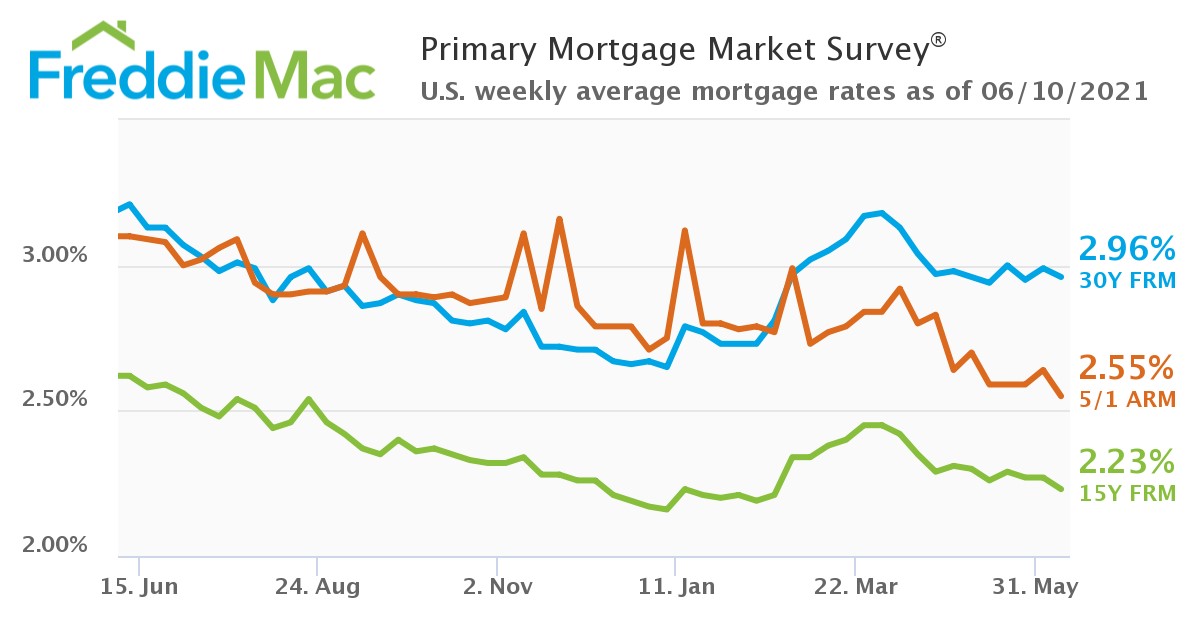

Amid a continued lack of homes available for sale and prices that continue to climb, mortgage rates fell again this week, sinking lower below the 3% mark as the 30-year fixed-rate mortgage (FRM) averaged 2.96%. Freddie Mac’s Primary Mortgage Market Survey (PMMS) [1] found the 30-year FRM down from last week when it averaged 2.99% [2]. A year ago at this time, the 30-year FRM averaged 3.21%.

Amid a continued lack of homes available for sale and prices that continue to climb, mortgage rates fell again this week, sinking lower below the 3% mark as the 30-year fixed-rate mortgage (FRM) averaged 2.96%. Freddie Mac’s Primary Mortgage Market Survey (PMMS) [1] found the 30-year FRM down from last week when it averaged 2.99% [2]. A year ago at this time, the 30-year FRM averaged 3.21%.

Also this week, the 15-year FRM averaged 2.23% with an average 0.6 point, down from last week when it averaged 2.27%. A year ago at this time, the 15-year FRM averaged 2.62%.

“The economy is recovering remarkably fast and as pandemic restrictions continue to lift, economic growth will remain strong over the coming months,” said Sam Khater [3], Freddie Mac’s Chief Economist. “Despite the stronger economy, the housing market is experiencing a slowdown [4] in purchase application activity [5] due to modestly higher mortgage rates. However, it has yet to translate into a weaker home price trajectory because the shortage of inventory continues to cause pricing to remain elevated.”

That slowdown mentioned by Khater was evident in this week’s report from the Mortgage Bankers Association (MBA) [5] that found mortgage applications on the decline, dropping 3.1% from the previous week. In addition to the drop in overall mortgage app volume, refis also saw a dip, as the refinance share of mortgage activity decreased [5] to 60.4% of total applications, from 61.3% the previous week.

On the upside, overall employment continues to gain steam, with the U.S. Department of Labor reporting [6] that, for the week ending June 5, the advance figure for seasonally adjusted initial unemployment claims was 376,000, a decrease of 9,000 from the previous week's unrevised level of 385,000, marking the lowest level for initial claims since March 14, 2020 when it was 256,000.

The continued uptick in employment could lead to a further decline in the number of homeowners in forbearance plans, as this week, the MBA reported approximately 2.1 million U.S. homeowners remain in forbearance plans [7], a 4.16% share of loans overall.

“The share of loans in forbearance declined for the 14th straight week, with small drops across most investor types and all servicer types,” said Mike Fratantoni [8], MBA’s SVP and Chief Economist. “Forbearance exits dropped to six basis points, the lowest weekly level since mid-February, but new forbearance requests, at four basis points, matched the recent weekly low from early May.”