Affordability woes are causing a crisis of confidence for builders who reported via survey that confidence is down due to high inflation and increased interest rates which stalled the housing market through “dramatically slowing sales numbers and buyer traffic.”

Affordability woes are causing a crisis of confidence for builders who reported via survey that confidence is down due to high inflation and increased interest rates which stalled the housing market through “dramatically slowing sales numbers and buyer traffic.”

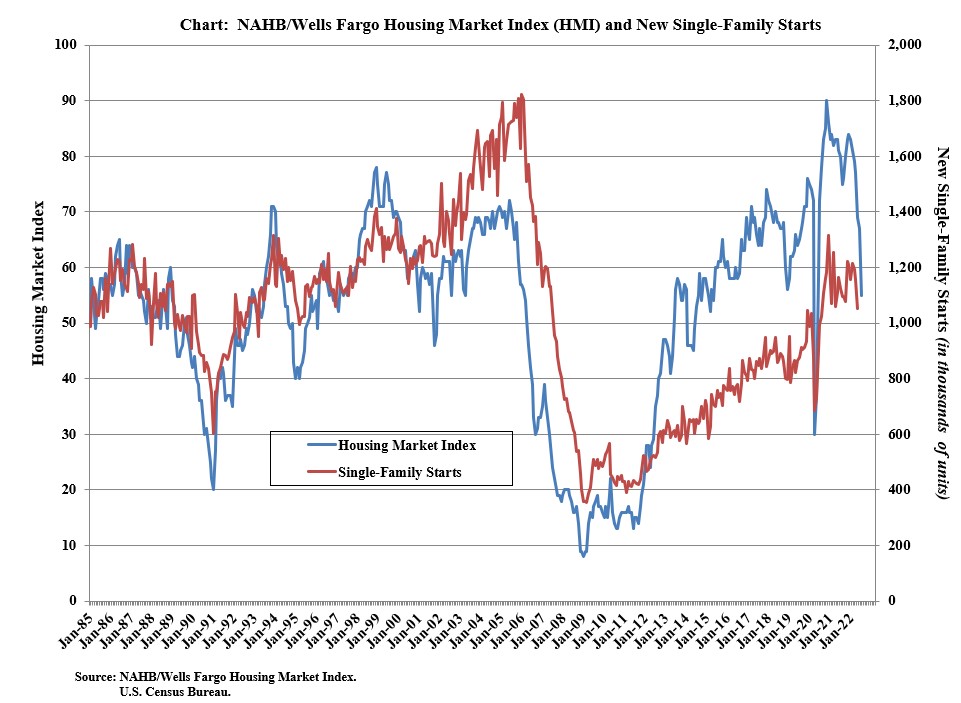

This information comes from the National Association of Home Builders and Wells Fargo Housing Market Index (HMI) who found that the market confidence for newly-built single-family homes posted its seventh consecutive month of declines in July 2022 falling by 12 points to a score of 55.

According to the survey, this is the lowest reading of the HMI since 2020 and the second largest single-month drop in the history of the HMI beat only by the 42 point drop at the onset of the pandemic in April 2020.

“Production bottlenecks, rising home building costs and high inflation are causing many builders to halt construction because the cost of land, construction and financing exceeds the market value of the home,” said NAHB Chairman Jerry Konter, a home builder and developer from Savannah, Ga. “In another sign of a softening market, 13% of builders in the HMI survey reported reducing home prices in the past month to bolster sales and/or limit cancellations.”

“Affordability is the greatest challenge facing the housing market,” said NAHB Chief Economist Robert Dietz. “Significant segments of the home buying population are priced out of the market. Policymakers must address supply-side issues to help builders produce more affordable housing.”

The survey, now running for 35 years, polls builder perception of the current single-family home sales and sales expectations for the next six months with the answers “good,” “fair,” or “poor” on the three components of the survey: current sales conditions, sales expectations, and prospective buyer traffic. Scores for each component are then used to calculate a seasonally adjusted index where any number over 50 indicates that more builders view conditions as good than poor.

All three HMI components posted declines in July: Current sales conditions dropped 12 points to 64, sales expectations in the next six months declined 11 points to 50 and traffic of prospective buyers fell 11 points to 37.

Looking at the three-month moving averages for regional HMI scores, the Northeast fell six points to 65, the Midwest dropped four points to 52, the South fell eight points to 70 and the West posted a 12-point decline to 62.

Click here to view the report in its entirety, including downloadable charts and tables illustrating their findings on national and regional levels.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news