. Waiting for the market to cool could take many months, and at that point we may have missed out on the opportunity to benefit from these super-low mortgage rates and price gains in the year ahead."

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news