Surely a trend that previous generations would have scoffed at, more buyers are finding it necessary to make offers on properties they have never set foot in to stay competitive in this rarified housing market.

Surely a trend that previous generations would have scoffed at, more buyers are finding it necessary to make offers on properties they have never set foot in to stay competitive in this rarified housing market.

The current housing climate is seeing near-record level lows of inventory, increasing interest rates after hovering at near-record lows during the pandemic, and ever-increasing housing prices are pushing homeseekers into taking riskier actions than previous generations would have to secure a home.

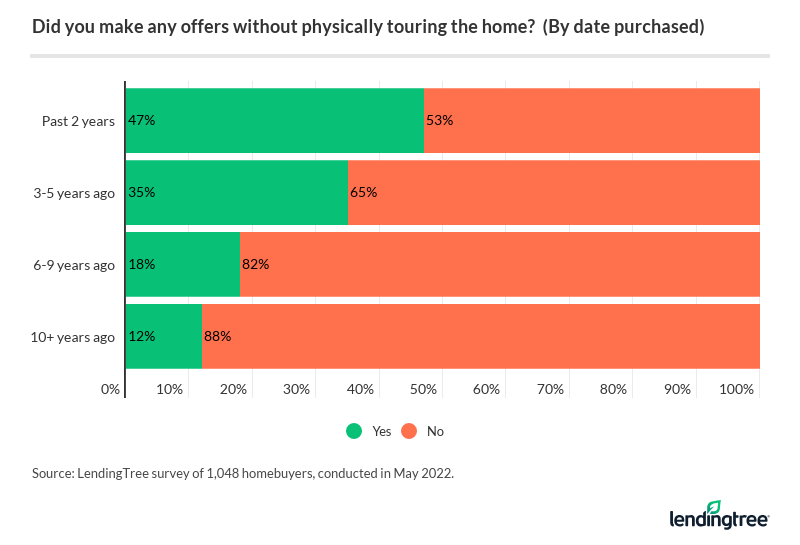

According to a new survey of 1,048 people conducted Qualtrics for LendingTree, 47% of borrowers made an offer on a house without laying eyes on it, others exhibited behavior that ranged from buying the first house available to them to paying massive sums above asking price just to have a chance at the American Dream.

While 47% of respondents said they bought a home without a physical tour, historically 24% of homebuyers overall and 12% who purchased their most recent home 10 or more years ago did the same.

“Buying a home sight unseen may seem like a good option if you’re in a hurry and want to make an offer as soon as possible, but it can easily backfire,” said Jacob Channel, LendingTree Senior Economic Analyst. “If you do decide to buy a home sight unseen, be sure that it has been professionally inspected by someone you can trust. That way, at the very least, you’ll know if there’s anything structurally wrong with the home before it becomes yours.”

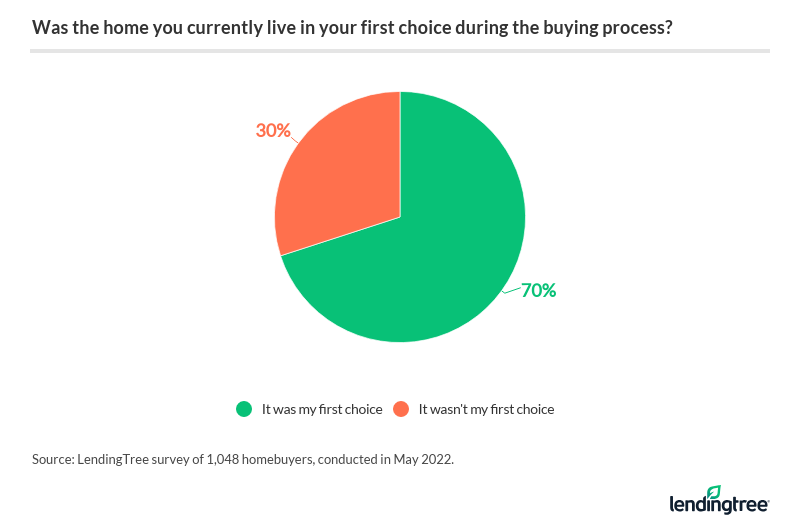

The survey also found that more consumers are compromising on what they desire as 30% of homeowners surveyed said the home they ended up buying was not their first choice.

First choice or not, many buyers are paying above the asking price. In the past two years, 24% paid more than the asking price, versus 5% who bought 10 or more years ago.

“The combination of low housing supply and the greater financial freedom that low rates provided buyers resulted in many people becoming willing to spend extra on the limited number of homes that were on the market,” Channel says. “With that said, the market is now showing signs of cooling down, so the days of tons of people paying well over asking price are likely coming to an end.”

The survey revealed that of respondents who have successfully purchased a house in the last two years, 36% do not expect to stay put long as they are already planning their next move within the next five years.

But overall, 85% of respondents still believe that owning a home is cheaper in the long run than renting.

Click here to view the results of LendingTree’s survey in their entirety.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news