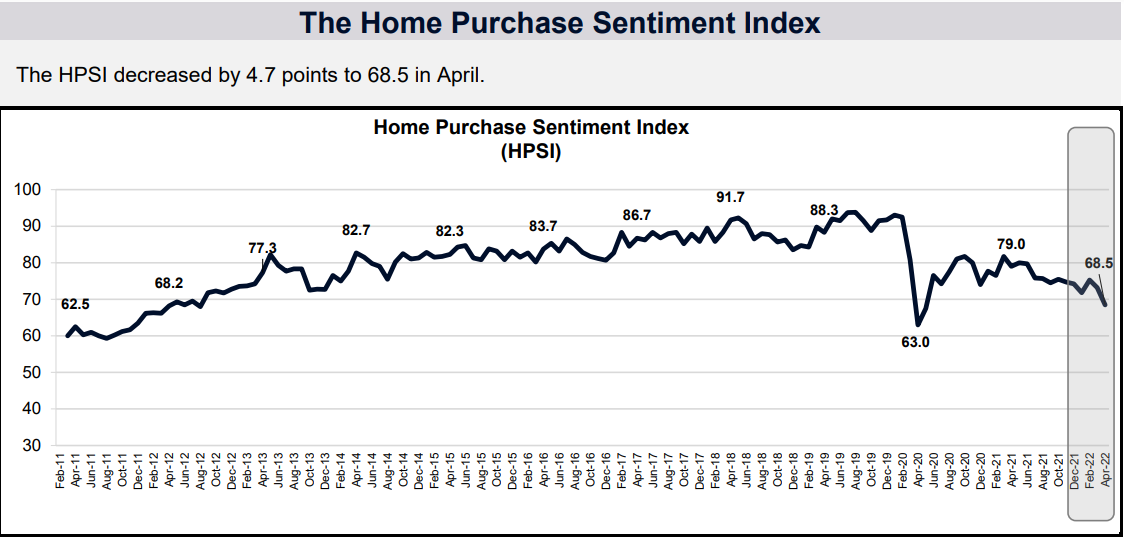

The latest iteration of Fannie Mae’s Home Purchase Sentiment Index (HPSI) for April decreased by 4.7 points to 68.5, its lowest level since May 2020, as rising mortgage rates and inflation pushed buyers to question affordability.

The latest iteration of Fannie Mae’s Home Purchase Sentiment Index (HPSI) for April decreased by 4.7 points to 68.5, its lowest level since May 2020, as rising mortgage rates and inflation pushed buyers to question affordability.

All six of the index’s components decreased month over month, which comes from Fannie Mae’s National Housing Survey (NHS). The HPSI reflects consumers’ current views and forward-looking expectations of housing market conditions and complements existing data sources to inform housing-related analysis and decision making. The HPSI is constructed from answers to six NHS questions that solicit consumers’ evaluations of housing market conditions and address topics that are related to their home purchase decisions.

One of the components asks whether now is a good time to buy a home or not—this component rose three percentage points to 76% of respondents who believe now is a bad time to buy a home. Additionally, 73% of respondents expect mortgage rates to continue their recent ascent over the next year, a survey high. Year-over-year, the full index is down 10.5 points.

“In April, the HPSI fell to its lowest level since the first few months of the pandemic, as consumers continue to report difficult homebuying conditions amid the budget-tightening constraints of inflation, higher mortgage rates, and high home price appreciation,” said Doug Duncan, Fannie Mae Senior Vice President and Chief Economist. “The current lack of entry-level supply and the rapid uptick in mortgage rates appear to be adversely impacting potential first-time homebuyers in particular, evidenced by the larger share of younger respondents (aged 18- to 34) reporting that it’s a ‘bad time to buy a home.’”

“Additionally, consumer perception regarding the ease of getting a mortgage also decreased across nearly all surveyed segments this month, suggesting to us that the benefit of the recent past’s historically low mortgage rate environment appears to have diminished, and affordability is poised to become an even greater constraint going forward,” Duncan continued. “This sentiment is consistent with our forecast of decelerating home sales through the rest of 2022 and into 2023.”

Other high-level takeaways from the report include:

Good/Bad Time to Buy

The percentage of respondents who say it is a good time to buy a home decreased from 24% to 19%, while the percentage who say it is a bad time to buy increased from 73% to 76%. As a result, the net share of those who say it is a good time to buy decreased 8 percentage points month over month.

Good/Bad Time to Sell

The percentage of respondents who say it is a good time to sell a home decreased from 74% to 72%, while the percentage who say it’s a bad time to sell remained unchanged at 21%. As a result, the net share of those who say it is a good time to sell decreased 2 percentage points month over month.

Home Price Expectations

The percentage of respondents who say home prices will go up in the next 12 months decreased from 48% to 44%, while the percentage who say home prices will go down increased from 20% to 25%. The share who think home prices will stay the same decreased from 28% to 26%. As a result, the net share of Americans who say home prices will go up decreased 9 percentage points month over month.

Mortgage Rate Expectations

The percentage of respondents who say mortgage rates will go down in the next 12 months increased from 4% to 5%, while the percentage who expect mortgage rates to go up increased from 69% to 73%. The share who think mortgage rates will stay the same decreased from 23% to 18%. As a result, the net share of Americans who say mortgage rates will go down over the next 12 months decreased 3 percentage points month over month.

Job Loss Concern

The percentage of respondents who say they are not concerned about losing their job in the next 12 months decreased from 86% to 84%, while the percentage who say they are concerned remained unchanged at 11%. As a result, the net share of Americans who say they are not concerned about losing their job decreased 2 percentage points month over month.

Household Income

The percentage of respondents who say their household income is significantly higher than it was 12 months ago decreased from 29% to 26%, while the percentage who say their household income is significantly lower increased from 13% to 14%. The percentage who say their household income is about the same increased from 53% to 56%. As a result, the net share of those who say their household income is significantly higher than it was 12 months ago decreased 4 percentage points month over month.

Click here to view the HPSI in its entirety.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news