New data from the Mortgage Bankers Association (MBA) Builder Application Survey (BAS) for May 2022 shows mortgage applications for new home purchases have decreased an overall 5% in contrast to a year ago; and compared to April 2022, applications decreased by 4%.

“Applications to purchase new homes in May fell by 4 percent from April, as mortgage rates hit 5.5 percent and further dampened demand. Activity was already constrained due to tight for-sale inventory, high sales prices, and extended building completion timelines,” said Joel Kan, MBA’s Associate VP of Economic and Industry Forecasting. “After increasing for 15 consecutive months, the average loan size fell slightly from April’s survey high to $430,855, which is a potential indication that cooling demand may be starting to moderate price growth.”

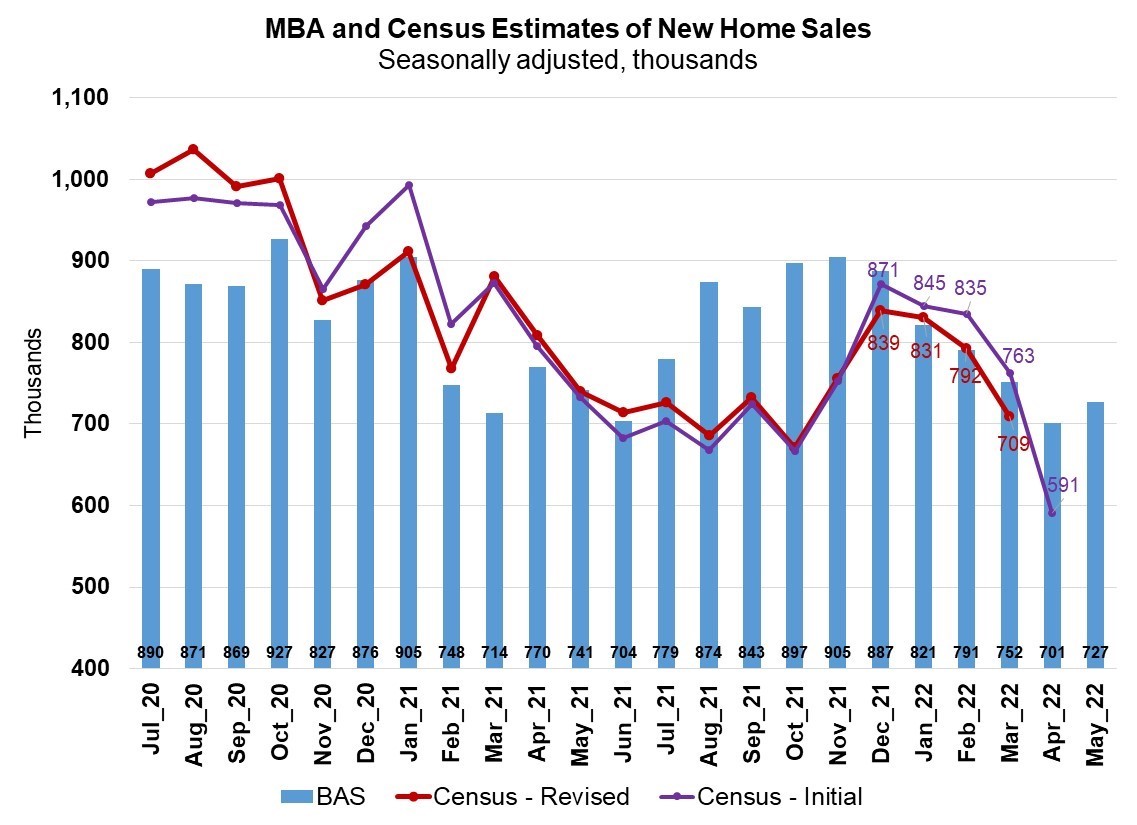

MBA estimates new single-family home sales were running at a seasonally adjusted annual rate of 727,000 units in May 2022, based on data from the BAS. The new home sales estimate is derived using mortgage application information from the BAS, as well as assumptions regarding market coverage and other factors.

“MBA’s estimate of new home sales increased for the first time in five months, showing a 4% gain to a 727,000-unit sales pace," said Khan.

