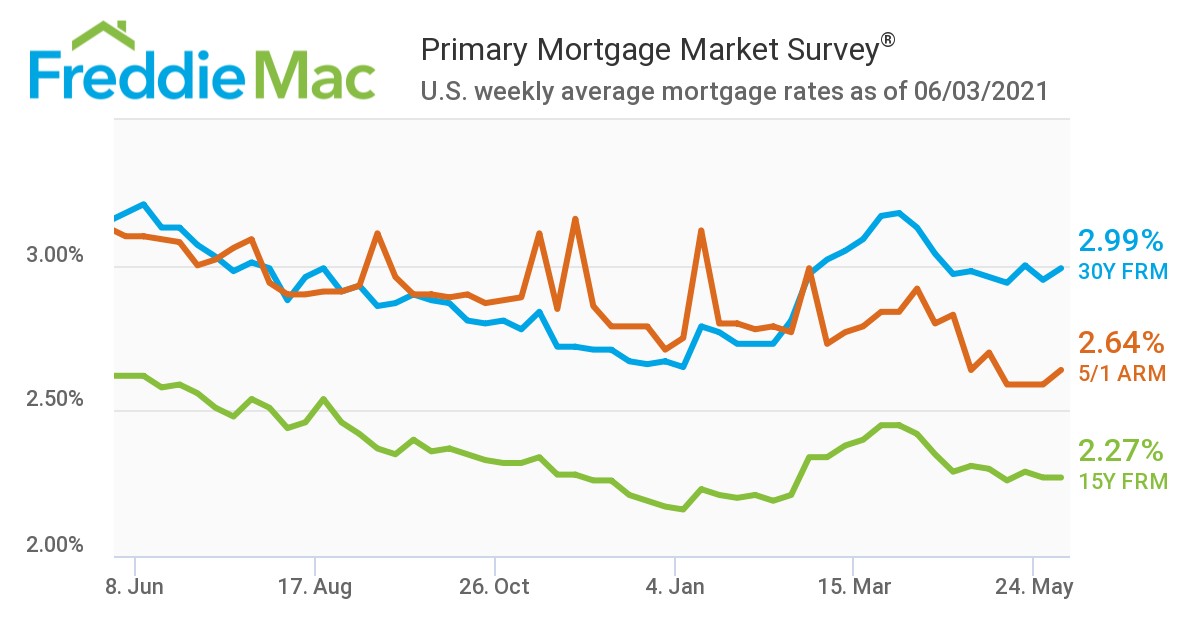

Mortgage rates rose slightly this week, but still remain below the 3% mark, as Freddie Mac’s Primary Mortgage Market Survey (PMMS) [1] found the 30-year fixed-rate mortgage (FRM) at 2.99%, up from last week’s total of 2.95%. [2] A year ago at this time, the 30-year FRM averaged 3.18%.

Mortgage rates rose slightly this week, but still remain below the 3% mark, as Freddie Mac’s Primary Mortgage Market Survey (PMMS) [1] found the 30-year fixed-rate mortgage (FRM) at 2.99%, up from last week’s total of 2.95%. [2] A year ago at this time, the 30-year FRM averaged 3.18%.

“Home prices continue to accelerate, while inventory remains low and new home construction cannot happen fast enough,” said Sam Khater [3], Freddie Mac’s Chief Economist. “There are many potential homebuyers who would like to take advantage of low mortgage rates, but competition is strong [4]. For homeowners however, continued low rates make refinancing an option worth considering [5].”

Freddie Mac also reported the 15-year FRM averaging 2.27% with an average 0.6 point, unchanged from last week. A year ago at this time, the 15-year FRM averaged 2.62%. The five-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 2.64% with an average 0.2 point, up from last week when it averaged 2.59%. A year ago at this time, the five-year ARM averaged 3.10%.

As noted by Khater, median home prices continued to appreciate in May, as Realtor.com reported [4] that prices reached an all-time high of $380,000, up 15.2% year-over-year.

And with prices at all-time highs, more and more are pressing pause on the search for a new home, the Mortgage Bankers Association (MBA) reported [6] that overall mortgage application volume was down 4% week-over-week for the week ending May 28, 2021.

“While interest rates remain affordable, and about 20 basis points below last year, the double-digit home price gains of the past 10 months have pushed the median listing price to a new record high, translating into a monthly mortgage payment $150 higher than the same time in 2020,” said Realtor.com Senior Economist George Ratiu [7]. “In addition to the higher cost, today’s homebuyers are facing extremely low inventory [4] and a competitive landscape, in which they are competing not only with other first-time buyers and homeowners looking for their next home, but also with deep-pocketed investment funds, bringing all-cash offers to the closing table. Not surprisingly, mortgage applications dropped for the second consecutive week, as many first-time buyers’ income growth is not keeping pace with rising real estate prices. As Americans return to a new normal in business and travel activity, housing markets are seeking relief from overheated demand.”