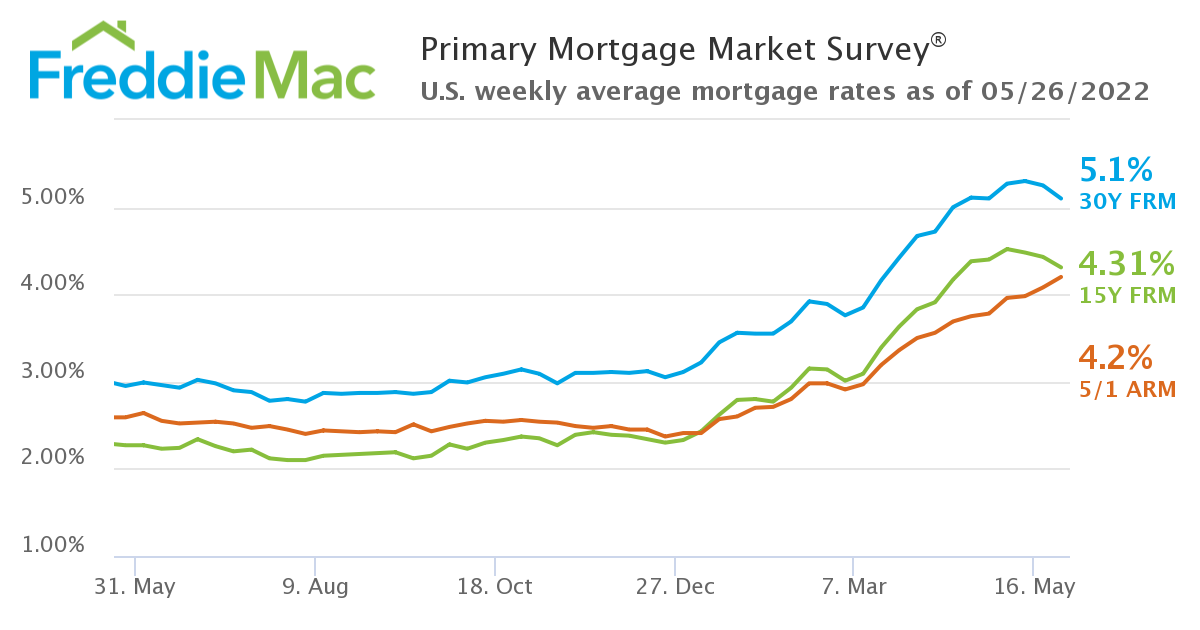

Mortgage rates have dropped for the second consecutive week, as the latest Freddie Mac Primary Mortgage Market Survey (PMMS) [1] found the 30-year fixed-rate mortgage (FRM) at 5.10% as of May 26, 2022, down from last week [2] when it averaged 5.25%. A year ago at this time, the 30-year FRM averaged 2.95%.

Mortgage rates have dropped for the second consecutive week, as the latest Freddie Mac Primary Mortgage Market Survey (PMMS) [1] found the 30-year fixed-rate mortgage (FRM) at 5.10% as of May 26, 2022, down from last week [2] when it averaged 5.25%. A year ago at this time, the 30-year FRM averaged 2.95%.

And as mortgages rates steadily drop, economic instability and continued inflationary concerns have forced many to re-think jumping into the market, as the Mortgage Bankers Association (MBA) reported application volume continues to drop, falling 1.2% week-over-week [3].

“Mortgage rates decreased for the second week in a row due to multiple headwinds that the economy is facing,” said Sam Khater [4], Freddie Mac’s Chief Economist. “Despite the recent moderation in rates, the housing market has clearly slowed, and the deceleration is spreading to other segments of the economy, such as consumer spending on durable goods.”

One factor weighing in this recent market slowdown is the decline in builder confidence, as the National Association of Home Builders (NAHB) reported [5] that double-digit price increases for materials and home price appreciation are taking a toll on overall demand. The most recent Producer Price Index (PPI) report from the Bureau of Labor Statistics (BLS) [6] found that building material prices were up 19.2% year-over year, and have risen 35.6% since the start of the pandemic.

While the price of softwood lumber did drop 15.6% in April, since reaching its most recent trough in September 2021, softwood lumber prices have risen 60.4%. The price of both steel mill products prices climbed 2.4% in April, and ready-mix concrete prices rose 1.3%, while gypsum products remained flat in April.

“New construction data shows that completed homes, ready for sale, dropped 5.1% from the prior month, and were 8.6% below April 2021,” said Realtor.com Senior Economic Research Analyst Joel Berner [7]. “Homebuilder sentiment, as measured this month by the National Association of Home Builders’ Housing Market Index, is down 10.4% from May of last year, and at its lowest level since the early days of the pandemic. Dark and stormy is the current mood, but a period of steadier rates below recent highs will give buyers, sellers, and builders alike the time to adjust to the new financial environment.”

Also this week, Freddie Mac reported the 15-year FRM averaging 4.31% with an average 0.8 point, down from last week when it averaged 4.43%. A year ago at this time, the 15-year FRM averaged 2.27%. The five-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 4.20% with an average 0.3 point, up from last week when it averaged 4.08%. A year ago at this time, the five-year ARM averaged 2.59%.

“Mortgage rates leveling off is a lifeline for prospective homebuyers already dealing with inflation and record-high listing prices, and welcome news for the housing market at large,” added Berner. “The spike in the cost of home financing over the last four months has led to a four-month slide in new home sales, and a three-month slide in existing home sales. The current slowdown in the market, while increasing the number of homes for sale, may actually exacerbate the existing overall housing shortage in the long term, if the news causes builders to pull back.”