The seasonally adjusted estimate for May is an increase of nearly 4% from the April pace of 701,000 units. On an unadjusted basis, MBA estimates that there were 61,000 new home sales in May 2022, a decrease of 6.2% from 65,000 new home sales in April.

By product type, conventional loans composed of nearly 76% of loan applications, FHA loans composed 13.6%, RHS/USDA loans composed 0.2% and VA loans composed 10.4%. The average loan size of new homes decreased from $436,576 in April to $430,855 in May.

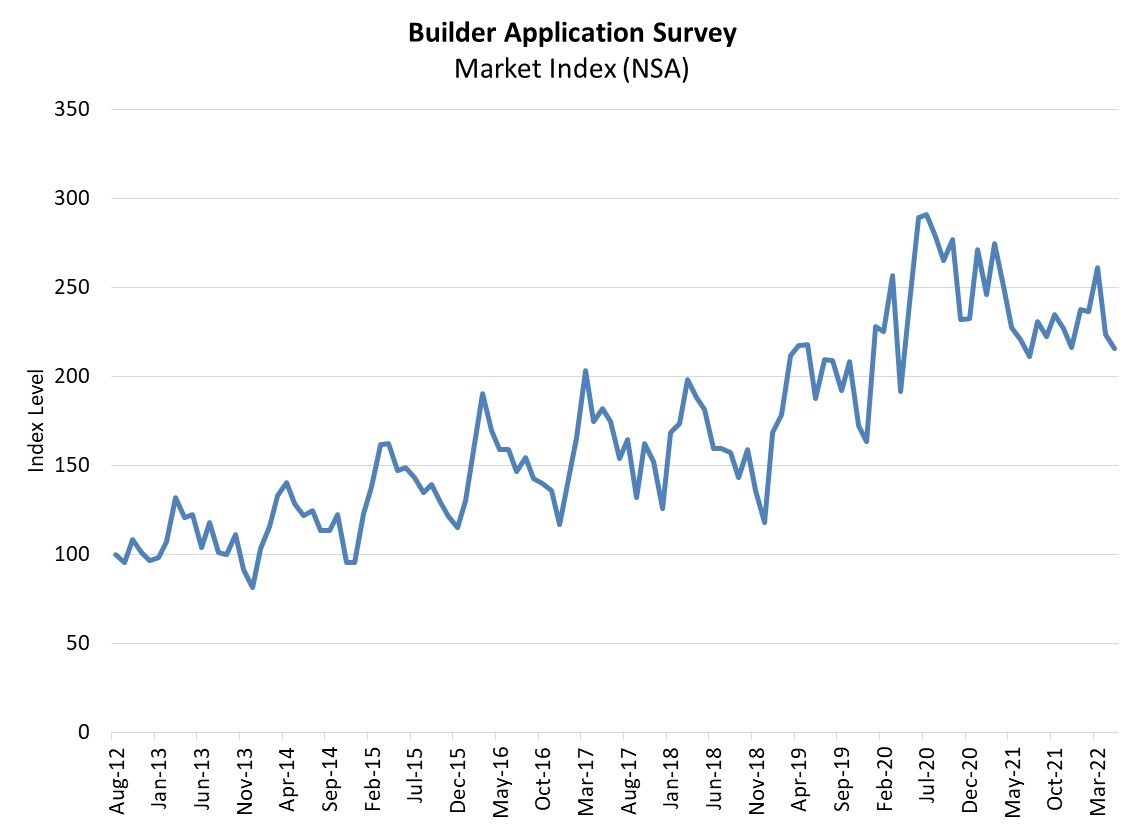

MBA’s Builder Application Survey tracks application volume from mortgage subsidiaries of home builders across the country. Utilizing this data, as well as data from other sources, MBA is able to provide an early estimate of new home sales volumes at the national, state, and metro level.

Data also provides information regarding the types of loans used by new home buyers. Official new home sales estimates are conducted by the Census Bureau on a monthly basis. In that data, new home sales are recorded at contract signing, which is typically coincident with the mortgage application.

To read the full report, including charts and methodology, click here.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news