Inflating mortgage costs, driven by skyrocketing prices and interest rates, have made mortgages less affordable than at any time since at least 2007. According to the latest market report from Zillow, demand for homes has pulled back in response —easing price growth, slowing sales, and boosting inventory.

Mortgage rates shot up in early June, averaging 5.78%2 as of Thursday. A new purchase of a typical U.S. home at that rate would mean monthly mortgage payments of approximately $2,127, —some 51% higher than a year ago and up 36% year to date.

"Mortgage rates took an unprecedented leap skyward over the past two weeks and quickly multiplied housing costs as they rose," said Zillow economist Nicole Bachaud. "We are already seeing signs of waning demand, and expect these recent rate hikes to quicken the market's needed rebalancing. While shoppers will likely experience less competition for homes than the frenzied recent months, their purchasing power has dwindled."

Incomes are lagging further behind fast-rising mortgage costs, leading to the most significant affordability challenges in the past 15 years. The latest data available from April shows monthly payments taking about 28% of homeowners' monthly income.

This is dangerously close to the 30% threshold, beyond which is considered a cost burden. With rates now far above April's average, that share is at or very near 30% already.

Although rents have soared since the start of 2021, the rapidly rising cost of a mortgage still makes rent the cheaper option nearly everywhere. A typical rent payment in May is more expensive than a mortgage payment, including taxes and insurance, in just five of the 50 largest U.S. metros. In May 2019, rent was more expensive in 28 of those metros.

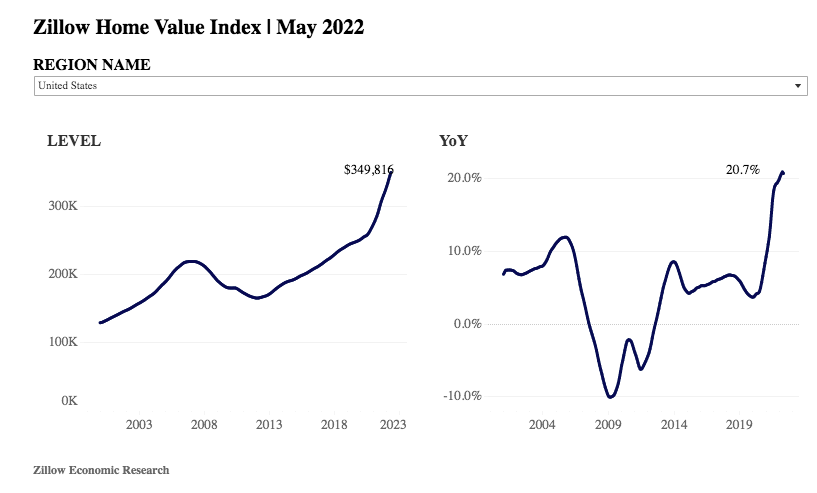

After annual price appreciation set new record highs for 13 straight months, home values finally turned the corner in May to show a slightly slower pace of annual growth —20.7%, down from 20.9% in April.

"Arriving in the middle of the spring selling season, this deceleration is a clear signal that buyers are dialing back their demand for homes in the face of daunting affordability challenges," said Jeff Tucker, Senior Economist at Zillow.

The trend appears to show that the market passed an inflection point for home values between April and May, transitioning from ever hotter to somewhat cooler price growth. The typical U.S. home is now worth $349,816, nearly $60,000 more than last year, and almost $95,000 higher than in May 2020.

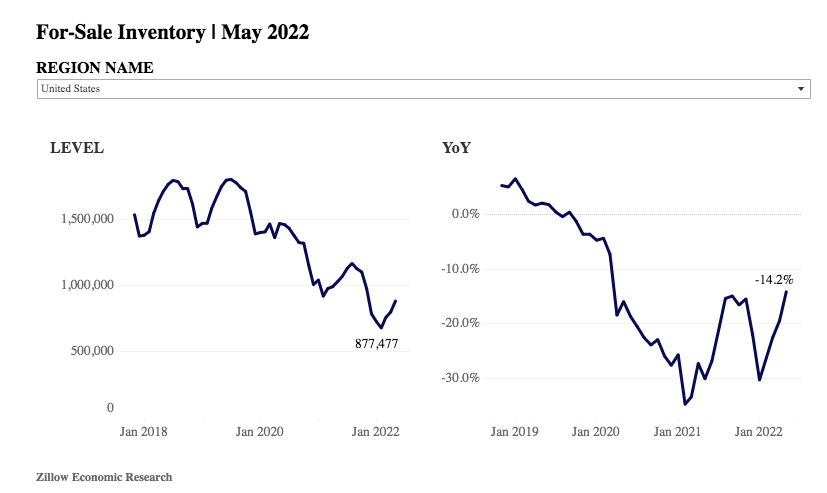

New data shows sales are also slowing. The number of for-sale listings that went under contract in May is down nearly 20% from 2021, when that activity was near a four-year peak, and is 2% below that of May 2019.

The median time on market for new listings is just seven days, holding steady from April, and even with last May. The share of listings with a price cut is ticking up as well —rising to 11.5% in May from a recent low of 8.5% in February.

Inventory of for-sale listings continued its steady spring climb and now sits just 14.2% below its year-ago level. That leaves buyers with 50% fewer options than they had to choose from in May 2019.

Overall, typical rents are also up to $1,979 in the U.S. and rising fast, with 1.2% monthly growth that slightly edged April's 1.1% month-over month rise.

To read the full report, including more charts and methodology, click here.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news