Leveraging data from 890,000 unique users, LendingTree has released new research on Generation Z from the 2021 calendar year on where they are most likely to move to after graduating and leaving home.

Leveraging data from 890,000 unique users, LendingTree has released new research on Generation Z from the 2021 calendar year on where they are most likely to move to after graduating and leaving home.

Generation Z, born between 1997-2012 and now aged 18-24, is beginning to see its first wave of homebuyers and by all available data, are more likely to move out of their area or state to find ideal living conditions, somewhat helped along by the adoption of remote work.

By their account, Gen Z only made up 10% of all purchases, but are making a “growing splash” as more of the generation comes to age.

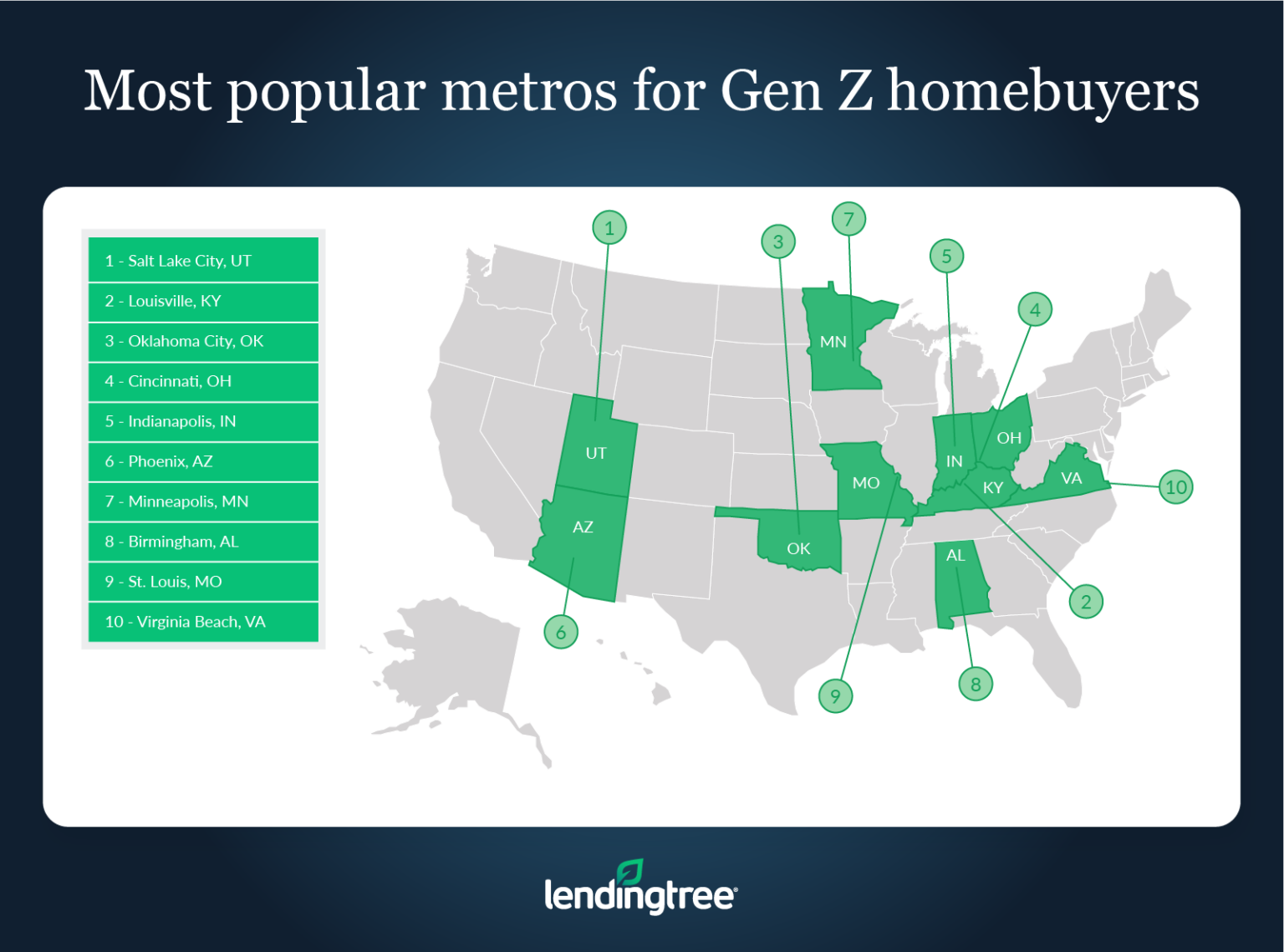

The most popular city for Gen Z to purchase property in was Salt Lake City, Utah for the second year in a row. In this city 16.60% of all buyers were in the Gen Z age range, while on the other end of the scale, San Francisco, California, was the city with the least amount of Gen Z buyers with only 3.64% of mortgages going to them.

The top three cities that Gen Z is moving to and their stats are:

Salt Lake City, Utah

- Share of mortgages offered to Gen Zers: 16.60%

- Average Gen Z homebuyer age: 21.82

- Average credit score among Gen Z homebuyers: 701

- Average down payment amount among Gen Z homebuyers: $28,874

- Average requested loan amount among Gen Z homebuyers: $291,952

Louisville, Kentucky

- Share of mortgages offered to Gen Zers: 15.68%

- Average Gen Z homebuyer age: 22.09

- Average credit score among Gen Z homebuyers: 699

- Average down payment amount among Gen Z homebuyers: $14,268

- Average requested loan amount among Gen Z homebuyers: $171,773

Oklahoma City, Oklahoma

- Share of mortgages offered to Gen Zers: 15.34%

- Average Gen Z homebuyer age: 22.17

- Average credit score among Gen Z homebuyers: 697

- Average down payment amount among Gen Z homebuyers: $19,690

- Average requested loan amount among Gen Z homebuyers: $173,752

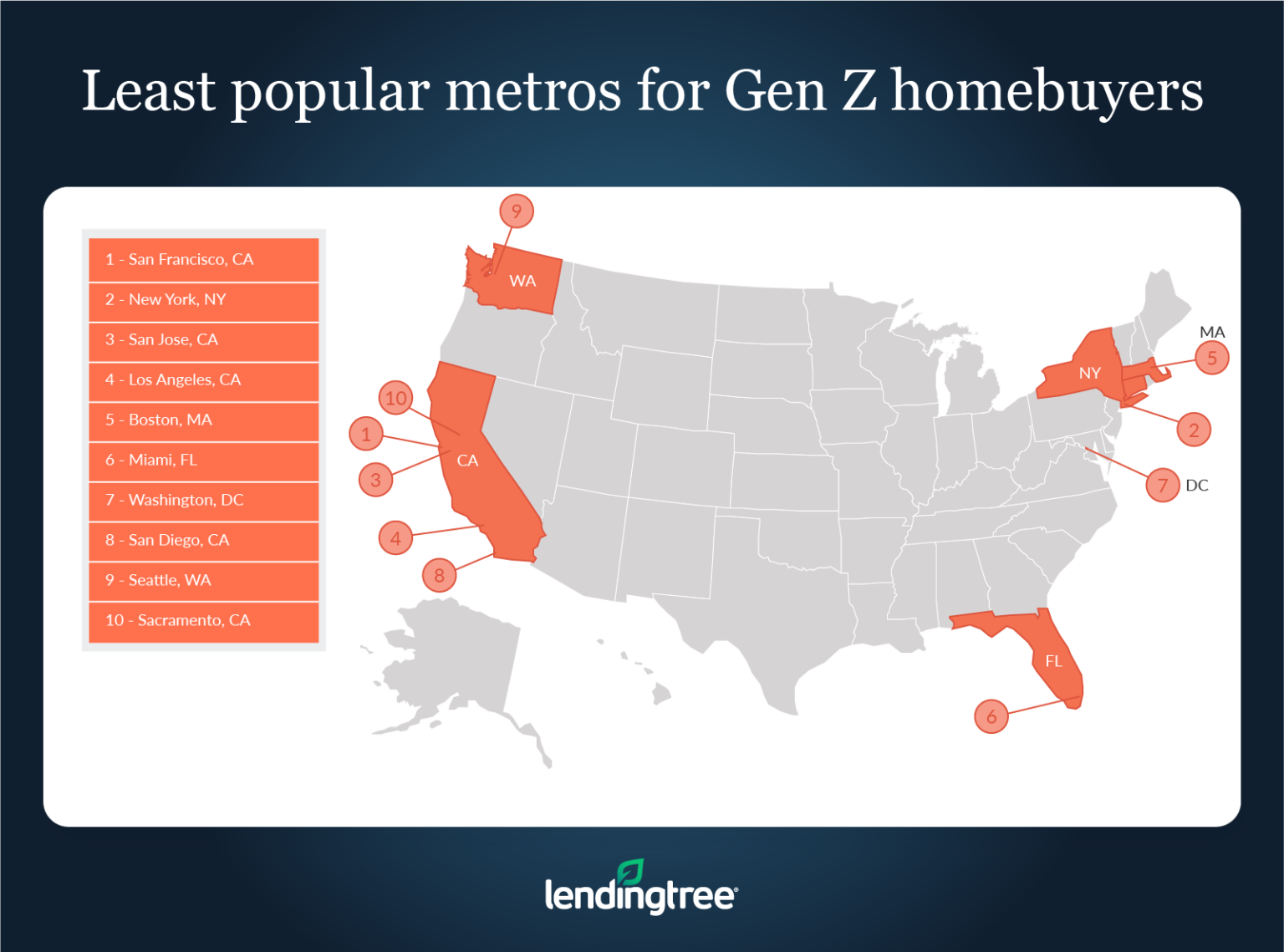

All of the bottom-10 metro areas that had the least amount of Gen Z buyers were on either the Atlantic or Pacific coasts. The bottom three metro areas were:

San Francisco, California

- Share of mortgages offered to Gen Zers: 3.64%

- Average Gen Z homebuyer age: 22.53

- Average credit score among Gen Z homebuyers: 723

- Average down payment amount among Gen Z homebuyers: $42,933

- Average requested loan amount among Gen Z homebuyers: $408,005

New York, New York

- Share of mortgages offered to Gen Zers: 4.41%

- Average Gen Z homebuyer age: 22.53

- Average credit score among Gen Z homebuyers: 717

- Average down payment amount among Gen Z homebuyers: $31,877

- Average requested loan amount among Gen Z homebuyers: $302,268

San Jose, California

- Share of mortgages offered to Gen Zers: 4.53%

- Average Gen Z homebuyer age: 22.44

- Average credit score among Gen Z homebuyers: 722

