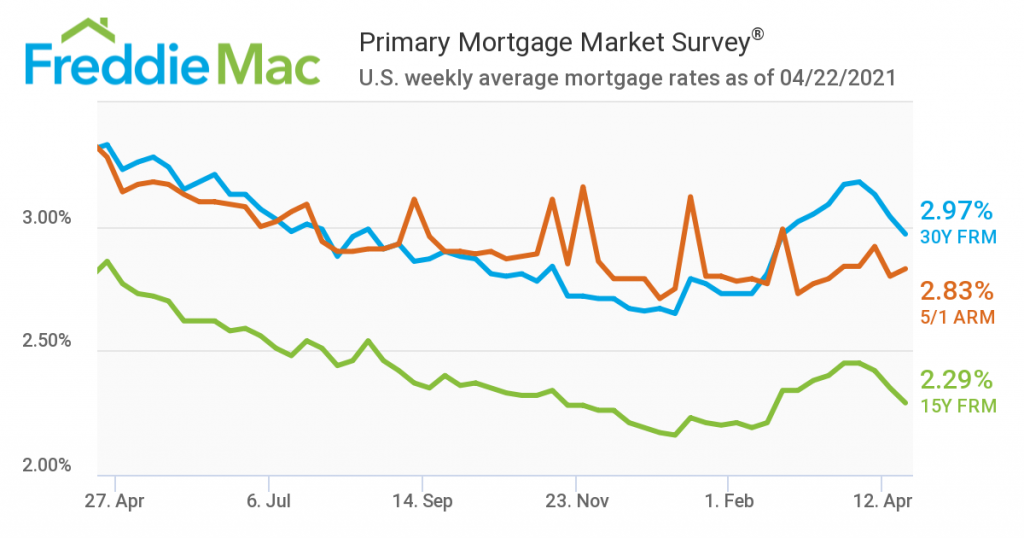

Mortgage rates dipped below the 3% mark, as Freddie Mac reported that the 30-year fixed-rate mortgage (FRM) averaged 2.97% this week, down 0.7% from last week’s rate of 3.04%. A year ago at this time, the 30-year FRM averaged 3.33%.

Mortgage rates dipped below the 3% mark, as Freddie Mac reported that the 30-year fixed-rate mortgage (FRM) averaged 2.97% this week, down 0.7% from last week’s rate of 3.04%. A year ago at this time, the 30-year FRM averaged 3.33%.

“The drop in mortgage rates is good news for homeowners who are still looking to take advantage of the very low rate environment,” said Sam Khater, Freddie Mac’s Chief Economist. “Freddie Mac research suggests that lower income and minority homeowners have been less likely to engage in the refinance market. Low and declining mortgage rates provide these homeowners the opportunity to reduce their monthly payment and improve their financial position.”

With rates down, mortgage applications were up, as the Mortgage Bankers Association (MBA) reported a week-over-week rise of 8.6% in mortgage apps, up from 3.7% over the previous week.

Also this week, the 15-year fixed-rate mortgage (FRM) averaged 2.29% with an average 0.6 point, down from last week when it averaged 2.35%. A year ago at this time, the 15-year FRM averaged 2.86%. The five-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 2.83% with an average 0.3 point, up from last week when it averaged 2.80%. The five-year ARM averaged 3.28% a year ago.

It’s a case of more competing for a constantly shrinking piece of the pie, as the market has become prime for sellers cashing in as prices hit all-time highs. Redfin recently reported that the median home sale price hit $341,250, a 17% increase from last year at this time when the pandemic basically brought U.S. home sales to a halt.

“The continued break in higher rates is good news for homebuyers and comes as new supply could be reaching a turning point thanks to a surge in new listings just as the housing market hits the best time of the year to sell a home and builders find ways to build a growing number of new homes despite challenges,” said realtor.com Chief Economist Danielle Hale. “Buyers still have to grapple with fast-selling homes and rising prices, but at least there may be more options to choose from soon. This should help home sales maintain recent momentum--below fall’s peak activity, but higher than we saw before the pandemic jump-started the market.”

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news