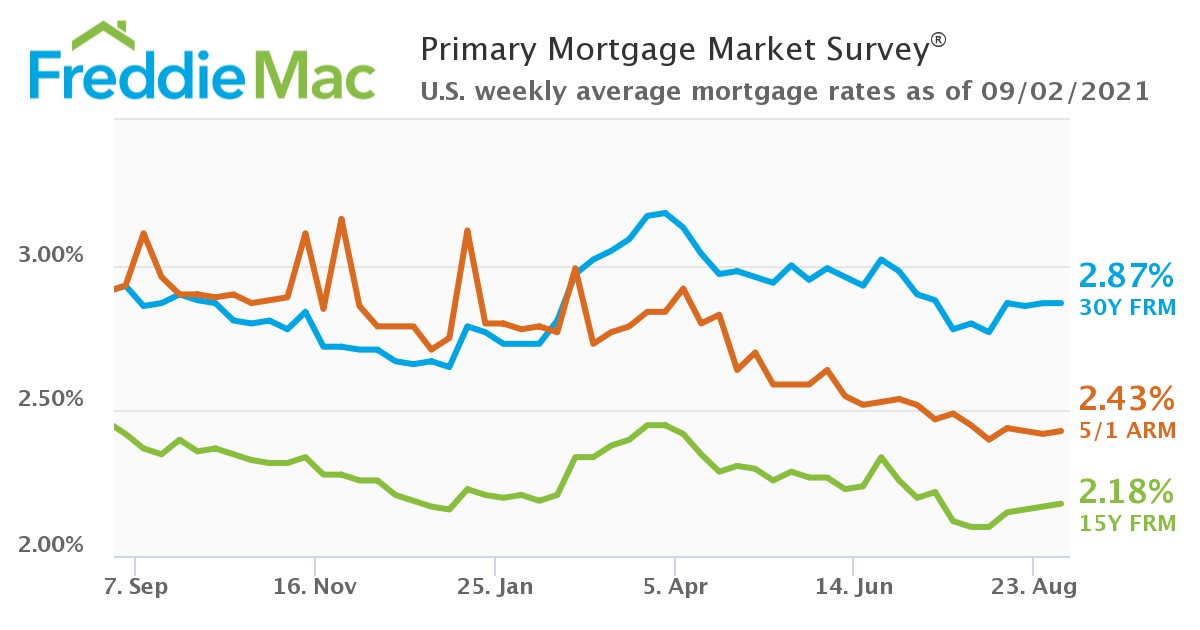

Freddie Mac has reported that the 30-year fixed-rate mortgage (FRM) averaged 2.87% with an average 0.6 point for the week ending September 2, 2021, unchanged from last week. A year ago at this time, the 30-year FRM averaged 2.93%.

Freddie Mac has reported that the 30-year fixed-rate mortgage (FRM) averaged 2.87% with an average 0.6 point for the week ending September 2, 2021, unchanged from last week. A year ago at this time, the 30-year FRM averaged 2.93%.

“Economic growth and the acceleration in inflation have moderated in the last month, giving the markets comfort and leading to a stabilization in mortgage rates,” said Sam Khater, Freddie Mac’s Chief Economist. “Heading into the fall, home purchase demand is stable, home sales remain firm and above pre-pandemic levels, and inventory of unsold homes is tight, but improving modestly. These factors will allow for home price pressures to ease over the remainder of the year.”

Housing supply concerns seem to be easing a bit, as Realtor.com, in its Monthly Housing Report for August 2021, reported that inventory and new listings improved during the month, with 432,000 newly-listed homes hitting the market during the month, a 4.3% rise in inventory year-over-year.

Realtor.com Chief Economist Danielle Hale noted, “Low mortgage rates have motivated homebuyers to endure this year's challenging market and now some buyers are starting to see their persistence pay off. This month, new sellers added more affordable entry-level homes to the market compared to last year, while others began adjusting listing prices to better compete with an uptick in inventory.”

Smaller homes are becoming more abundantly listed, as Realtor.com’s examination of single-family homes found that the share of homes having between 750- and 1,750-square-feet increased from 30.6% in August 2020 to 37.0% in August 2021, while the inventory of homes having between 3,000- and 6,000-square-feet decreased from 23.9% to 19.3%.

“Real estate markets are making slow but steady progress toward normalization as we move into autumn,” said Realtor.com's Manager of Economic Research George Ratiu. “Realtor.com’s latest inventory data show that more homeowners are listing their homes for sale and that this fresh crop of homes consists of smaller properties, which provide a much-needed infusion of affordability in a tight market. With more supply, the overheated price growth of the past year is decidedly downshifting into single-digit territory. For sellers, this fall represents a good time to take advantage of still-rising prices. For first-time buyers, more options and favorable financing offer the promise that after a year of frustrating bidding wars, finding the right home may finally be within reach.”

Part of that steady progress toward normalization is the return of more Americans to the workforce, as the U.S. Department of Labor reported the advance seasonally adjusted insured unemployment rate was 2.0% for the week ending August 21, a decrease of 0.1 percentage point from the previous week's unrevised rate. In the week ending August 28, the advance figure for seasonally adjusted initial unemployment claims was 340,000, a huge decrease of 14,000 from the previous week's revised level, marking the lowest level for initial unemployment claims since March 14, 2020 when it was 256,000.

Despite rates still lingering below the 3% mark, the Mortgage Bankers Association (MBA) reported mortgage loan application volume declining 2.4% from the previous week. The refinance share of mortgage activity decreased slightly to 66.8% of total applications, from 67.3% the previous week.

"Even with a slight increase, purchase activity hit its highest level since early July, as applications for conventional and government loans increased,” said Joel Kan, MBA's Associate VP and Industry Forecasting. “Home purchase activity continues to be dominated by higher price tiers of the market, with the purchase average loan size now at $396,500, the highest average in five weeks. According to FHFA, June's year-over-year increase in home prices was 18.8%, while the second quarter saw a 17.4 percent increase overall. Both measures set new records, as housing demand continued to outpace the inventory of homes for sale."

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news