One thousand people took part in Fannie Mae’s third quarter 2021 National Housing Survey and reported back that affordability and remote work are still very much important to members of all demographics and age groups.

One thousand people took part in Fannie Mae’s third quarter 2021 National Housing Survey and reported back that affordability and remote work are still very much important to members of all demographics and age groups.

The survey was conducted by Fannie Mae’s Economic and Strategic Research Group with the help of ReconMR and Dynata, who placed the phone calls to households because of Coronavirus closures at their call centers. The 1,000 person sample size was selected and weighted to represent the economic and racial makeup of the general population as a whole.

When asked for their thoughts on housing affordability and the impact that remote work has had on the way they view housing, Fannie Mae found that an additional 20% of respondents believe that housing affordability has declined, along with affordable houses in general being harder to find.

Editors note: The questions asked in this version of the National Housing Survey do not occur in every quarterly survey. The last time these questions were asked of respondents was in the fourth quarter of 2017, which explains the gap in the dataset.

“Interestingly, most survey respondents think their own current housing is affordable, a belief that has not changed since 2017,” the survey said. “However, in 2021, we saw a dramatic increase in the percentage of consumers who felt that housing in their area had become both less affordable and more difficult to find. In 2017, 45% of homeowners said affordable housing in their area was difficult to find, a number that ballooned to 69% in 2021.”

Fannie Mae believes this is due to ongoing inventory constraints; if people that view their home as affordable and are in an otherwise unaffordable area, they may opt against moving—this is true for either homeowners or renters.

However, 92% of homeowners reported that they felt their home mortgage was still affordable in the current real estate market.

How remote working and commuting impact housing preferences

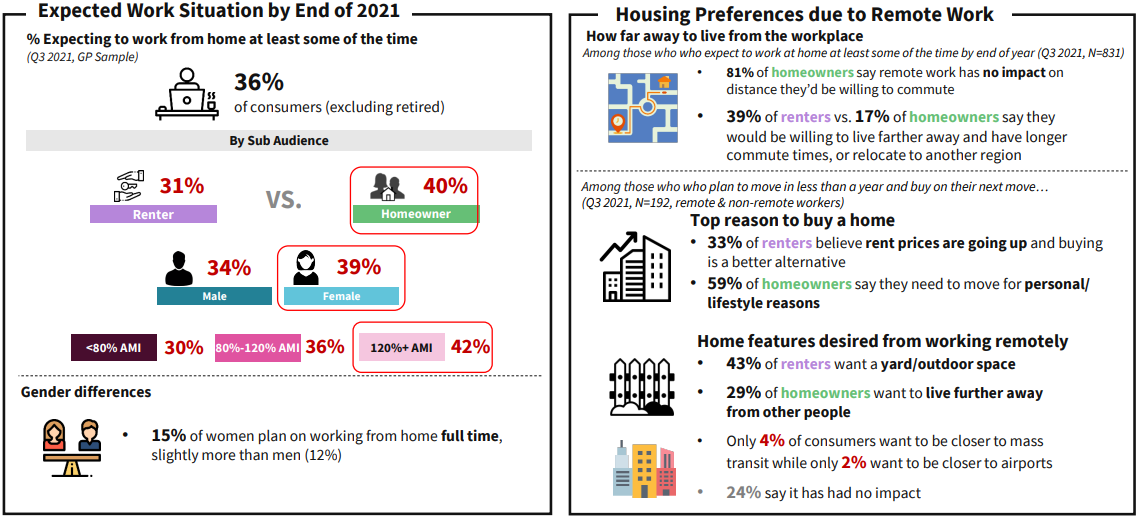

More than one-third of respondents expected to work from home at least some of the time, while nearly half indicated that they would need to physically go to their workplace every day. Digging deeper, a higher percentage of homeowners than renters said they could work remotely (40% of homeowners vs. 31% of renters). Additionally, a larger percentage of higher-income respondents said they expected to have some type of remote work situation.

When asked if remote work would impact their willingness to live farther away in a hybrid-type work situation, more renters said they would be willing to do that over homeowners and an additional 13% would be willing to completely relocate to another region.

Fannie Mae explains in their report that remote-working renters are more willing to move than homeowners because the physical act of moving is typically easier: They can move at the end of their lease, while homeowners would need to sell their house – typically a much longer and far more complicated process. The data also showed that remote-working, lower-income respondents are more willing to commute longer distances than other higher-income respondents, most likely because they can find less expensive housing farther away from job centers.

Reasons for moving and buying

The survey also asked respondents who planned on moving in the next 12 months and the reasons they expected to move.

While homeowners indicated that they plan on moving due to a new job or family (59%), renters indicated that they plan to move overwhelmingly for one reason: rent hikes (33%).

“These potential near-term buyers were also asked if remote working had any impact on their desired home features,” the survey said. “Unsurprisingly, given the changing work paradigm, as well as behavioral shifts likely stemming from the pandemic, 38% of all respondents said they wanted more outdoor/yard space, while 27% said they wanted to live farther away from neighbors. Renters, in particular, wanted more outdoor space, while current homeowners said living closer to family and friends was a priority.”

Ongoing demand for all types of more affordable homes

“Clearly, consumers have become much more aware of the lack of housing affordability, and continued remote work flexibility is likely giving many the ability to live farther away in more affordable areas,” the survey concluded. “Consumers who want to purchase in the next year indicate that work/personal lifestyle—or rent prices going up, for those renting—are their main reasons for moving, and many indicated that they want more outdoor space and privacy.”

“To us, these insights suggest that if more homes or rental properties became available in slightly less dense areas, it would likely be welcome relief for many households. But with single-family housing prices expected to increase by 7.6% in 2022, as measured by the FHFA Purchase-Only Index, after rising an astonishing 17.6% in 2021, both current and potential homeowners may continue to have difficulty purchasing a home.”

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news