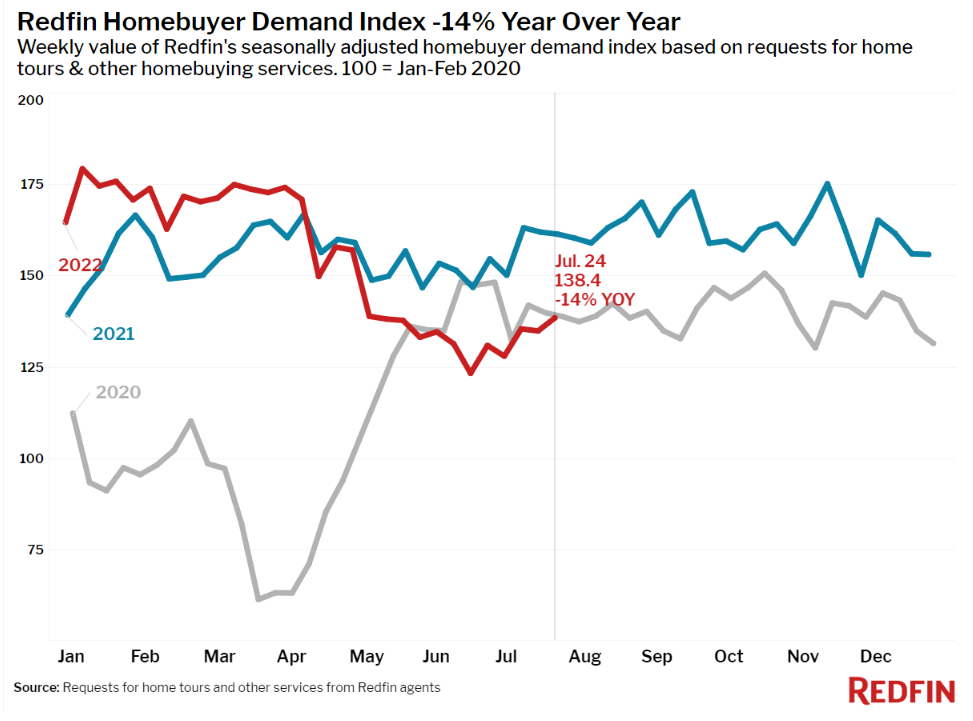

A half-point drop in mortgage rates is luring some homebuyers back to the market, according to a new report from Redfin as the Homebuyer Demand Index [1]—a measure of requests for home tours and other home-buying services from Redfin agents—has increased 15 points since the week of June 19, reversing a 10-week trend of decreasing demand that began in mid-April. Searches of homes for sale on Google have also risen 11% since late May, and touring levels have been relatively stable over the past two weeks.

A half-point drop in mortgage rates is luring some homebuyers back to the market, according to a new report from Redfin as the Homebuyer Demand Index [1]—a measure of requests for home tours and other home-buying services from Redfin agents—has increased 15 points since the week of June 19, reversing a 10-week trend of decreasing demand that began in mid-April. Searches of homes for sale on Google have also risen 11% since late May, and touring levels have been relatively stable over the past two weeks.

"The housing market seems to be settling into an equilibrium now that demand has leveled off," said Redfin Chief Economist Daryl Fairweather [2]. “We may still be in for some surprises when it comes to inflation and rate hikes from the Fed, but for now an ease in mortgage rates has brought some relief to buyers who were reeling from last month’s rate spike. Although the number of sales is down considerably from last year, first time-homebuyers with not a lot of cash are welcoming the decline in competition, and anyone who intends to stay in their home for many years doesn’t need to worry about these short-term fluctuations in home prices."

Freddie Mac reported that last week [3], the 30-year fixed-rate mortgage (FRM) fell 24-basis points from 5.54% to 5.30%, ahead of the Fed’s latest rate hike [4].

Redfin found:

- Fewer people searched for “Homes for Sale” on Google—searches during the week ending July 23 were down 26% from a year earlier, but are up 11% since late May.

- The seasonally-adjusted Redfin Homebuyer Demand Index was down 14% year over year during the week ending July 24, but has risen 15 points since the week of June 19.

- Touring activity as of July 10 was down 4% from the start of the year, compared to an 18% increase at the same time last year, according to home tour technology company ShowingTime.

- Mortgage purchase applications were down 18% from a year earlier during the week ending July 22, while the seasonally-adjusted index was down 1% week over week.

- The median home sale price was up to $384,871, up 9% year-over-year, the slowest growth rate since August 2020. Prices fell 2.9% from the peak during the four-week period ending June 19. A year ago they rose 0.9% during the same period.

- The median asking price of newly listed homes increased 14% year-over-year to $395,925, but was down 3% from the all-time high set during the four-week period ending May 22. Last year during the same period median prices were down just 1.1%.

- The monthly mortgage payment on the median asking price home hit $2,336 at the current 5.3% mortgage rate, up 42% from $1,648 a year earlier, when mortgage rates were 2.8%. That’s down slightly from the peak of $2,482 reached during the four weeks ending June 12.

However, Redfin reports the uptick in early demand has not carried through to home-purchase contracts or sales, as pending home sales are down, with fewer homes being listed, and inventory is piling up with homes taking longer to sell. Home-sale prices continue to decline, with the year-over-year growth rate falling to 9%, its lowest level since August 2020.

“Whether we label the current economy a recession doesn’t matter much except for sentiment. The under-the-hood stats—on consumption, real income and inflation—significantly worsened last quarter,” said Redfin Deputy Chief Economist Taylor Marr [5]. “Weaker economic growth and poor consumer sentiment are weighing on both homebuyers and sellers. The upside is that mortgage rates fall when the potential for economic growth is weak. This could help bring more rate-sensitive homebuyers off the fence to move forward with a purchase.”