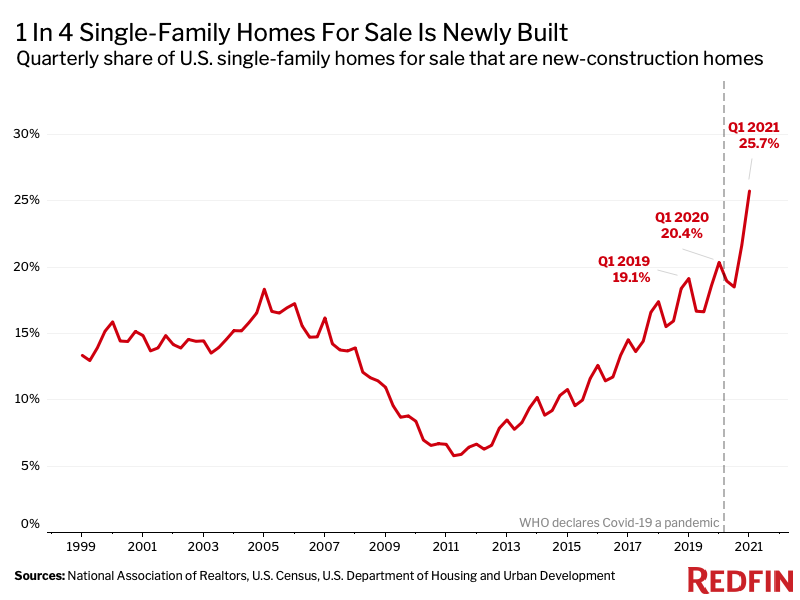

Despite the struggles faced by homebuilders in terms of rising supply costs, newly-constructed homes have steadily been accounting for a larger share of U.S. housing starts. According to Redfin, 25.7% of single-family homes for sale during Q1 were newly-constructed homes, up from 20.4% a year earlier, representing the highest share on record. The number of new residential construction projects jumped nearly 20% month-over-month in March to its highest level since 2006.

Despite the struggles faced by homebuilders in terms of rising supply costs, newly-constructed homes have steadily been accounting for a larger share of U.S. housing starts. According to Redfin, 25.7% of single-family homes for sale during Q1 were newly-constructed homes, up from 20.4% a year earlier, representing the highest share on record. The number of new residential construction projects jumped nearly 20% month-over-month in March to its highest level since 2006.

"Building homes has become more attractive and profitable during the pandemic due to record-low mortgage rates and red-hot homebuyer demand," said Redfin Lead Economist Taylor Marr. "At the same time, many homeowners have opted to stay put and refinance or remodel their existing homes instead of selling them, allowing new-construction homes to take up a larger portion of the market."

The National Association of Home Builders (NAHB) recently reported that the price of lumber has tripled over the past year, forcing the price of a new single-family home to rise $35,872 on average.

Many homebuyers have also turned to the new-construction market due to the fierce bidding wars nationwide. Redfin Salt Lake City Market Manager Ryan Aycock commented that the U.S. housing shortage has grown so severe that some newly built homes now have waitlists that are 90 buyers deep. Some builders are even canceling contracts with buyers who refuse to accept price increases.

"New construction has typically been a good option for buyers who don't want to deal with bidding wars because builders don't usually set deadlines for offers. Buyers also like that they can often buy a new home for what it's actually listed for rather than having to offer way over the asking price to win," said Redfin Houston Real Estate Agent Melanie Miller. "However, inventory for new construction is very low and prices are now rising for many new and pre-construction homes because lumber prices have gone up. I had one buyer who came to terms with a builder at a certain price. The builder called us the next day, and said they can't do that price anymore because their suppliers just increased prices."

Regionally, the El Paso, Texas market led the way, with 53.2% of single-family homes for sale in Q1 newly built—the largest share of the 82 U.S. metropolitan areas in Redfin's analysis. Other metro market shares of new-built homes included:

- Boise, Idaho (46.7%)

- Houston, Texas (35.5%)

- Raleigh, North Carolina (34.5%)

- Baton Rouge, Louisiana (34.1%)

- Albany, New York (33.7%)

- Nashville, Tennessee (31.9%)

- Charlotte, North Carolina (31.6%)

- Oklahoma City, Oklahoma (30.8%)

- Knoxville, Tennessee (29.6%)

Markets boasting the least amount of newly-built homes were led by Fresno, California with just 2.4% of Q1 single-family homes for sale being newly built, followed by:

- Oakland, California (2.9%)

- Bakersfield, California (3.2%)

- Riverside, California (3.4%)

- Pittsburgh (3.8%)

- Anaheim, California (4.2%)

- San Diego (4.4%)

- Las Vegas (4.5%)

- Camden, New Jersey (4.7%)

- Newark, New Jersey (5%)

Click here to read more from Redfin’s latest report.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news