- Average down payment amount among Gen Z homebuyers: $48,041

- Average requested loan amount among Gen Z homebuyers: $425,545

Other key takeaways from the report include:

- The average credit score of Gen Z mortgage borrowers can vary widely across the U.S. The average credit score among Gen Z homebuyers is highest in San Francisco at 723 — 31 points above the average score where it’s lowest (New Orleans).

- Down payment amounts also vary by metro. There’s a $35,155 difference between the average down payment among Gen Z homebuyers in Los Angeles and New Orleans, where they’re the highest and the lowest, respectively, across the 50 largest metros.

- Like credit scores and down payments, mortgage amounts can also change quite a bit depending on where buyers live. In San Jose, Calif., where Gen Z homebuyers get the largest mortgages, the average loan amount offered to members of that generation totaled $425,545. That’s $253,772 more than the average loan amount in Louisville, Ky., where Gen Z homebuyers are borrowing the least.

So what does Gen Z have to look forward to? Not much, if they’re just getting into the game. Rising prices and interest rates are already pricing many out of the market because their incomes are not as high due to the fact they are just starting their careers.

“Owing to these challenges, many Gen Zers may consider cheaper alternatives to homebuying like renting or living with family,” LendingTree said. “Fortunately, while these more affordable options may be more appealing for the time being, Gen Zers will likely have more opportunities to become homebuyers over the coming years as their earnings increase and a greater supply of housing hits the market and brings prices down.”

Click here to view the list of the top 50 cities that Gen Z are flocking towards.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news