And the pendulum continues its mighty swing …

And the pendulum continues its mighty swing …

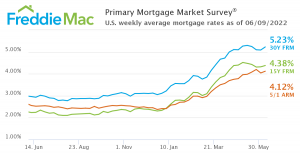

After two weeks of declines, Freddie Mac has reported that the 30-year fixed-rate mortgage (FRM) averaged 5.23% for the week ending June 9, 2022, up from last week when it averaged 5.09%. A year ago at this time, the 30-year FRM averaged 2.96%.

“After little movement the last few weeks, mortgage rates rose again on the back of increased economic activity and incoming inflation data,” said Sam Khater, Freddie Mac’s Chief Economist. “The housing market is incredibly rate-sensitive, so as mortgage rates increase suddenly, demand again is pulling back. The material decline in purchase activity, combined with the rising supply of homes for sale, will cause a deceleration in price growth to more normal levels, providing some relief for buyers still interested in purchasing a home.”

And with the rise in rates comes the anticipated dip on mortgage application volume, as the Mortgage Bankers Association (MBA) reported that application volume fell to a 22-year low this week, falling 6.5% week-over-week.

“Mortgage applications have been declining, with both purchases and refinances seeing pullbacks in activity,” said Realtor.com's Senior Economist and Manager of Economic Research George Ratiu. “Buyers of a median-price home are looking at a monthly mortgage payment that is 55% higher than it was a year ago, adding an extra $695 to their monthly expenses. Compounding these pressures, almost 20 states have average gasoline prices above $5 per gallon, pushing living expenses to new highs, especially as employers insist on squeezing workers back into offices.”

Freddie Mac also reported that this week, the 15-year FRM rose, averaging 4.38% (with an average 0.8 point), up from last week when it averaged 4.32%. A year ago at this time, the 15-year FRM averaged 2.23%. Also up this week was the five-year Treasury-indexed hybrid adjustable-rate mortgage (ARM), averaging 4.12% (with an average 0.3 point), up from last week when it averaged 4.04%. A year ago at this time, the five-year ARM averaged 2.55%.

“For many Americans looking for affordable pockets of housing, mid-sized cities remain a viable alternative, especially as the number of homes for sale has been on the rise, bringing fresh options,” said Ratiu. “The overarching challenge is balancing the ability to find a well-priced home, which often means traveling farther away from city centers, with the potential need to commute to an office. It is up to companies to maintain flexibility for a workforce which is being squeezed from all directions at once, or risk losing employees. The economic outlook is highly dependent on the well-being of the American consumer.”

Consumer outlook on the U.S. economy, however, remains bleak, as the latest Fannie Mae Home Purchase Sentiment Index (HPSI) remained comparatively flat in May—decreasing by only 0.3 points—but inching nearer its 10-year- and pandemic-low of 63.0 recorded in April 2020. The HPSI measures consumers’ home purchase sentiment from Fannie Mae’s National Housing Survey (NHS) into a single number, measuring their current views and forward-looking expectations of housing market conditions. The HPSI found consumers still concerned about housing affordability, with the “Good Time to Buy” indicator reaching a new survey low, as 79% of respondents reported that now is a bad time to buy a home. Seventy percent of HPSI respondents anticipate a continued rise in mortgage rates over the next year.

“Consumers’ expectations that their personal financial situations will worsen over the next year reached an all-time high in the May survey, and they expressed greater concern about job security,” commented Doug Duncan, Fannie Mae SVP and Chief Economist on the latest HPSI readings. “Further, respondents’ pessimism regarding homebuying conditions carried forward into May, with the percentage of respondents reporting it’s a bad time to buy a home hitting a new survey high. The share reporting that it’s ‘Easy to Get a Mortgage’ also decreased across almost all segments.”

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news