Both data and anecdotal evidence suggest the ibuying real estate market is ramping back up following a pandemic-era slowdown.

Both data and anecdotal evidence suggest the ibuying real estate market is ramping back up following a pandemic-era slowdown.

Instant buying, or ibuying, happens when real estate companies use algorithms to evaluate a property’s worth based on comparable market data and purchase houses, from the owner, in quick cash transactions. Benefits to the seller include cash offers, flexible move dates, and the convenience of preparing and showing the home. For those same reasons, ibuyers tend to charge sellers a higher fee than traditional agents.

According to analysis by Redfin, firms including Redfin, Zillow, and Opendoor put ibuying on hold at the onset of the coronavirus pandemic amid economic uncertainty. These major brands resumed their ibuying businesses in May and June 2020, when it became clear that the market was, to say the least, rebounding.

The newest data from Redfin, which covers Q1 2021, showed that those aforementioned top ibuyers collectively purchased 4,383 homes. That number is about 6% lower than one year earlier, yet it is up 20.6% since the prior quarter, which indicates an increase in ibuying activity following a pandemic-related pause.

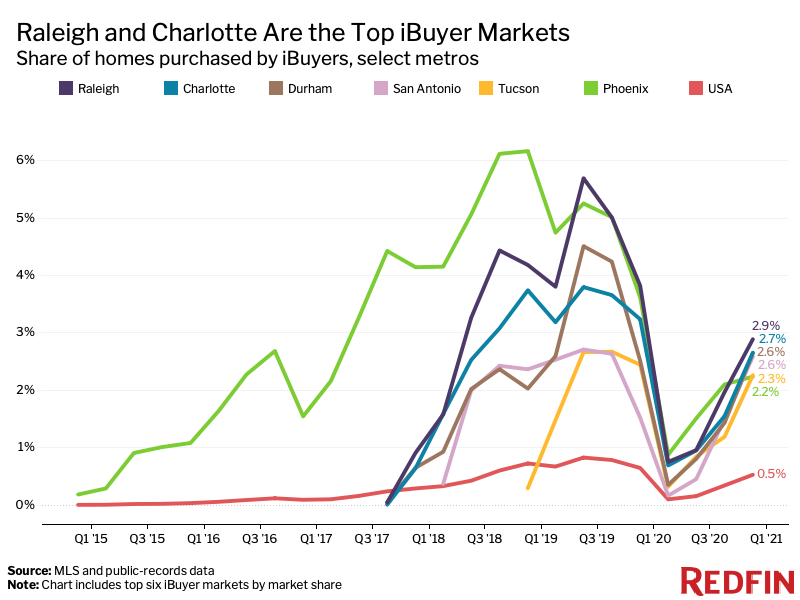

Redfin reports that ibuying continues to occupy but a tiny portion of the overall housing market, with these types of purchases making up only .5% of homes that sold across 418 metropolitan areas tracked by Redfin. That’s down from a peak of .8% in the second half of 2019 but up from .3% in Q4 2020.

Allister Booth, Acquisitions Specialist at Redfin, says ibuying business began ramping up in January and February.

"Since then, we’ve just had a constant barrage of deals," Booth said. "We’re back to full speed and are buying more homes than we were last year. After we buy and renovate those homes, we know we’ll be able to sell them because there are so many more buyers in the market right now than there are homes available."

The report also reveals that ibuyers purchased less-expensive homes than the typical buyer—ibuyers paid a median $302,050 in the first quarter compared to the median purchase price for the typical American homebuyer, $320,000.

The typical home, in an ibuying transaction, found a buyer after 13 days on the market—the quickest pace since at least 2015, when Redfin began recording ibuyer data. By comparison, the typical home in the overall market spent 31 days on the market (also the quickest pace on record).

By region, North Carolina is a strong ibuyer market, the report indicated, with Raleigh ibuyers purchasing 2.9% of the homes that sold during the first quarter. Next came Charlotte at 2.7%, followed by Durham, then San Antonio, Texas at 2.6%, Tucson, Arizona at 2.3%, and Phoenix at 2.2%.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news