Despite record low interest rates, homeownership affordability continued to decline nationally in May, as the Federal Reserve Bank of Atlanta’s national Home Ownership Affordability Monitor (HOAM) index fell from 97.58 in April 2021 to 94.29 in May. According to the Federal Reserve Bank of Atlanta, an index reading below 100 is an indication that the cost of owning an area's median-priced home is no longer affordable to households earning the median income. As of May, median home prices peaked at $330,500 on a three-month moving average, a record 21.6% increase from a year earlier. At the same time, the median income was estimated to be around $66,740. With home prices reaching record levels, the median-income household would pay about 32% of its income to own the average-priced home, a level that exceeds the 30% affordability threshold set by the U.S. Department of Housing and Urban Development (HUD).

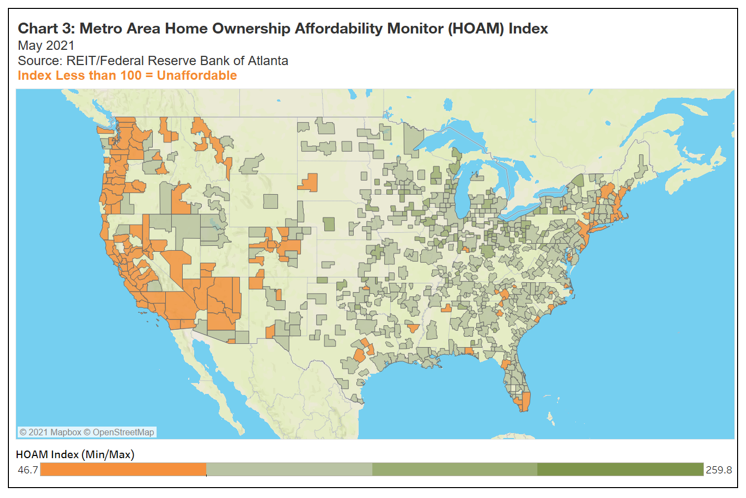

The month of May marked the fifth consecutive month of affordability declines, as among all U.S. metros, 23% were deemed unaffordable based on the Atlanta Fed’s HOAM index, up from 16% a year ago. The study also found that as affordability continues to decline, home sales are beginning to slow in many markets.

Year over year, affordability dropped by 10.13%, marking the sharpest fall since 2018. Unlike previous declines, which primarily followed spikes in interest rates, a rise in home prices and a lack of inventory have served as key drivers to the deterioration of affordability. Interest rates have fallen 30 basis points from May 2020 and remain near historic lows. The HOAM index indicates that the increase in home prices outweighed the gains in affordability offered by lower interest rates.

Further evidence that affordability is increasingly becoming a burden for prospective homeowners comes from a new Zillow analysis that found affordability issues are expected to worsen by the end of 2021, and are likely to leave millions newly housing cost burdened, as record low mortgage rates and dampened rent growth are quickly evaporating with housing costs rising faster than incomes.

The Zillow study cited mortgage payments as a percentage of U.S. income reached 19.4% in June—the most current observed data—and are anticipated to surpass 2018 levels in August. Assuming home values grow in line with what economists have forecast, that percentage could rise to more than 23.1% by the end 2021, depending on where mortgage rates are heading in the coming months.

Regionally, nine of the 10 least affordable metropolitan areas in May were in California, with the New York-Newark-Jersey City area ranking sixth (see the table above). With home prices at record levels in these markets, many current homeowners have decided to sell and move to lower-cost areas. At the same time, a majority of the 10 most affordable metros were clustered in Ohio and Pennsylvania (see the map below). Other affordable areas included Des Moines-West Des Moines, Iowa; St. Louis, Missouri-Illinois; Little Rock-North Little Rock-Conway, Arkansas; and Syracuse, New York. Although prices may have increased in these markets, home prices remained moderately affordable to households earning the median income.

Approximately 82% of U.S. metro areas had a decline in affordability during the past year. Markets like Charleston, South Carolina; Harrisburg, Pennsylvania; Albany, New York; and Baltimore, Maryland, saw an increase in affordability mainly because home prices remained flat or only increased moderately. On the other hand, metros such as Boise City, Idaho; Phoenix, Arizona; Austin, Texas; and Bridgeport, Connecticut, experienced a sharp increase in home prices, which significantly hurt affordability. In Boise City, for example, home prices rose 33% in the past year, resulting in a 19.5% drop in homeownership affordability. Boise City, Phoenix, and Austin have seen a surge of new residents moving into the region from higher-cost coastal markets. Many of these new residents have recently sold homes with a significant amount of equity and have ample cash to put toward a home purchase.

Measures to ease the affordability issue have been taken, most recently by Fannie Mae in an effort to assist more renters on the path to homeownership with the announcement of a new feature in its automated underwriting system (AUS) to incorporate rent payments in the mortgage credit evaluation process.

"For many households, rent is the single largest monthly expense. There is absolutely no reason timely payment of monthly housing expenses shouldn't be included in underwriting calculations," said Federal Housing Finance Agency (FHFA) Acting Director Sandra L. Thompson. "With this update, Fannie Mae is taking another step toward understanding how rental payments can more broadly be included in a credit assessment, providing an additional opportunity for renters to achieve the dream of sustainable homeownership."

The Federal Reserve Bank of Atlanta’s HOAM also noted the following in May:

- As the price of homes for sale reached peak levels, the values of houses that are not on the market have soared. In May, home values rose 17.2% year-over-year, the highest level of appreciation since 2005, when values jumped 16.2%.

- In the 12 months ended in May 2021, the inventory of homes for sale fell more than half, as the supply of available homes plummeted to just one month as demand continues to greatly exceed supply. Generally, an inventory supply of four to six months is considered balanced.

- Sales of existing homes began to fall in January 2021 and continued to decline through May, as the lack of available houses limited sales volumes. New home sales have also trended downward this year as increased land, labor, and materials costs have led many builders to initially limit the number of sales in order to better manage expenses. Even so, declining affordability is starting to suppress housing demand as more and more buyers begin to indicate an unwillingness to purchase houses as prices rise sharply.

- As noted, material and labor constraints tied to the pandemic continue to affect construction activity. However, builders have begun to deliver homes that were already on order. As a result, housing starts in Q1 were up 13% from a year earlier (see chart 8).

- Since the peak in delinquencies last year, mortgages have steadily rolled off forbearance plans, and lenders have reported that most borrowers have resumed payments. Federal forbearance guidelines, coupled with favorable home equity positions have helped stave off a wave of foreclosures.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news