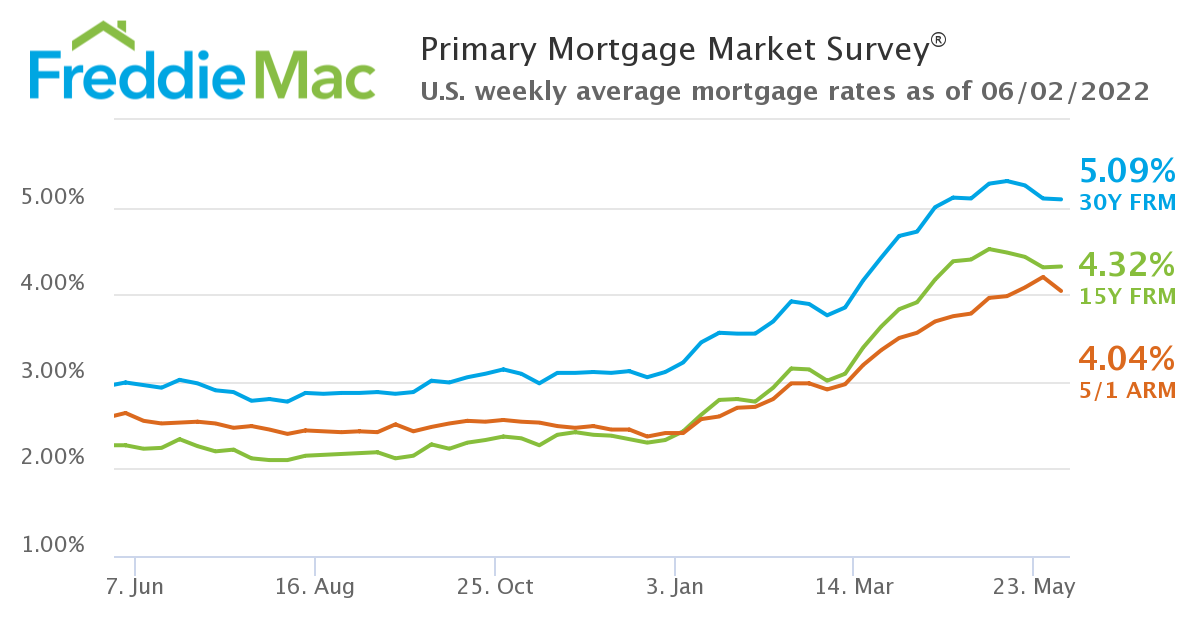

In a market experiencing a continued fluctuation in rates, Freddie Mac reported in its latest Primary Mortgage Market Survey (PMMS) that the 30-year fixed-rate mortgage (FRM) averaged 5.09% for the week ending June 2, 2022, down slightly from last week’s reading of 5.10%. A year ago at this time, the 30-year FRM averaged nearly a full 2% lower at 2.99%.

In a market experiencing a continued fluctuation in rates, Freddie Mac reported in its latest Primary Mortgage Market Survey (PMMS) that the 30-year fixed-rate mortgage (FRM) averaged 5.09% for the week ending June 2, 2022, down slightly from last week’s reading of 5.10%. A year ago at this time, the 30-year FRM averaged nearly a full 2% lower at 2.99%.

“Mortgage rates continued to inch downward this week, but are still significantly higher than last year, affecting affordability and purchase demand,” said Sam Khater, Freddie Mac’s Chief Economist. “Heading into the summer, the potential homebuyer pool has shrunk, supply is on the rise and the housing market is normalizing. This is welcome news following unprecedented market tightness over the last couple years.”

As affordability and inflationary issues continue to impact the pool of potential buyers, the Mortgage Bankers Association (MBA) reported earlier this week that application volume continues to slide, dropping 2.3% week-over-week.

It’s not just new buyers who are scaling back, as rates continue to scare away those seeking a refinance, as the MBA also reported the overall share of refinance activity decreasing to 31.5% of total applications this week, down from 32.3% the previous week.

Hannah Jones, Economic Data Analyst at Realtor.com, notes that the slight drop has made this an opportune time for some, but buyer activity continues to wane.

“The decrease in the mortgage rates over the last couple weeks has offered some relief to buyers who have faced a relentless rise in home prices,” said Jones. “High prices and recent interest rate hikes slowed down buyer activity in April as shown by a month-over-month drop in existing home sales (-2.4%), new home sales (-16.6%), and pending home sales (-3.9%), as some buyers opted out of the market altogether. Home buyers continued to contend with record-high home prices in May, however hope is on the horizon as the latest week’s housing data shows another increase in the number of homes for sale compared to last year.”

Prolonged builder confidence has impacted new home construction, however the light at the end of the tunnel may be coming in the way of a decline in the price of raw materials.

While the latest Producer Price Index (PPI) report released by the Bureau of Labor Statistics, found the prices of goods used in residential construction ex-energy (not seasonally adjusted) climbed a slight 0.5% in April, the price of softwood lumber declined 15.6% in April. Building material prices are still up 19.2% year-over-year and have risen 35.6% since the start of the pandemic, further driving down builder confidence.

“And while inventory is still low by historical standards, it is starting to tilt in a more buyer-friendly direction,” continued Jones. “This is likely to lead to slower price growth in the not-so-distant future as sellers compete for buyers, finally creating a more balanced market. However, those who are currently home shopping will tell you that we’re not there yet, as still-high interest rates and home prices are creating challenges in finding their ideal home.”

Freddie Mac also reported this week that the 15-year FRM averaged 4.32% with an average 0.8 point, up slightly from last week when it averaged 4.31%. A year ago at this time, the 15-year FRM averaged 2.27%.

And while the five-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) saw slight popularity as rates have risen, ARMs dipped this week to 4.04% with an average 0.3 point, down from last week when it averaged 4.20%. A year ago at this time, the five-year ARM averaged 2.64%. The MBA reports that ARM interest continues to fall, with ARM activity decreasing to just 8.75% of total applications.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news